Macro Theme: |

Key Levels: |

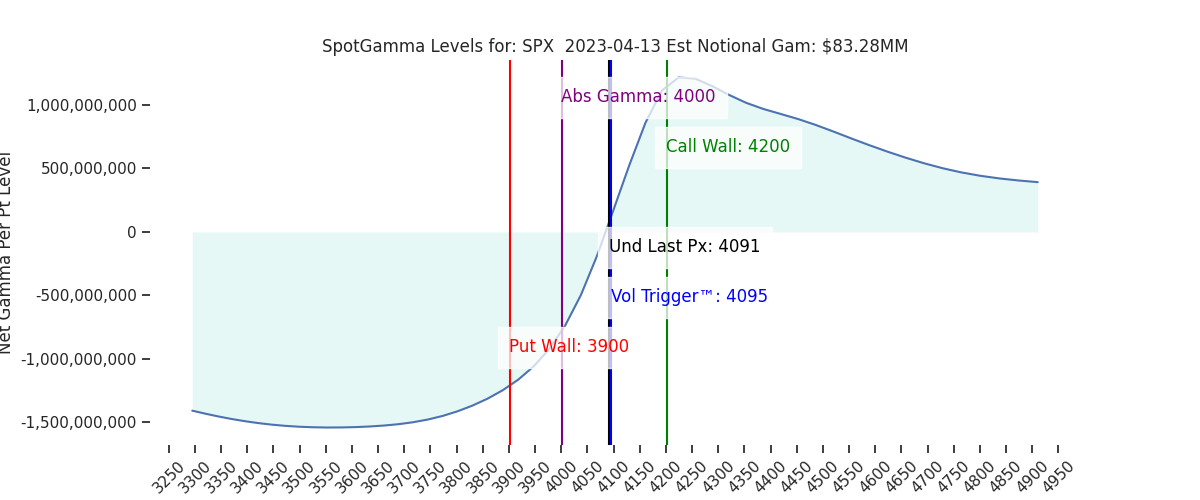

| Macro Note TBA | Reference Price: 4091 SG Implied 1-Day Move: 0.98% SG Implied 5-Day Move: 2.69% Volatility Trigger: 4095 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 |

Daily Note:

NOTE TO FOLLOW PREOPEN

| SpotGamma Proprietary SPX Levels | Latest Data | SPX Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

