AMC, RKT and other meme stocks are ripping higher due to an options gamma squeeze. As traders buy call options, options market makers must buy stock to stay hedged. We believe this hedging flow is whats causing massive stock moves.

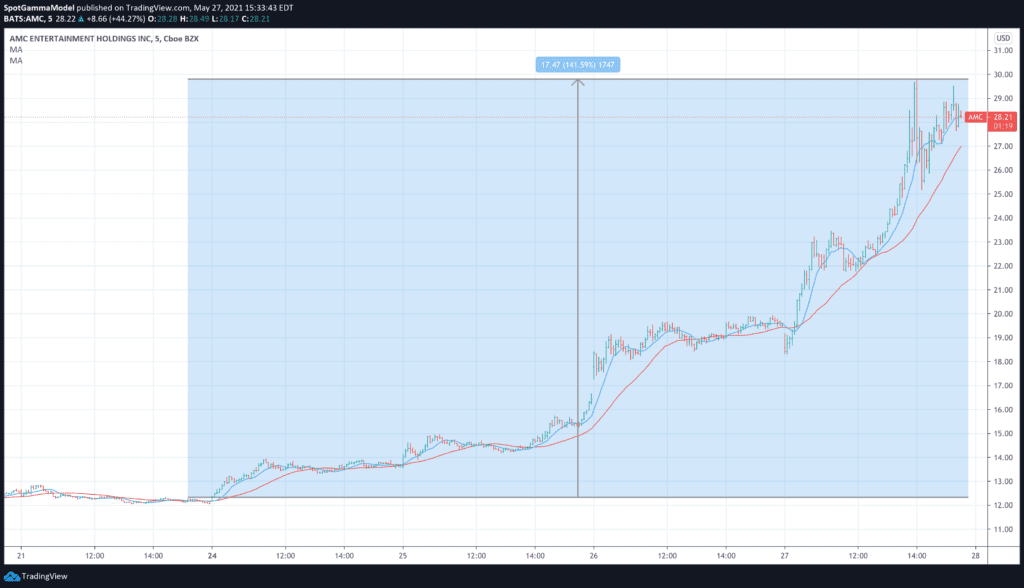

AMC is up nearly 140% this week alone. As you can see the stock hit “escape vol-ocity” in the past 2-3 sessions as short dated call option volume spiked.

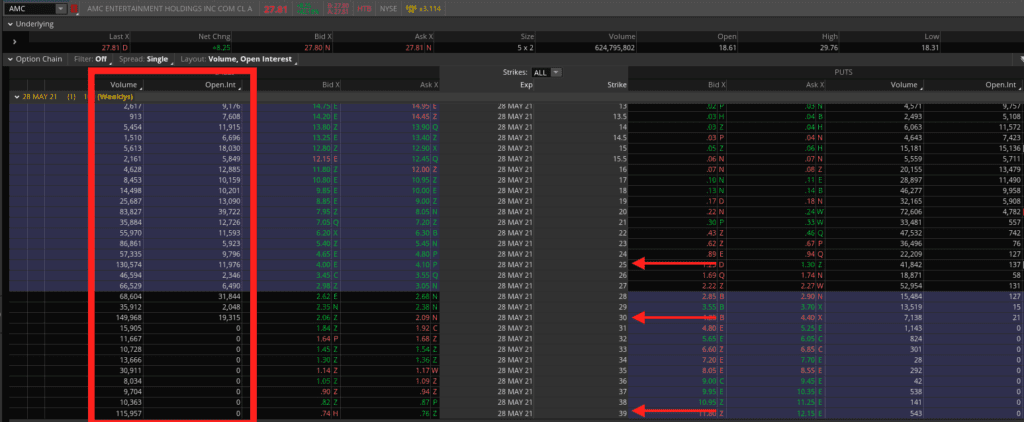

Below we have a snapshot of the current options volume in AMC. As you can see in the red box the days options volume is massive – and it heavily outpaces open interest. This is particularly true of the 25 and 30 strikes in which volume is near 150k for today.

If traders are buying large amounts of calls, then market makers are short calls. To hedge these positions, market makers must buy AMC stock. Call buyers forcing market makers into purchasing stock is the essence of the options gamma squeeze.

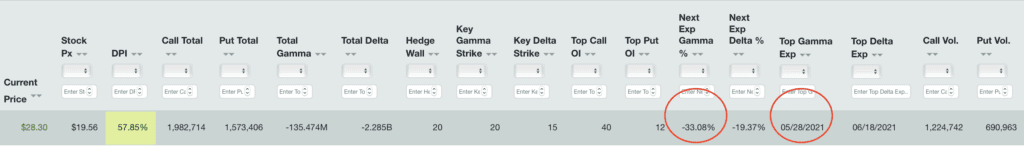

To start the day our EquityHub options model was telling us that nearly 30% of total AMC gamma expired tomorrow, 5/28. We think that number shifts to 50% based on the wild volume taking place today. Because so much gamma expires tomorrow we think that AMC will likely consolidate as call options decay kicks in, which allows dealers to unwind some of their long stock hedge position.

It may be then on Monday that the squeeze restarts as call buyers reload on the next set of weekly call options (6/4/21 expiration).