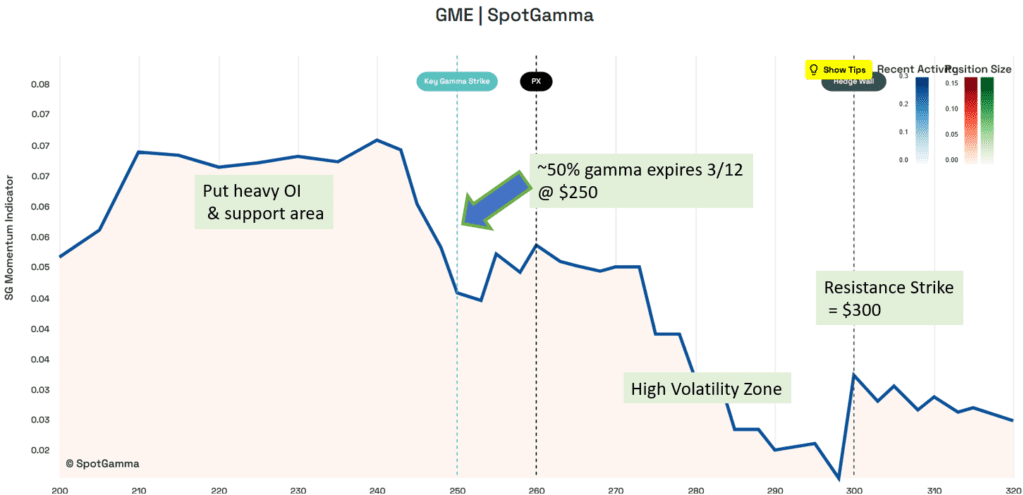

Yesterday we added a video which provided an update on our GME gamma squeeze model. We noted that some 50% of total GME gamma was set to expire at the close of trading on Friday, March 12th. The strike with the largest gamma position was the $250 strike, with most of that held in puts.

We suggest this is largely a put position as you can see our EquityHub chart below is shaded red which implies its mostly put gamma active in GME. If GME can cross the $300 strike then we think that a call squeeze can start anew.

Because such a large amount of GME gamma expired today we think that GME will “unpin” this $250 area next week and start a new run higher. $800 is now the largest delta strike in GME, indicating a massive options position at that level and a possible upside target.