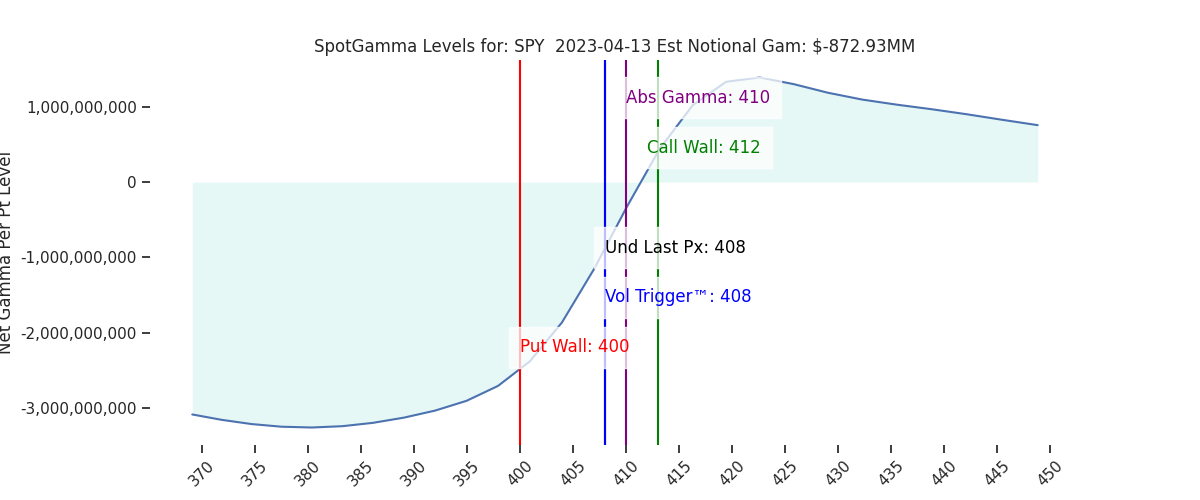

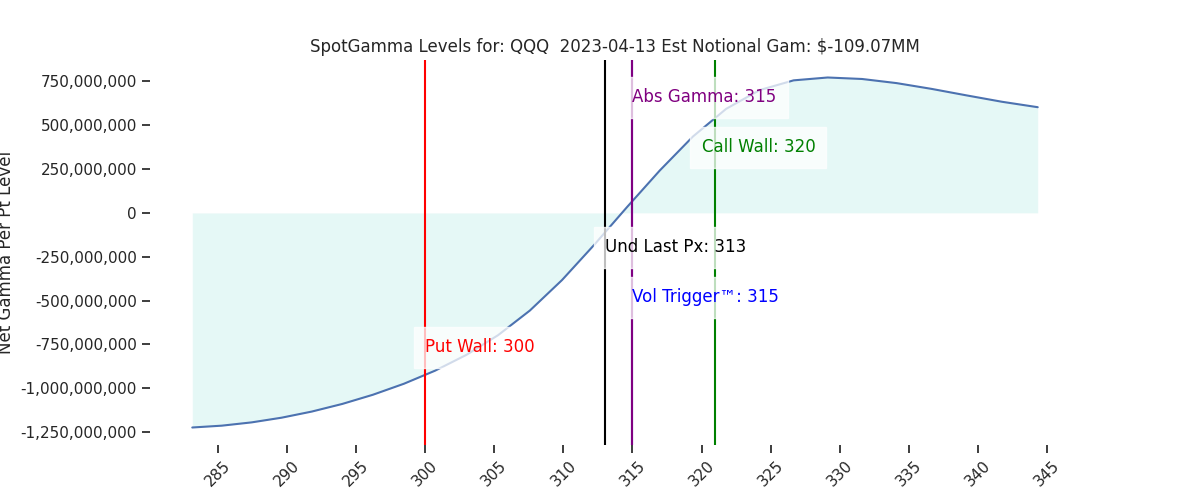

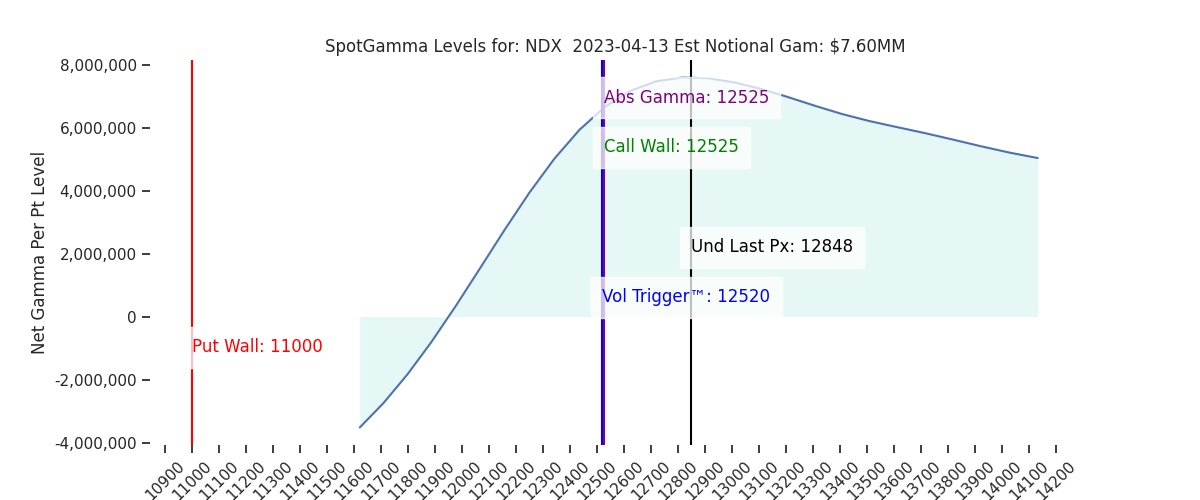

| Reference Price: | 4091 | 4092 | 408 | 12848 | 313 |

| SG Implied 1-Day Move: | 0.98%, | (±pts): 40.0 | VIX 1 Day Impl. Move:1.2% | ||

| SG Implied 5-Day Move: | 2.69% | 4109 (Monday Reference Price) | Range: 3999.0 | 4220.0 | ||

| SpotGamma Gamma Index™: | 0.45 | 0.85 | -0.19 | 0.05 | -0.03 |

| Volatility Trigger™: | 4095 | 4095 | 408 | 12520 | 315 |

| SpotGamma Absolute Gamma Strike: | 4000 | 4000 | 410 | 12525 | 315 |

| Gamma Notional (MM): | 83.0 | 68.0 | -873.0 | 8.0 | -109.0 |

| Call Wall: | 4200 | 4200 | 412 | 12525 | 320 |

| Put Wall: | 3900 | 3900 | 400 | 11000 | 300 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4095 | 4095 | 410.0 | 11913.0 | 339 |

| Gamma Tilt: | 1.11 | 1.03 | 0.8 | 1.7 | 0.94 |

| Delta Neutral Px: | 4027 | ||||

| Net Delta (MM): | $1,573,447 | $1,486,336 | $190,117 | $49,878 | $99,197 |

| 25 Day Risk Reversal: | -0.06 | -0.05 | -0.06 | -0.05 | -0.05 |

| Call Volume: | 569,779 | 377,457 | 2,201,991 | 8,686 | 780,023 |

| Put Volume: | 884,839 | 742,945 | 2,825,333 | 8,267 | 956,844 |

| Call Open Interest: | 6,012,107 | 5,935,151 | 6,910,163 | 54,886 | 4,667,656 |

