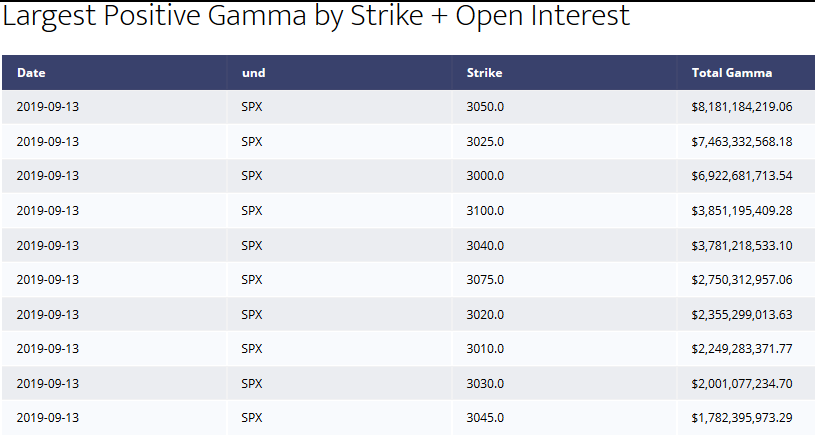

September 20th has a large options gamma roll ahead in the S&P500 (SPX, SPY). There are substantial call and put positions and there was obviously a lot of movement up this month. We also have the Fed which is expected to lower rates by 25 bps. This could provide a market catalyst just as large options positions are being rolled. We show lots of call gamma currently overhead – so far that resistance has meant little to the markets as it powers head on any sliver of positive China trade news. However, as we go higher the resistance increases. You can see in the table below there is a lot of options gamma overhead.

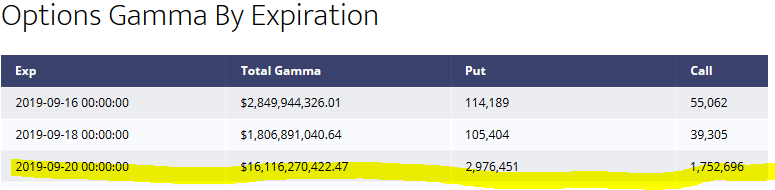

Notice the size of gamma in the September expiration. Its most likely that large positions start to roll next week which could provide some interesting movement, mixed in with the Fed means the stage is set for a decent move.

See more options data at the tables page here.