From Market Euphoria to “Elevator Down”

Markets experienced a dramatic reversal last week. Monday began with bullish momentum after the government shutdown deal was reached, yet by Thursday the market was facing intense selling pressure. Notably, SPX broke below the critical 6,800 risk pivot level we emphasized daily in our Founder’s Notes, triggering higher volatility.

As call-heavy positioning unwound in the negative gamma regime, price action grew more violent. Dealers who were long stock to hedge short call positions had to sell stock as those calls lost value, creating self-reinforcing downside pressure.

We descrbied this phenomena earlier in the week as an “elevator down” dynamic, where deepy negative gamma consistently carried the market down from Wednesday’s close into Friday morning.

The zone of dealer long gamma between 6,650 and 6,800 has provided some shock-absorber effect, although this will likely shift somewhat next week. The overall gamma curve remains negative, meaning price action could still move dramatically. Two critical levels traders should watch are part of the JPM Collar Trade expiring at the end of December: a short call at 7,000 and a long put position at 6,330.

VIX is up 7% last week to 20, and VVIX was similarly up 7% to close at 108. We saw OTM call buying in size throughout, including 180k Nov/Dec 25 call spreads traded earlier on the week for 50 cents. This bid to vol is worth watching, as higher expecations of volatility can become self-reinforcing.

Next Week’s Big Event: All Eyes on NVDA Earnings

Next week’s market structure is almost entirely defined by the confluence of three major events compressed into a 72-hour window: VIX expiration Wednesday morning, NVDA earnings Wednesday after-hours, and November monthly OPEX Friday.

This creates an unusual dynamic that will heavily influence price action. The current setup shows NVDA implied vol at approximately 65% for the weekly cycle, with an expected move of 7% for $4.6 trillion in market cap, not to mention the impact to related semiconductor and AI stocks.

This means Wednesday-Friday likely determines whether we spend December grinding toward new highs or consolidating October’s gains. With SPX in negative gamma and the 6,800 pivot broken, there’s no clear support until we see material put selling and positive gamma re-established—and both likely require clarity on NVDA’s earnings first.

Beyond NVDA earnings and expiration dynamics, traders should also watch for Tuesday’s ADP Emplyoment Estimate (11/18) and FOMC Minutes (11/19) as economic and inflationary concerns continue to weigh on the market.

As always, we encourage traders to position accordingly: this does not look like a week to force trades early. Wednesday night will define the regime, improving conviction into Friday’s monthly OPEX.

Single Stock Highlight: The CRWV Bloodbath

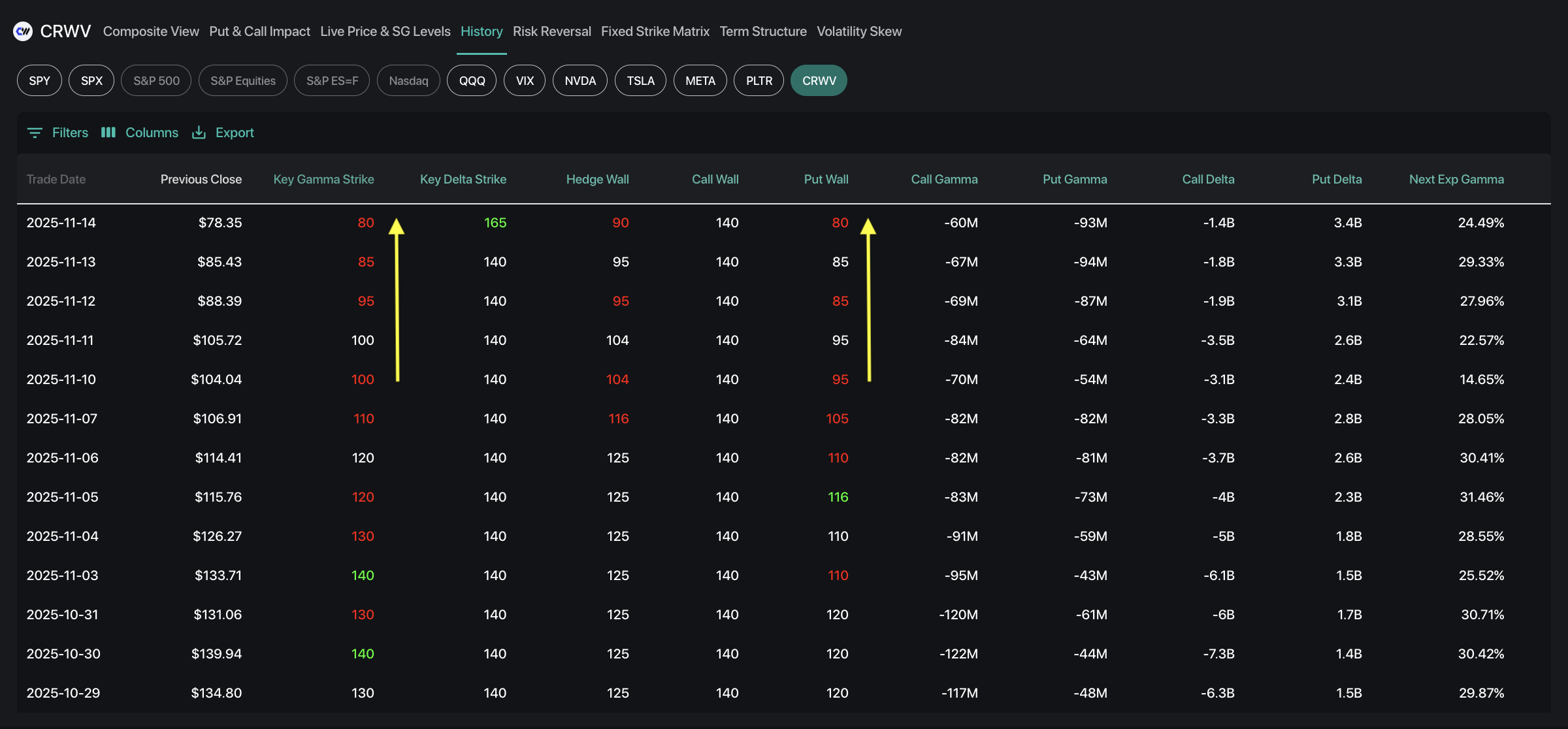

Trouble in the AI world continued this week, with CoreWeave (CRWV) down an eye-popping 30% from $110 to $77 despite beating analyst expectations. Lowered guidance and narrow margins became investor concerns, which echoes PLTR’s selloff two weeks prior.

CRWV’s put wall shifted from 95 to 80, and the Key Gamma Strike shifted from 100 to 80. On the downward move, traders continued buying puts and selling pressure persisted. As a result, CRWV fell like a knife cutting through butter.

The stock is currently trading around its Put Wall at 80. From our Synthetic OI model, there are significant put sellers at 75 and 70, which could provide some local support.

Interestingly, CRWV remains skewed towards calls with the Call Wall still at 140, indicating room to run should sentiment turn around in the name. Changes next week to open interest will shed light on the likely trajectory for the stock.