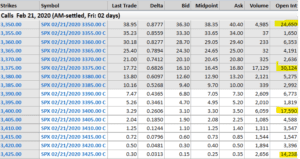

Today (2/19) we are looking at the size and potential of the Feb SPX AM OPEX roll that takes place on Friday (2/21). As you can see below there are some decent sized call positions which will have to be addressed – either closed or rolled. You can see there are some decent sized positions […]

call roll

The January 2018 Market Analogy

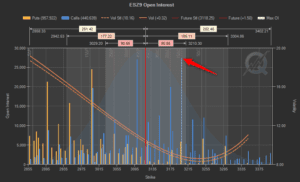

We’ve been seeing extreme call/put measures the past several weeks and these extreme measures only give way to more extreme measures. Nomura & JPM noted how heavy call positioning is relative to puts recently. There is also anecdotal evidence like this chart below, where Macrohedged notes: ” We cannot recall EVER seeing max OI for […]

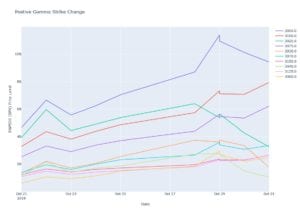

Call Roll Gamma Trap

Most of the time when we talk about “gamma traps” people assume its a downside only event. I don’t think thats true. As I once read somewhere “gamma happens both ways”. There is evidence the last several days rise in stocks was caused by calls being rolled up. If market makers are on the other […]