What a legendary post! Spot on. $SPX 4400 it is! @spotgamma https://t.co/1dbjB9eo8p — magicavi (@magicavi89) August 25, 2023 The following analysis was revealed in real time both to our SpotGamma members, and posted to our Twitter account, in real time. On Friday August 25th Fed Powell gave a speech at the Jackson Hole symposium. This […]

HIRO

HIRO Can Help Find Stock Lows

Today AAPL stock cratered after announcing a cut in iPhone 14 production. Options flow may have helped traders identify the stock low – we walk you through how.

The Setup for a Gamma Squeeze in GME

Here we identify the options setup needed for a gamma squeeze in a stock like GME. Using our EquityHub we analyze the existing options position, and then look for signs of strong live options orderflow via our HIRO application. Specifically, you want to see large open interest at call strikes just above where a stock […]

Elon Buys 9% of TWTR & Calls Buyers Rush In

Elon Musk bought 9% of TWTR shares which spiked the stock over 20%. We ran our HIRO (hedging impact of real time options) indicator live as the market open (here), and explained how TWTR “out kicked its gamma coverage”. Below is our end of day recap, showing how call trading may have driven TWTR prices.

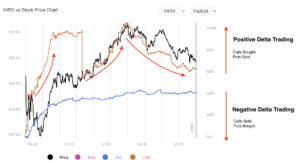

Using HIRO + SpotGamma Levels For ES / SPY Trading

Here we provide a great example of how large options-based support levels line up with our intraday options trading algo called HIRO. The SpotGamma HIRO Indicator measures the hedging impact of all options trades in real time. When SpotGamma HIRO shows that options flows confirm support and resistance levels, it can be a powerful combination.

Identifying Opportunities with HIRO

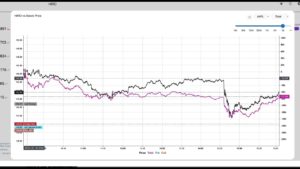

Trader Doug Pless recently played a common setup we see in the HIRO data. HIRO can be quite valuable in helping traders identify a turn in trend, not only on declines but also on strong rallies. Below is a chart of MSFT from Friday, and you can see that the stock (black line) traded sharply […]

There Are Times When Nothing Is Happening

The goal of HIRO is to alert users as to when options order flow may be impacting a stocks price. Equally important is knowing when options are not involved! A member asked us today about NVDA’s flow, and our response was “there’s nothing going on!”. This can be seen by the fact that the HIRO […]

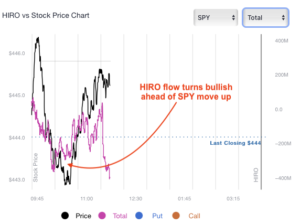

Using HIRO with SPY to Confirm Reversals

This morning we had a volatile opening, with SPY ripping ~$2 higher before reversing sharply (black line). The HIRO signal (purple) did not move up along with SPY on that opening, suggesting the options market wasn’t “buying” the move. After that opening rip, SPY sold sharply lower to $443. It was on those lows that […]

HIRO In Action: COIN

Today we noted strong call buying to start the day in COIN (Coinbase). This call buying is shown below, in orange, in the form of estimated hedging impact. The hedging impact, or HIRO signal, is tied to the right Y axis. The signal suggests that as traders buy calls, market makers are likely selling those […]