Trader Doug Pless recently played a common setup we see in the HIRO data. HIRO can be quite valuable in helping traders identify a turn in trend, not only on declines but also on strong rallies.

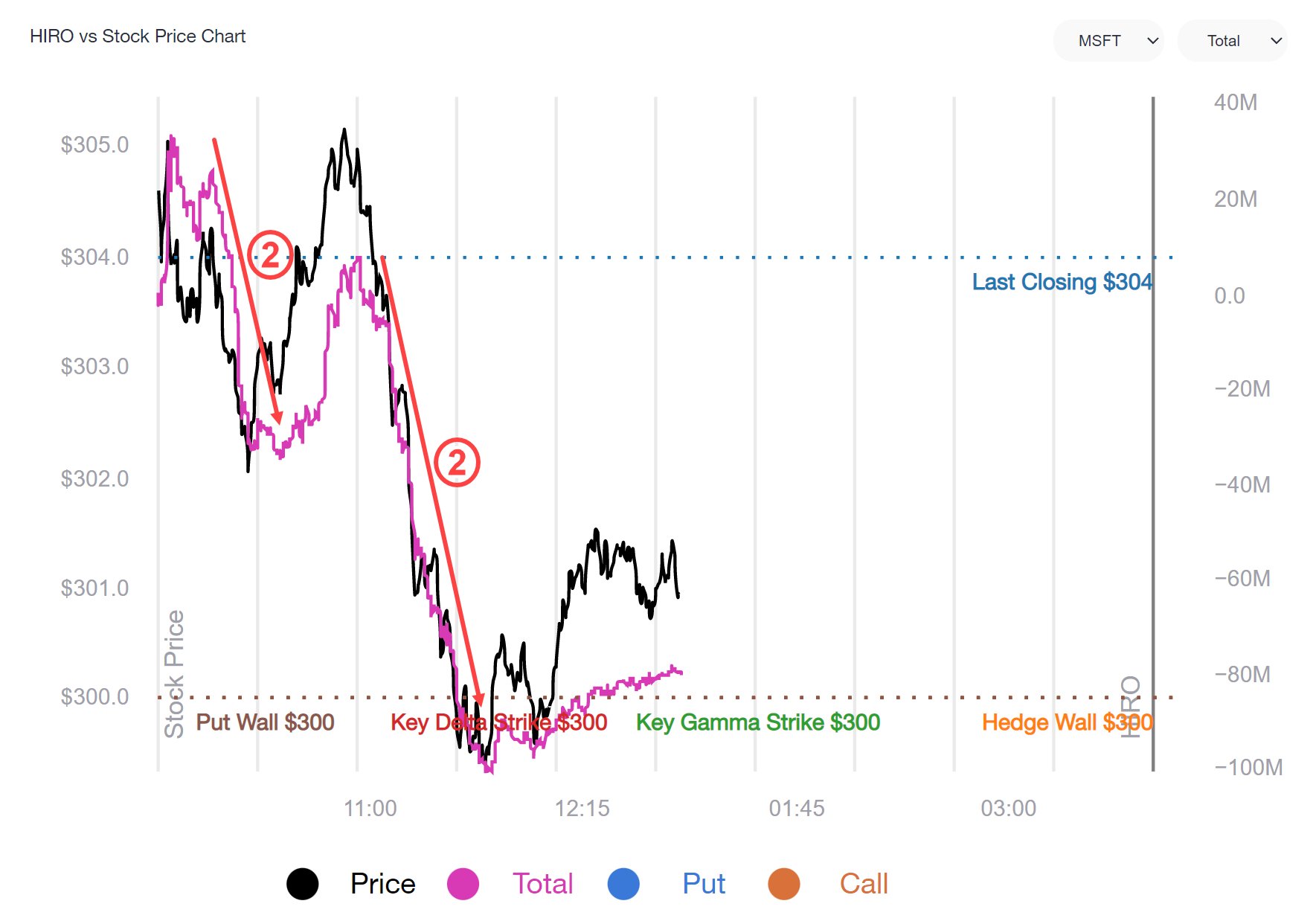

Below is a chart of MSFT from Friday, and you can see that the stock (black line) traded sharply lower down in to the $300 strike. You’ll note at 300 there are several labels, which key support levels derived from our Equity Hub data.

As the stock sells of into that level, there is an interesting divergence in the HIRO data (purple line). If the HIRO line is trending lower, as labeled with the red “2” arrows, that is indicating traders are either selling calls or buying puts. This may lead options market makers to short MSFT stock.

When the HIRO line shifts sideways, or turns higher, that indicates that the call selling and/or put buying has stopped. Its at those point(s) that we see the stock mean revert.