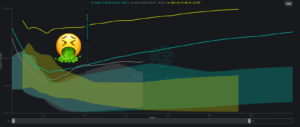

$GME vol has totally faded, just like the interest in @TheRoaringKitty twitter feed (sooo many video clips – that can’t be him posting). Anyway, here we see the peak in 1-month IV at +340% on Tuesday (yellow) when the stock hit >$60. Stock up, vol up. Now the IV’s (and GME’s stock price) have come […]

skew

SpotGamma with Public: Semi Skews & the Stock Bubble

Brent Kochuba, Founder of SpotGamma, joined brokerage Public to discuss semi stock skews, and why he thinks stocks are in a bubble. However, that bubble may continue to expand – watch to find out why. Below is an automated transcript, please forgive any grammatical errors: Hey everyone welcome to Leading Indicator, a show bringing you […]

Comparing Earnings IV’s for Edge

In a recent Member Q&A session SpotGamma discussed how traders can analyze implied volatility and potential stock movements by comparing the relative moves and reaction of stocks in similar sectors. Here we look at the volatility & setup into SMCI’s earnings report, and its subsequent reaction, to guide us on what may happen for AMD […]

Subscriber Webinar: Implied Volatility & The Release of The IV Dashboard

### You must be logged in to access this content. Don’t have an account with SpotGamma? Sign up today to view unique key levels, Founder’s Notes, market commentary, options analysis tools, and expert insights. If you’re already a SpotGamma subscriber, log in here: Username or E-mail Password Remember Me Forgot Password

Measuring Options Vanna, and its Impact, using VIX & Skew

In this video SpotGamma breaks down how to measure vanna impact, and why changes in options implied volatility can be a major driver of stock prices. We cover core concepts like, volatility premium, skew, and gamma.

AAPL Options Insanity

From ZH And since nothing else has changed and we already showed what is going on from a delta- and gamma-hedging perspective… … we will give the last word to the Bear-Traps report which describes the “Insanity” in Apple Options: The convexity skew picture on big-name equities like Apple $AAPL has gone parabolically stupid. Let’s keep this […]

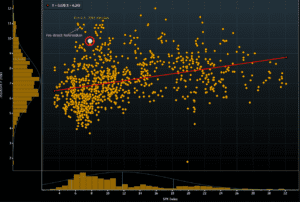

SPX Skew Nears All Time Highs

As per Bloomberg, Skew (which measures the price of calls vs puts) can often spike when investors are concerned about market risk. Puts will be in higher demand than calls and this moves the skew measurement higher. Currently skew is very high due to a slew of events in the next week: FOMC, BREXIT vote, […]