What a difference a week makes. The S&P 500 went from consistently hitting all-time highs with 6,450 touched on Wednesday to close Friday down 1.6% to 6,238.

This dramatic shift from “zombie market” to spiking realized volatility exemplifies the need for protective puts and/or VIX calls as insurance, as we highlighted in the daily pre-market Founder’s Notes throughout last week. Insurance like this grows increasingly important as markets pivot from complacency to concern.

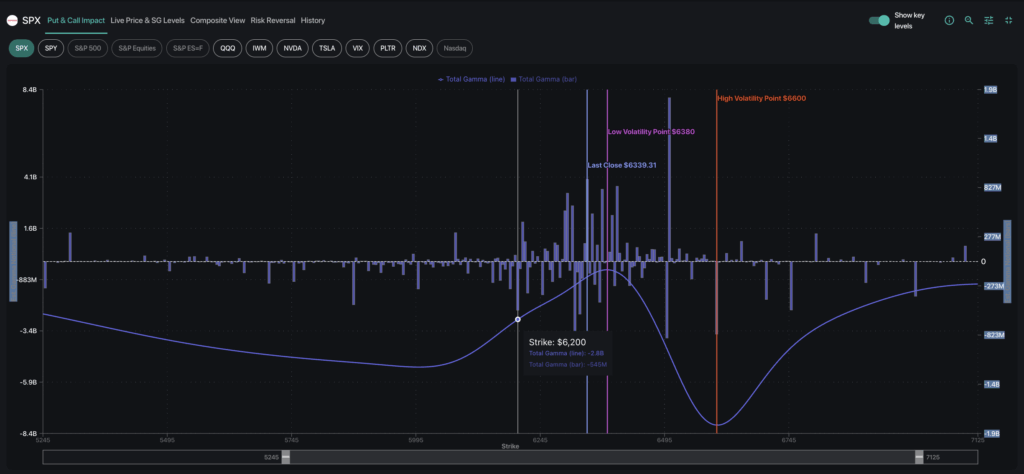

On Wednesday evening both META and MSFT delivered blowout earnings, initially suggesting the bull run would continue. However, the real damage arrived Friday when disappointing NFP data combined with ongoing tariff headline risks pushed the market below the critical 6,300 pivot level.

This awakened volatility from the summer slumber, as the VIX surged from 15 to 20 by week’s end. Our Volatility Dashboard had been highlighting the unusually low IV and the risk of this exact scenario for weeks: with 1-month realized vol compressed to just ~6%, any catalyst could trigger a sharp vol expansion.

Single Stock Moves: The Healthcare Highlights

This past week saw UNH drop to a 5-year low. However, the stock showed an unusual upside skew premium despite being driven to recent lows – an anomaly where call options 100 points out-of-the-money were trading with very sizeable premiums of 63 cents above at-the-money options.

The positive skew premium indicated elevated call demand from retail buyers hoping for recovery. However, when the stock bounced from $240 to $243 the call premiums actually lost value because the IV collapsed faster than the increase in price.

This positioning created a prime selling opportunity as the market was pricing in an absurd rally scenario – making these overpriced calls attractive candidates for premium selling strategies when skew premiums become excessive relative to realistic expectations.

Another healthcare stock on traders’ radar was Novo Nordisk (NVO), which plunged -18% on Tuesday following disappointing trial results before bouncing at the $45 put wall on Friday. Following the initial selloff, the stock saw heavy demand for upside structures rather than outright equity purchases, reflecting limited trader conviction.

Next Week’s Outlook: Navigating the New Regime

The question we now face: Is this a mild correction allowing vols to reset a bit and call skews to cool, or is this the start of something more severe? Our positional analysis suggests the former, since we don’t see the massive imbalances that characterized the July & August 2024 selloff.

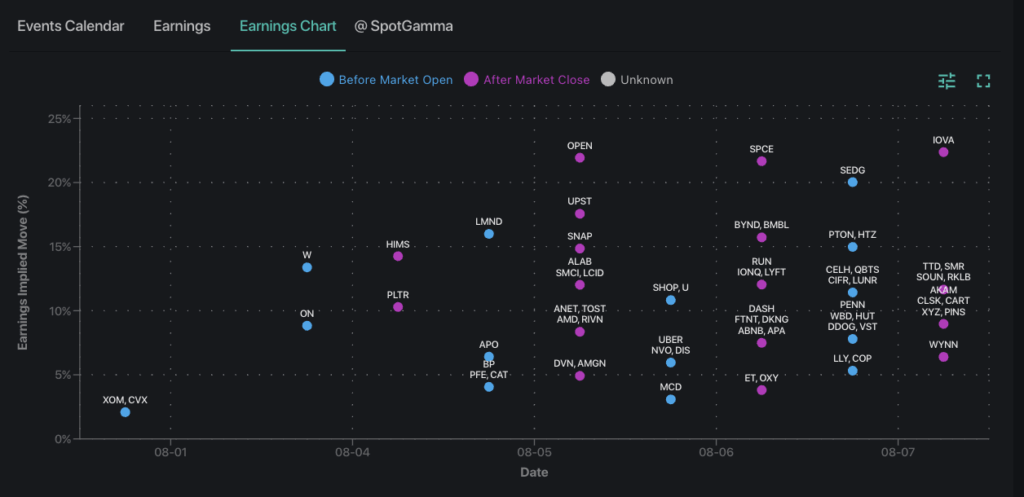

The upcoming calendar brings lighter fundamental headlines with 11% of S&P 500 market cap reporting earnings, but several key events still bear watching:

- Earnings from Energy, Healthcare, and Utilities sectors

- CPI (8/12)

The market’s zombie phase appears to be ending, replaced by more traditional price discovery. For active traders, this environment offers significantly more opportunities than the recent low-volatility grind – the key is having the right tools to navigate the increased volatility.

Stay positioned, stay informed, and remember: in volatile markets like these, having the right data and tools makes all the difference.