Last week, SPX tested the key gamma levels at 6,640 and 6,750 we highlighted in Monday’s Founder’s Note, marking a new all-time high with a close 6,716. The impact of the government shutdown starting on October 1 seems to have barely registered.

On Tuesday, the massive JPM Collar rolled from the 6,505 strike to a new 7,000 call for December 31 expiration with ~40k contracts. Positive dealer gamma around 6500 consequently became greatly reduced.

Continuing the trend we have seen in the past month, the S&P 500 complex has remained dependent on stabilizing, positive gamma provided by 0DTE put sellers, with some positions exceeding 10k-15k contracts on a daily basis.

Fixed Strike vols remain shockingly low with Monday SPX at-the-money IV at just 6%. However, the VIX remains elevated at 16.65, with large positive strikes below serving as support. This is a good deal higher than suggested based on extremely low IVs and <7% monthly realized volatility.

While basement-level volatility reinforces stable price action, this runs directly counter to the elevated VIX — and we expect this discrepancy to end by the October 17 OPEX with either vols picking up, or the VIX coming down.

Within the VIX gamma complex, 16.5 is where negative gamma starts to deepen. A breach above that level could accelerate movement towards the larger gamma strikes at 20 and 22.

Crypto Positioning Signals “Full Steam Ahead”

Within the crypto space, we have seen consistent bullish flow in the past week, with IBIT and ETHA both up 10%.

Based on the bullish positioning for IBIT, traders have aggressively looked for continued upside through massive call buying that evolved strategically with last week’s rally towards the $70 call wall.

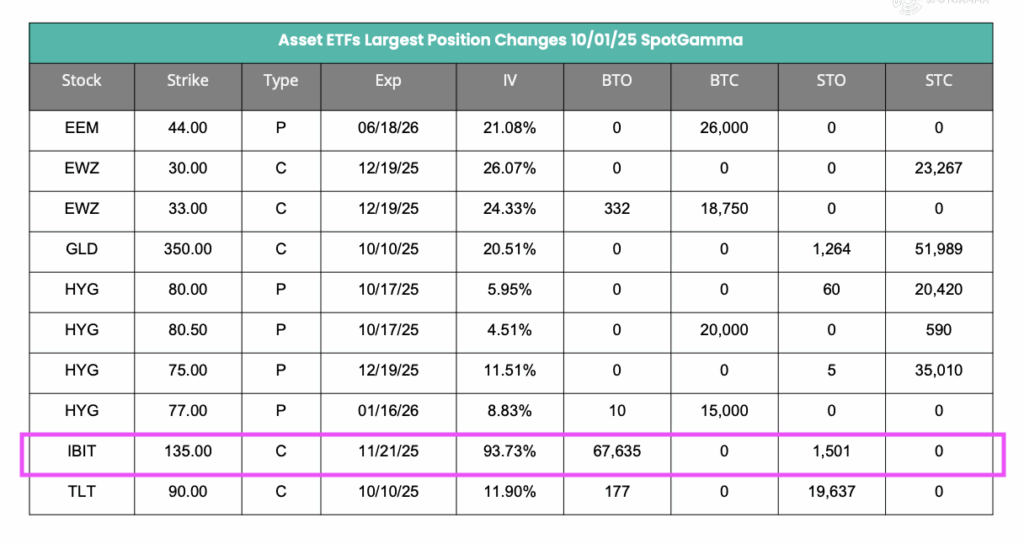

On October 1, 68k contracts were opened at the $135 strike (93.73% IV) expiring mid-November, indicating conviction for an extended rally far beyond $70.

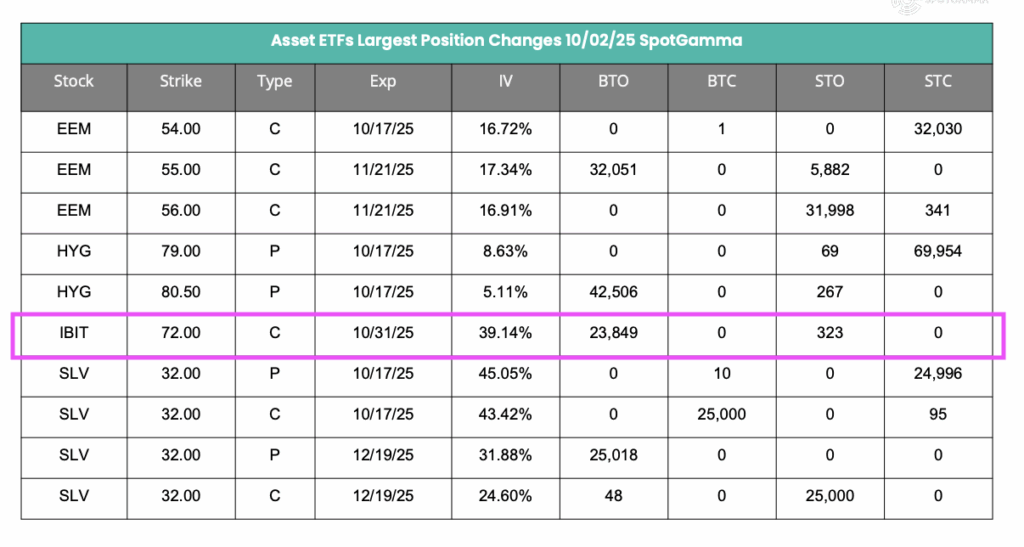

The next day on October 2, positioning became more tactical with 24k contracts opened at the $72 strike (39.14% IV) for late October, suggesting traders are now targeting a measured breakout just above the current resistance level.

