And since nothing else has changed and we already showed what is going on from a delta- and gamma-hedging perspective…

… we will give the last word to the Bear-Traps report which describes the “Insanity” in Apple Options:

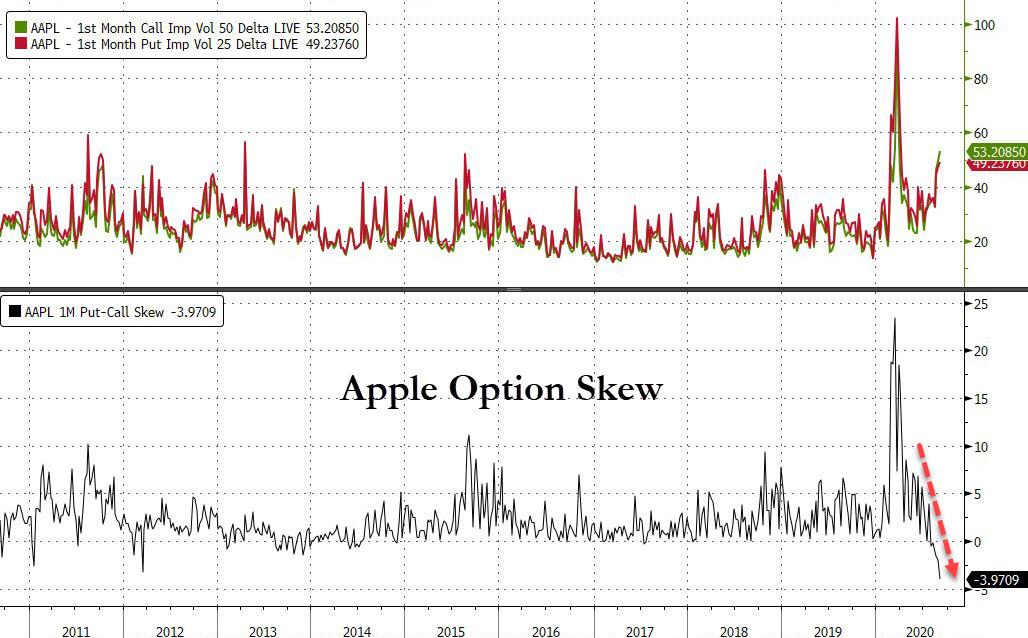

The convexity skew picture on big-name equities like Apple $AAPL has gone parabolically stupid. Let’s keep this simple and draw a conclusion.

- Apple $AAPL Stock near $130

- Jan $180 Strike Calls costs $4

- Jan $80 Strike Puts costs $1

*Both options are $50 out of the money, approx data, BUT it is nearly 3x more expensive to buy upside risk in AAPL equity. What does this mean?

Apple closed near $130, while the cost of speculative upside calls is weighted heavily against the buyer. Someone must have reached out to Buffett today because he can make a fortune in selling $AAPL upside calls. Let us explain.

Highly unusual activity, we have a higher stock price in Apple AAPL with a much higher cost of equity upside. Equity vol usually explodes higher in market crashes, NOT bull markets. As you can see above, in normal Apple equity bull markets – see all of 2019 – AAPL implied vol has been CHEAP!

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

In our institutional client chat on Bloomberg, a hedge fund put on this trade and we are sharing it with permission.

Think of the January 2021 expiration. The client bought the $200 call and sold the $250 call, 1 x 4, and got paid $3.50 to put the trade on.

Apple was worth $1.5T at the end of July and today she stands tall at $2.2T. In order for the client to lose money* at January expiration, the stock has to breach $270 ($129 today), which would put the company’s market capitalization very close to $5T, by January 2021, that is a little over four months away.

*The mark to market in the short run can be extremely painful though – if Apple equity soars another 10-20% (Apple is up 50% since late July), that is indeed the catch. AAPL is trading nearly 65% above its 200-day moving average vs. 42% in February’s great bull run.

There are a handful of quant funds pushing around a few stocks (with high impact on QQQ, NDX, SPY) in the options markets. The dealers are getting very nervous. Last 15 days – Imaging being a large market maker in Apple and Tesla equity options. You make a market, bid – offer, you get lifted and lifted over and over again by buyers to the point where you have raised the price of calls vs puts to multi-year extremes. How short is the Street gamma? VERY.

When call vs. put skew gets this extreme it can be a solid leading risk indicator.