| Put Open Interest: | 11,565,106 | 11,222,517 | 13,864,394 | 62,466 | 8,030,696 |

| Key Support & Resistance Strikes: |

|---|

| SPX: [4150, 4100, 4050, 4000] |

| SPY: [410, 408, 405, 400] |

| QQQ: [320, 315, 310, 300] |

| NDX: [14000, 13000, 12525, 12500] |

| SPX Combo (Strike, Percentile): [(4276.0, 83.54), (4252.0, 93.38), (4227.0, 77.79), (4211.0, 85.19), (4198.0, 97.64), (4190.0, 81.68), (4174.0, 93.2), (4170.0, 79.99), (4162.0, 92.15), (4149.0, 97.19), (4141.0, 88.13), (4129.0, 85.31), (4125.0, 90.5), (4121.0, 77.13), (4100.0, 93.63), (4080.0, 80.33), (4076.0, 79.49), (4071.0, 79.06), (4059.0, 85.41), (4051.0, 87.02), (4010.0, 87.11), (4002.0, 93.32), (3961.0, 79.56), (3949.0, 90.48), (3912.0, 80.51), (3900.0, 94.81)] |

| SPY Combo: [418.66, 413.76, 388.87, 408.87, 423.96] |

| NDX Combo: [12527.0, 13131.0, 12309.0, 13337.0, 12810.0] |

| Sub Login Support Follow @SpotGamma Strike Charts Historical Chart Gamma Expiration Tool |

| ©TenTen Capital LLC d.b.a. SpotGamma Please leave us a review: Click Here |

| See the FAQ for more information on SpotGamma data & analysis. |

| All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE. This content is intended solely for subscribers, please do not distribute the information without the express written consent of SpotGamma.com. |