Most of the time when we talk about “gamma traps” people assume its a downside only event. I don’t think thats true. As I once read somewhere “gamma happens both ways”. There is evidence the last several days rise in stocks was caused by calls being rolled up.

If market makers are on the other side of short call positions that get rolled higher, they will have to reduce their short hedges (assuming dealers are net long calls, hedged with short stock). In other words they need to buy back stock – be it futures, SPY, etc.

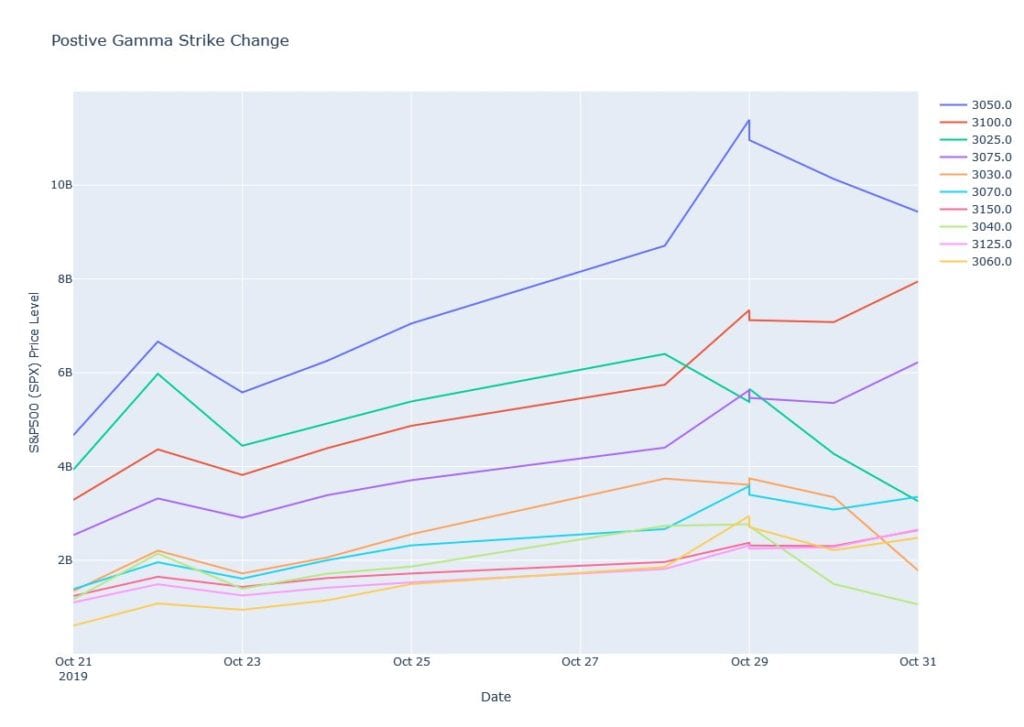

The chart below shows a recent history of positive gamma. You can see over the last few days the 3025 & 3050 strike started decreasing in favor of 3075 and 3100. This is evidence that calls were being rolled up.

The other indication is price action in the S&P500 itself. The last two days were very sharp moves up into the market close which is indicative of hedging. I speculate this is hedging as the price action appears impervious to price – in other words its buying regardless of impact and it is pretty large size. If the price action were say, a mutual fund, they would not want to rip through prices. They would work the order over a day or some other timeframe that reduces price impact. See in the chart below the sharp moves up in the last 10 minutes of the cash close. Its mechanical in appearance.

That brings us to the “Call Roll Gamma Trap” which is a result of both the roll but also the reflexivity of this action. Assuming dealers are net short puts and long calls, they are hedged with short futures. Puts obviously lose value as implied vols come in, causing more dealer stock buying. As dealers buy back hedges the higher market results in lower implied volatility (just look at the VIX smash) which results in lower options prices. This results in more dealer buying.

You can see how this cycle could become self-reinforcing and places a constant bid to the market.