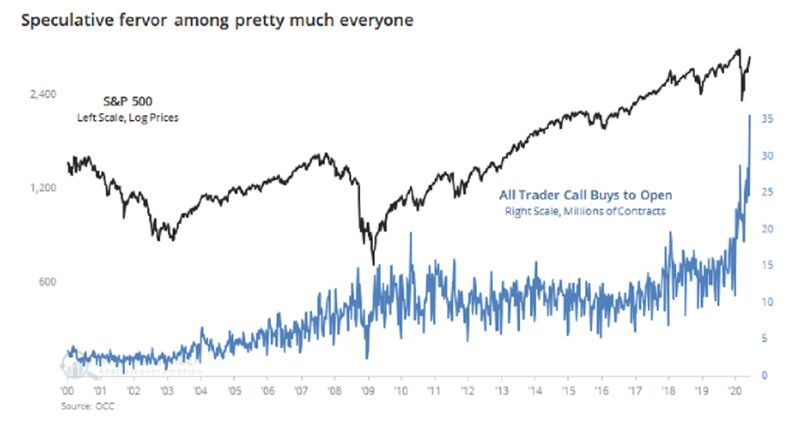

We have been reviewing the last 5 days of options data in light of reports showing record levels of call positions. Seen below you can see that call volumes have exceeded those of February 2020 – something we felt helped lead to the large drop in March.

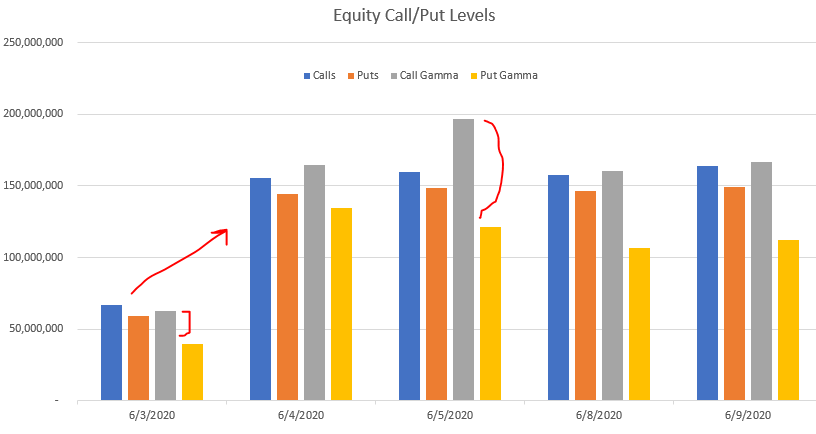

As you can see below our data suggests the real “fever” heated up late last week as call positions jumped. As the market rose that pushed gamma levels higher too. Note the divergence between call gamma and put gamma that has formed. This data is equities/etfs only, it does not include Index products.

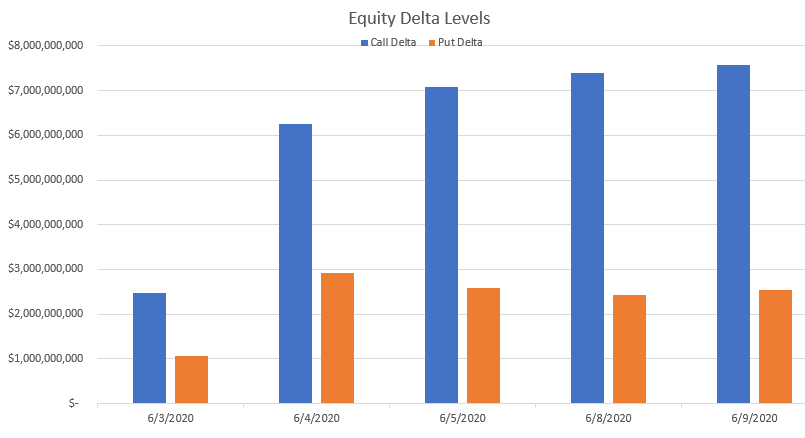

If you examine this from a delta perspective you can see a sharper divergence between puts and calls:

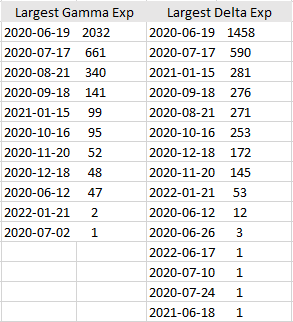

This suggests there is a fair amount of hedges in place as these calls push farther into the money. When might those calls be removed? You can see out of ~3800 products 6/19 is the dominant expiration.

While we cannot say for certain what the outcome of this is, one would have to mark June 19th as an important date. While my personal feeling is this pressures the market, large sales aren’t the only outcome. For example positions could be rolled in advanced, or holders could elect to take delivery.

Of course there is also VIX expiration on the 17th and the FOMC today (6/10).