0DTE Options trading continues to capture the attention of traders, as it appears to drive market behavior.

Consider this quote from SpotGamma Founder Brent Kochuba, in a recent 0DTE Bloomberg article:

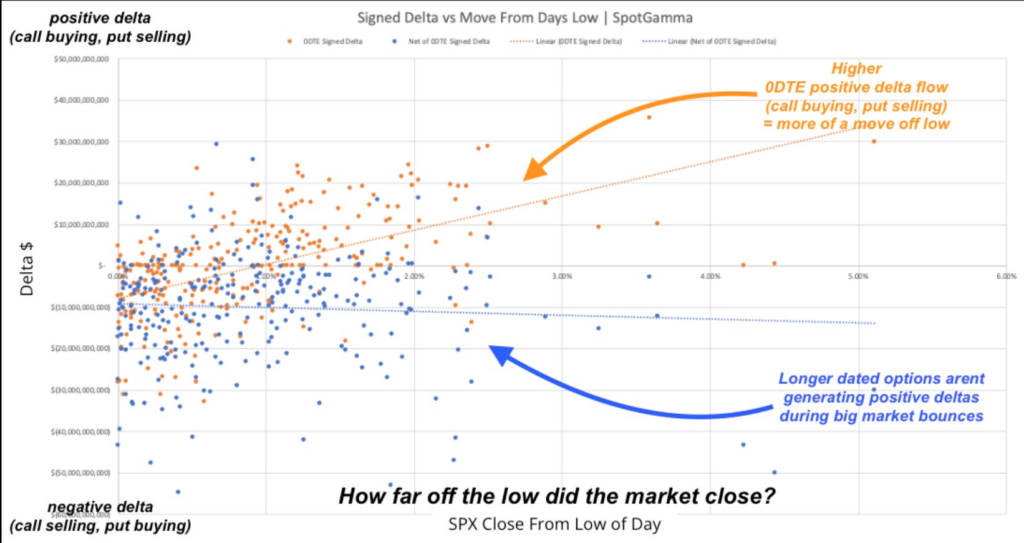

“To Brent Kochuba, founder of SpotGamma, the explosive rise of 0DTE options has actually acted as a positive market force. He conducted a study on the impact of the activity via a measure known as delta, or the theoretical value of stock required for market makers to hedge the directional exposure resulting from options transactions. From the start of 2022 to mid-February this year, positive 0DTE delta was tied to market rallies, a sign that short-dated calls were mainly being used to place wagers on stock rebounds.

“0DTE does not seem to be associated with betting on a large downside movement. Large downside market volatility appears to be driven by larger, longer dated S&P volume,” Kochuba said. “Where 0DTE is currently most impactful is where it seems 0DTE calls are being used to ‘buy the dips’ after large declines. In a way this suppresses volatility.”

How to Monitor 0DTE Options Trading in Real Time

In this video, SpotGamma uses our proprietary HIRO (Hedging Impact of Real Time Options) algorithm to detail the impact of live options flow – including 0DTE short dated options trading.

In essence, we can watch the 0DTE trading drama unfold in real time.

SpotGamma shows how options flow portents a market decline in real time. We believe this is because 0DTE put buyers, along with longer-dated put buyers lead dealers to have to short futures to hedge.