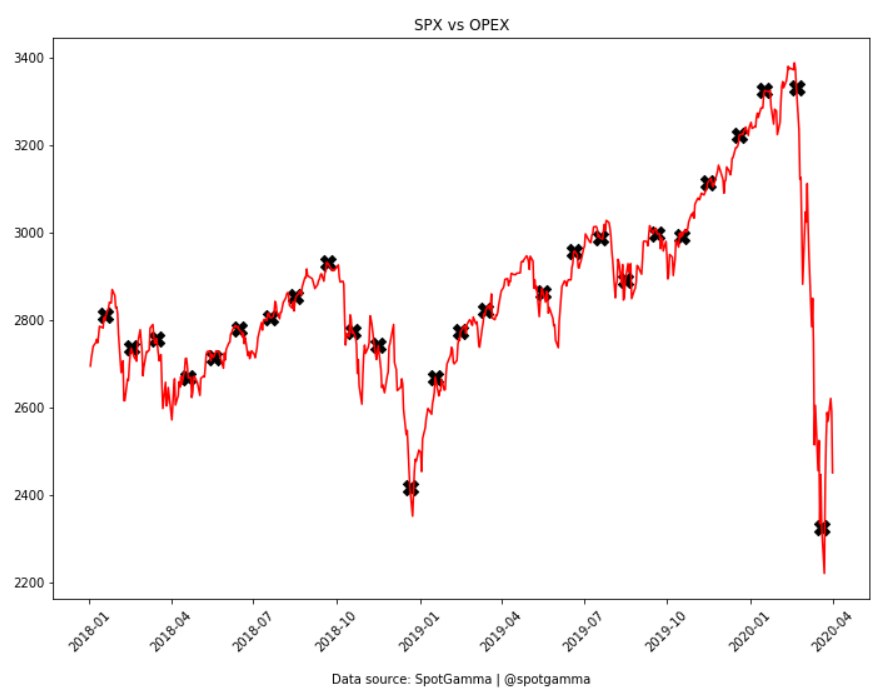

This past March monthly OPEX was one of the largest on record, and featured very large deep in the money put positions. We believed this was a key driver of market volatility in early March, and the change in markets following expiration has been drastic. March OPEX was on 3/20, and it was the following Monday (3/23) that marked the SPX low.

Equally as fascinating was the OPEX in late February (2/21), just prior to the market crash. There were record call positions leading into that expiration, with the market high registering 2/19. Of course the crash began the following Monday after many calls expired.

If you want to be up to date on the next large options expiration, subscribe now.