On 12/20 the S&P500 experienced its sharpest selling in over 3 months, as the index rapidly declined 1.6% – seemingly out of nowhere.

SpotGamma, in real time, flagged 0DTE trading as a likely culprit in a now-viral tweet:

Its a 0DTE driven plunge in the S&P.

— SpotGamma (@spotgamma) December 20, 2023

you can see the spread here between bearish 0DTE flow (teal) is identical to that of all flow (purple) informing us that the bulk of flow on this downdraft is all todays expiration. pic.twitter.com/WFGuRY2Cj8

This information was picked up in posts by both Bloomberg, and ZeroHedge:

For deeper analysis, watch the video below, and read what SpotGamma’s Founder, Brent Kochuba, wrote in the 12/21 Founder’s Note.

From SpotGamma’s 12/21 Founder’s Note:

Yesterday had a lot of the elements of a flash crash, as the only apparent trigger of downside action were the flows that caused them.

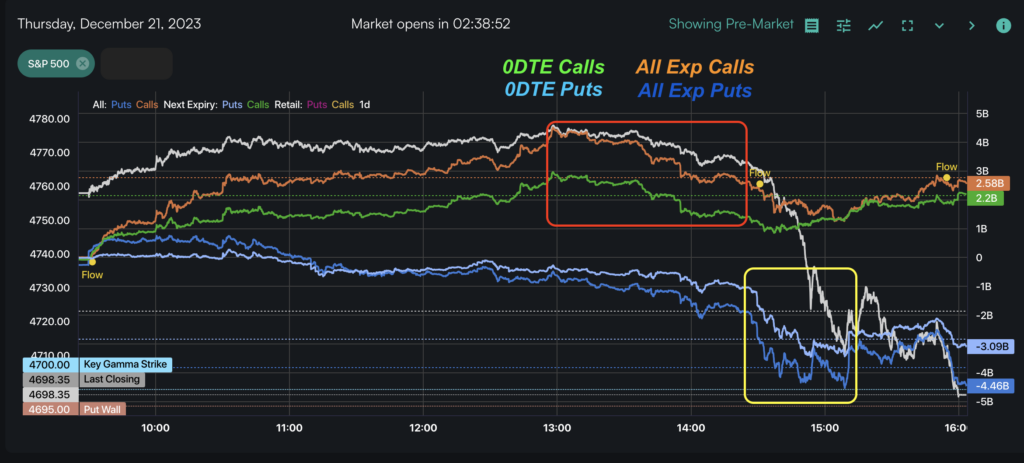

Heading into last nights 1pm ET treasury auction, our

HIRO readings were +$4bn on the day, and after that auction the negative deltas began to build. The first wave was call selling (red box), and the second wave was put buying (yellow box). In both cases the flow was predominantly 0DTE flow (we can tell because the spread between 0DTE lines and All Exp lines stays equidistant), and the end result of this is a lows of

HIRO are -$3bn around 3pm ET. Therefore that is roughly $7bn of S&P500 deltas dumped in about an hour – but that’s just S&P500. As we chronicled last night, Mag7 added another ~$1.5 billion of negative deltas.

Heading into this drawdown, ATM IV’s were <=8% (based on start of day), suggesting that traders were pricing in only ~50bps of movement in the S&P500. Therefore, as soon as the put buying picked up at 2:30PM, there seemed to be a scramble for negative 0DTE delta (i.e. put buying).

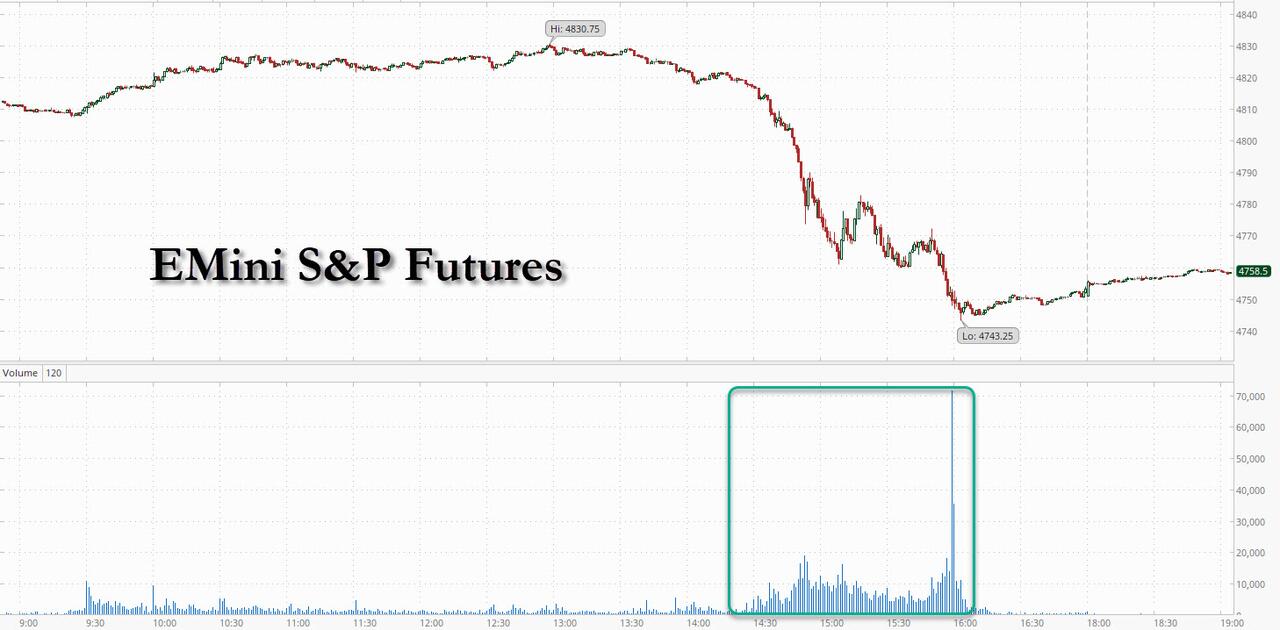

Whats interesting about this, is that its right after 2:30PM ET that selling in the ES picks up. Whether this was a hedging response to those negative

put deltas, or flow that coincided with it, the market pressure was likely the same. In either case, we are labeling yesterdays move as a “mini flash crash”.

From ZH (emphasis theirs): As Goldman’s Washington explains, while we have seen passive selling over the past few days, “it clearly is not enough to cause such a swift reversal intraday.” Looking at S&P E-Mini’s, most volume started printing after 2:30pm, even prior to the break of 4800 and the pickup in volume was real. The average run rate over the 45 minutes following the initial move was ~5x greater than earlier in the cash session.”