Last week, SPX tagged fresh all-time highs near the 6,700 Call Wall before surrendering gains in a series of controlled selloffs down to as low as 6,580, finally closing the week at 6,644.

The “Stock Up, Vol Up” system flashed warning signs mentioned in last Wednesday’s AM Founder’s Note. This dynamic represents a fundamental breakdown in the normal inverse relationship between equity prices and volatility, often indicating an overheated and unsustainable market rally

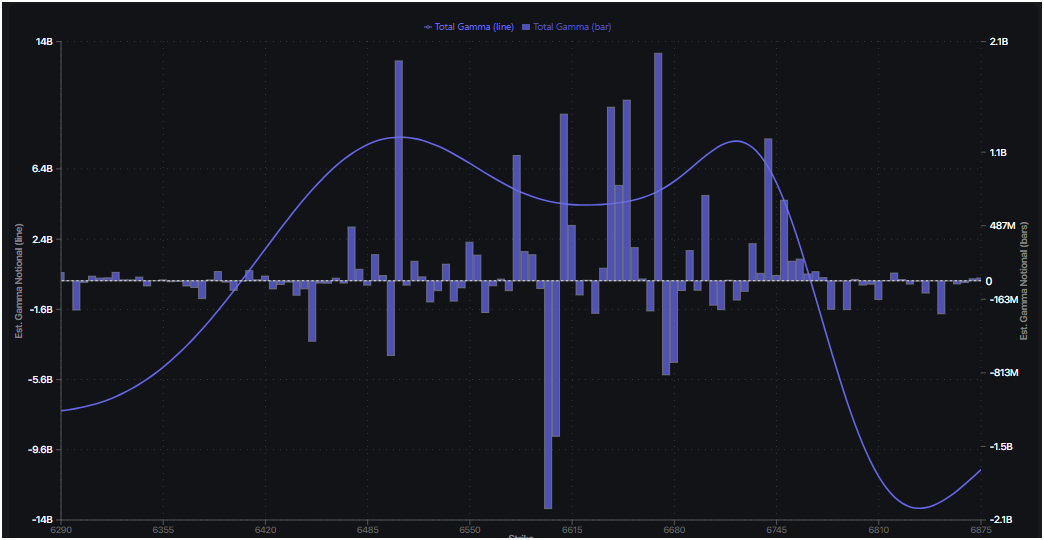

What kept this from becoming a more serious decline so far? The SPX dealer gamma positioning reveals a critical market structure as we approach the 9/30 quarterly OPEX: substantial positive gamma concentration in the 6,500-6,700 range has stabilized price action as market makers hedge by selling into rallies and buying into dips.

All roads lead to the 9/30 quarterly expiration this Tuesday. The massive gamma concentration around the 6,505 JPM Collar strike has provided a floor for this market, but that exact support structure will soon disappear.

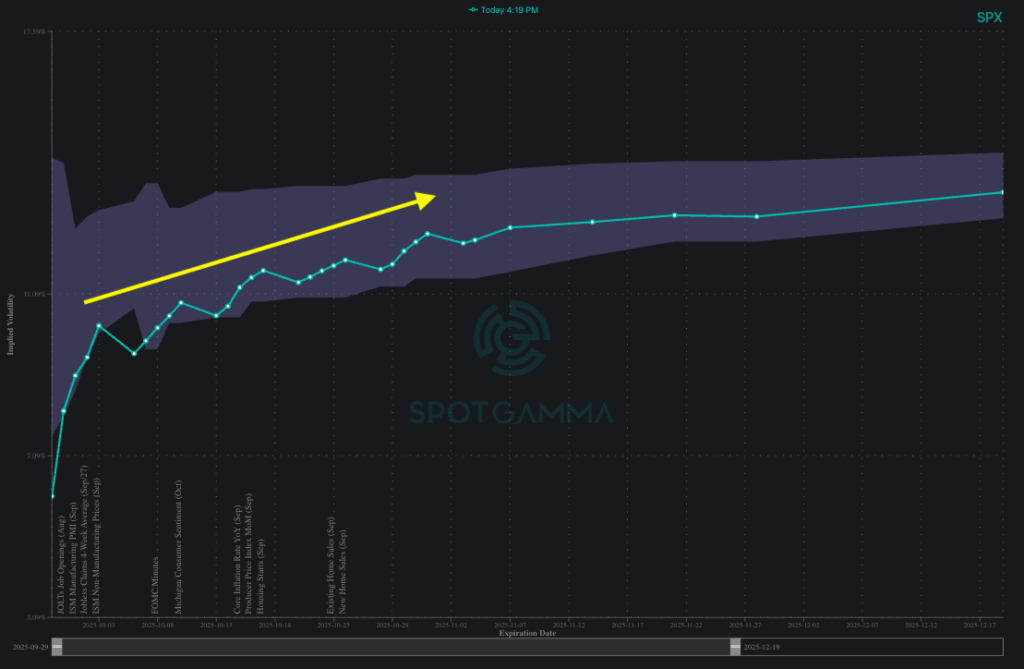

Implied volatility for SPX rises markedly immediately following 9/30 when the JPM Collar, and similar positive gamma positioning, expires. This indicates traders are gearing up for at least some uptick in market movement.

