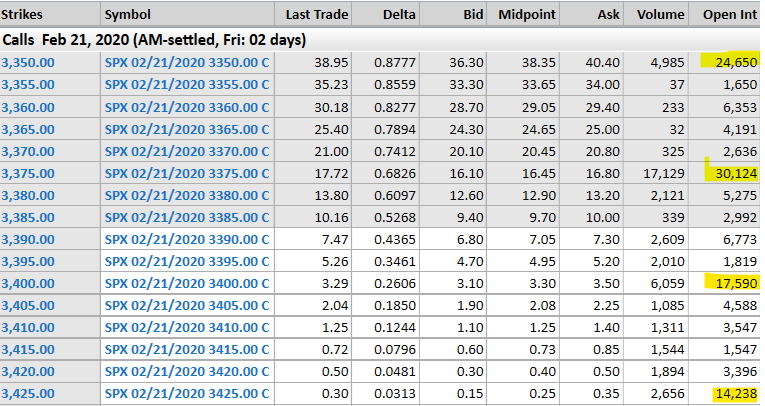

Today (2/19) we are looking at the size and potential of the Feb SPX AM OPEX roll that takes place on Friday (2/21). As you can see below there are some decent sized call positions which will have to be addressed – either closed or rolled. You can see there are some decent sized positions in the calls at 3350, 3375 and 4000. Those options are currently all fairly large in delta terms. Our model suggests that these calls are held LONG by dealers against which they are short futures. If these calls positions are rolled up in strike and out in time it may create a delta imbalance for dealers. This would mean they may have to buy back a substantial amount of futures.

As an interesting side note there is very little in terms of put positioning for Feb OPEX.