The declining IV and shorter timeframe from this trade is important: this reflects increased confidence in a sustained grind higher rather than an opportunistic trade waiting to capitalize on a volatility spike.

Given the upward climb of the crypto market this past week, these positions indicate stronger buy-side sentiment that is worth paying attention to over the next month.

How OPEX Could Shatter the Low-Vol Regime

There are three macro data releases scheduled for the upcoming week:

- Wednesday: FOMC Minutes

- Thursday: Jobless Claims (dependent on resolution of government shutdown)

- Friday: University of Michigan Sentiment

In the next two weeks, we are watching for the October 15 CPI as a primary pivot risk for markets. A hot print could pop the low-vol equilibrium and test risk-off conditions quickly, while benign inflation keeps the SPX 7,000 year-end dream alive.

Following the cancellation of Friday’s NFP report from the federal government shutdown, the focus now shifts to whether inflation data can support the Fed’s easing narrative, or if price pressures force a hawkish recalibration: the CME now prices a 99% chance of an October cut, leaving little room for disappointment.

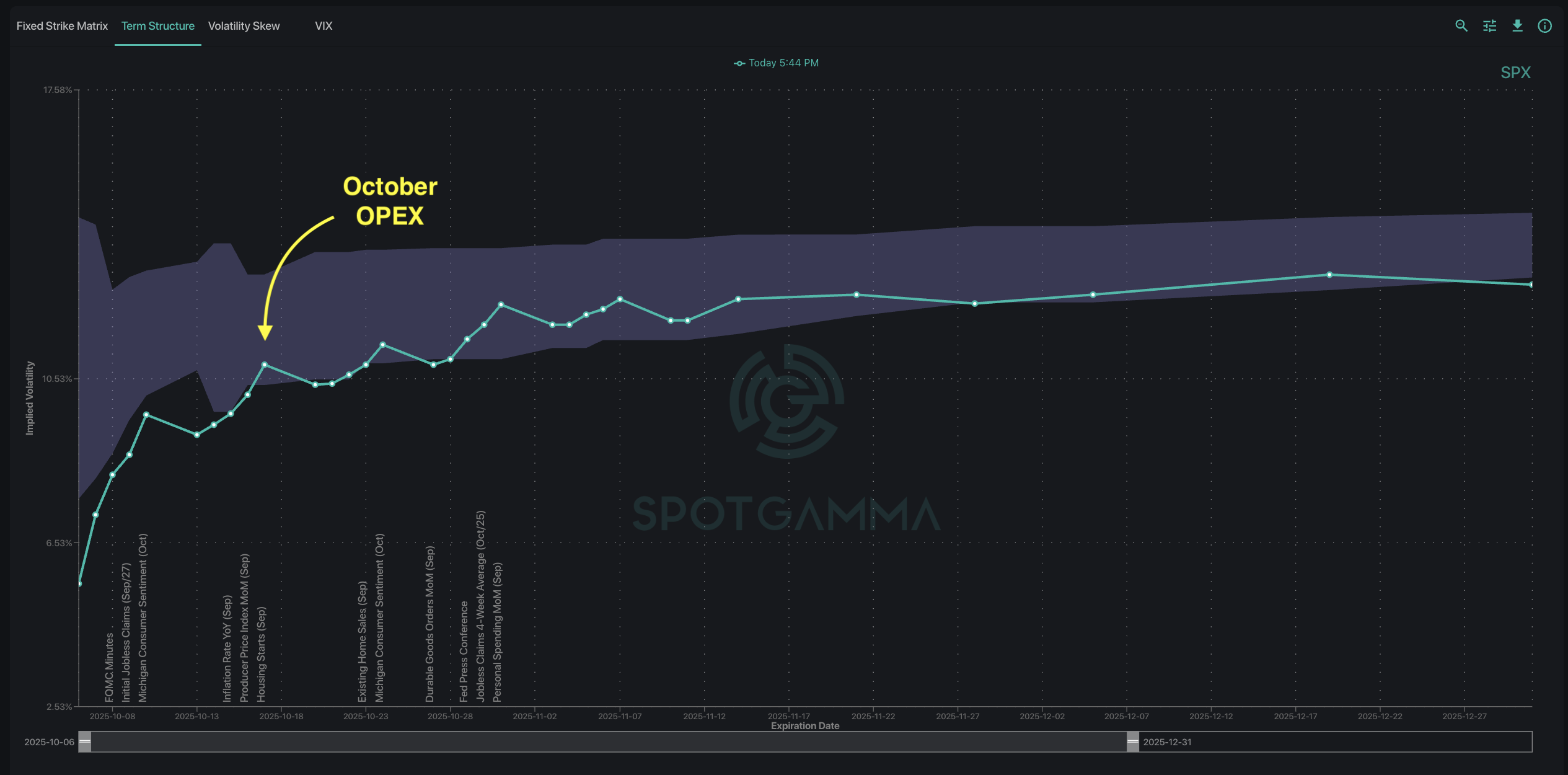

The October 17 monthly OPEX looms as the structural flashpoint with SPX term structure showing a pronounced implied volatility kink on this date, jumping from sub-10% short-dated IVs to 14%+ for longer-dated expirations. This also happens to coincide with the start of Q3 earnings season.

The setup unfolding is full of discrepancies and important nuances: volatility remains extremely low while the VIX stays elevated, market gamma exposure is positive yet dependent on continued options selling from 0DTE traders, and the economic data prints we normally rely on have been put on hold in the face of inflation and slowdown concerns.

We encourage our readers to remain watchful of the unfolding volatility dynamic to spot trading opportunities, with an eye towards dealer gamma exposure to continually reveal key support & resistance levels.