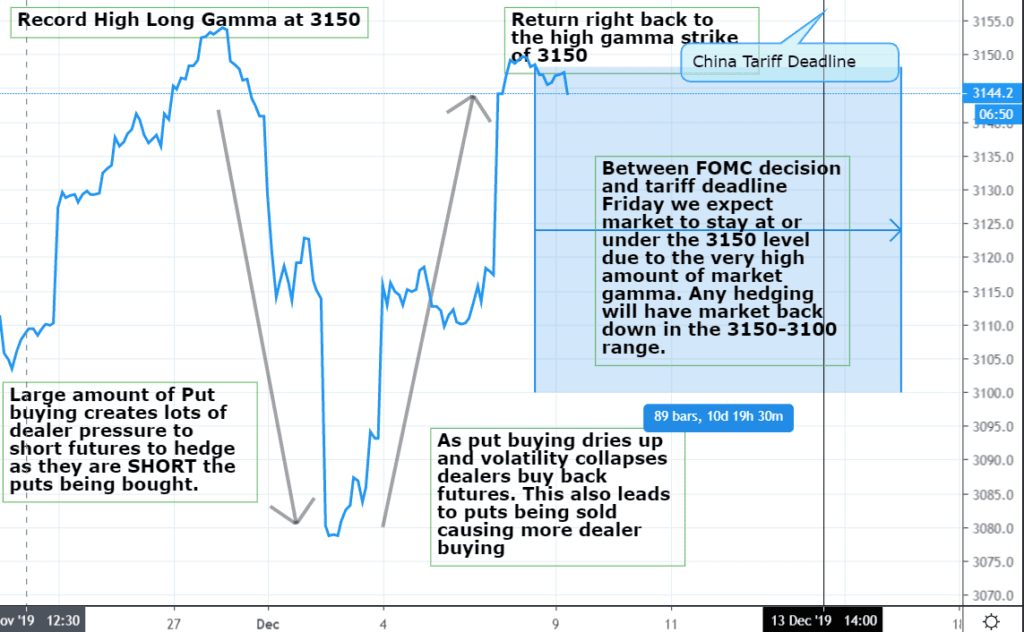

Here is a chart outlining how we saw the selloff during the first week of December 2019. There was record high gamma going into the first week of December which indicates that call:put ratios were at extremes. After a few negative tweets about trade and a poor ISM number selling started, and put buyers stepped in. This included one particularly large put buyer in the January 2980 puts. As people buy puts dealers are short those puts. To hedge they must sell futures.

After volatility calms these puts start losing value (and/or puts are sold) and force dealers to buy back futures. Its our opinion this is one cause for these “V” type moves.