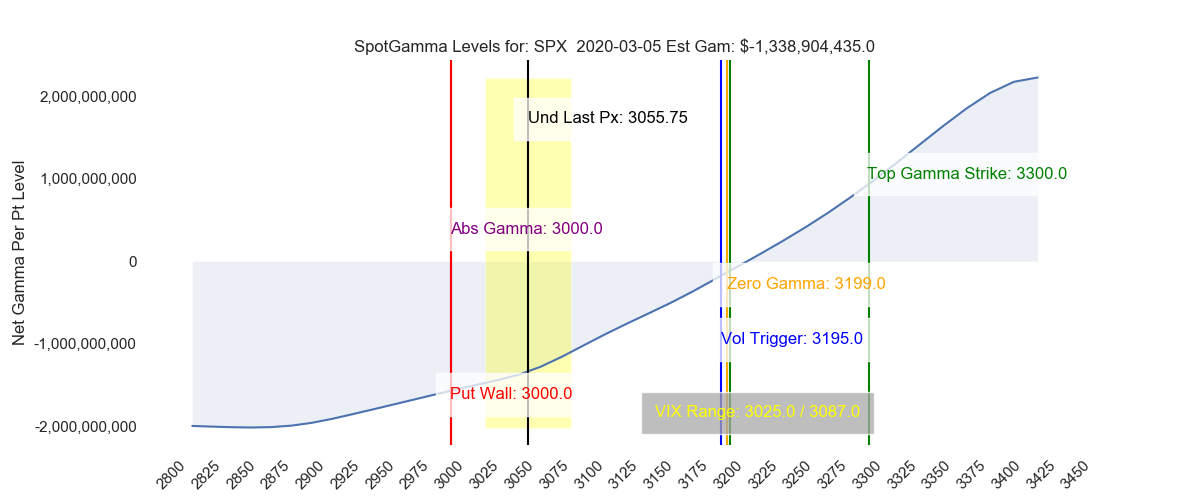

Great post from Heisenberg about Nomura and SocGen Gamma reports below. This chart went up on Thursday 3/5 – here is the SpotGamma gamma chart for reference:

In “We’re All Momentum Traders Now”, I spent quite a bit of time attempting to drive home one overarching point: Directional moves over the past two weeks have been amplified materially by gamma hedging flows, and that amplification is part and parcel of a feedback loop that can turn steep selloffs into outright routs.

This is familiar territory to regular readers. Hopefully, it will be well understood by all market participants at some point in the future, but I’m not optimistic about that.

The amusing reality of the situation was captured succinctly on Thursday by Nomura’s Charlie McElligott, who wrote that “even traders who view themselves as ‘fundamental’ or discretionary are in the same boat as ‘momentum’/ ‘negative convexity’ players”. Why? Well, because, as Charlie went on to emphasize, “we ALL operate under frameworks which allow for greater leverage deployment into trending markets, and conversely, dictate de-grossings into ‘VaR-events’”.

This dynamic – wherein directional moves are everywhere and always amplified by dealer hedging when gamma flips to the “dark side”, as it were – is likely to persist. “The gamma ‘breakeven’ remains painfully far away… before we are back in a ‘neutral’ position again which would contribute to ‘tighter’ ranges as the hedging behavior ‘compresses’”, McElligott said Friday.

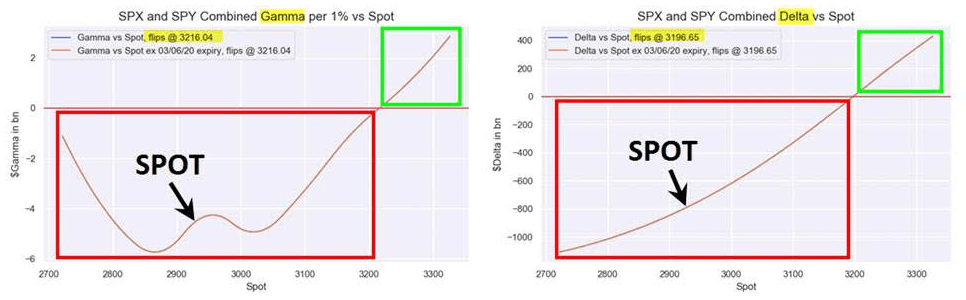

The size of vol.-selling flow for yield generation “has increased to such an extent that the hedging of these options has started to impact the index price itself”, he writes, before noting that on the bank’s estimates, “the flows from option gamma hedging can account for 10-15% of total daily volumes on index futures”.

After reiterating the basic concept (i.e., that “under normal conditions, hedging activity dampens market volatility… but in circumstances when total option gamma turns negative, hedging activity exacerbates market moves) he rolls out the following visual which illustrates the dynamic as it operated during the worst week for US equities since the crisis.

(SocGen explains: “Chart shows the distance from the gamma transition threshold — speed — vs the subsequent day absolute index return in %. Large moves in spot occur mostly during periods of negative gamma”)

“In the selloff in the last week of February 2020, option hedging continued to amplify volatility both on the upside and the downside”, Cassot writes