The big remaining question revolves around October’s setup. With cyclical data releases (ISM, JOLTS, Jobless Claims) clustered in early October, and the term structure showing elevated IVs for post-9/30 expirations, conditions appear ripe for an increase in realized volatility.

Single Name Warning Signs: Heavy Hedging Activity

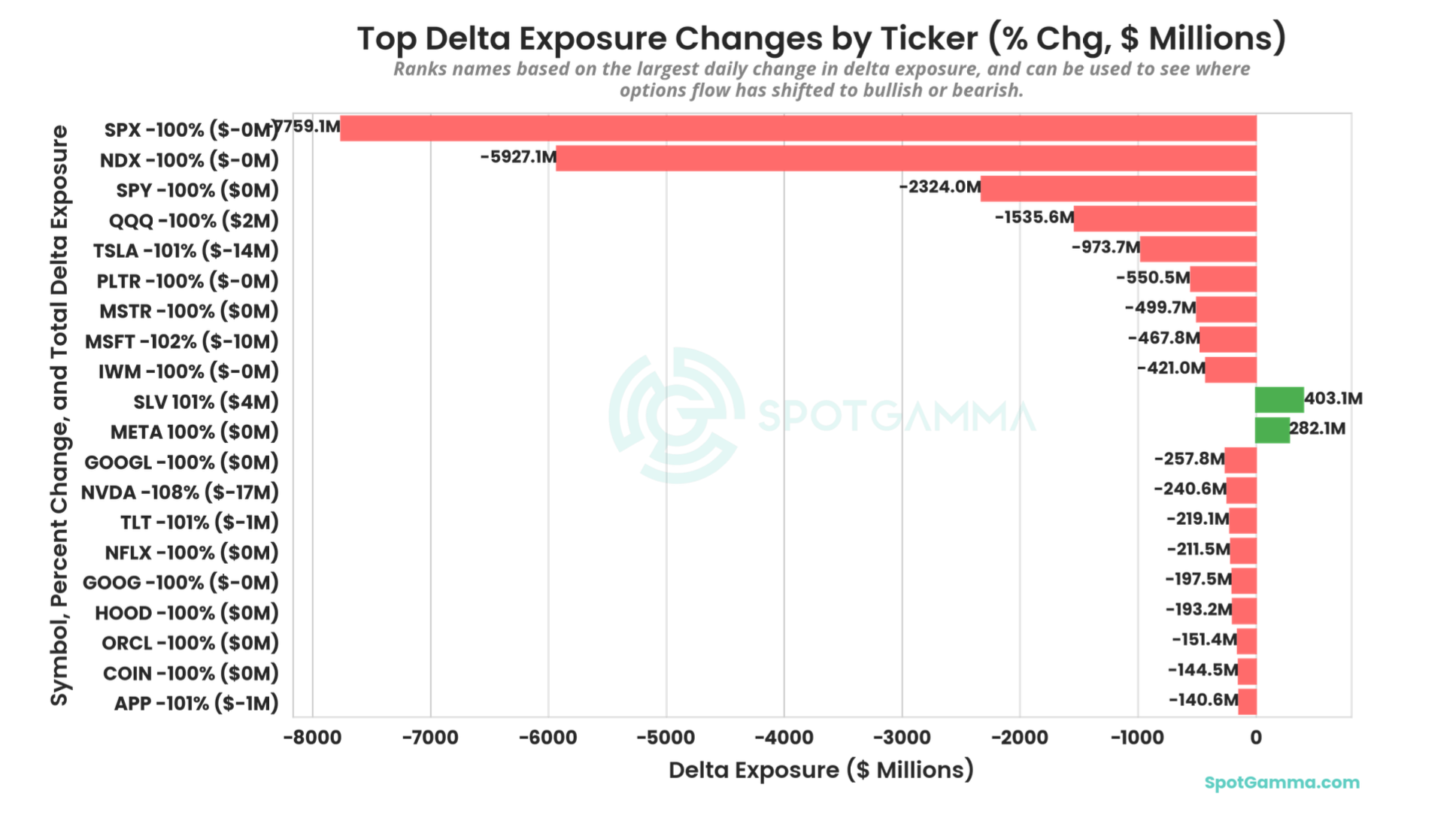

The options positioning data from our Synthetic OI model reveals systematic and escalating downside hedging across virtually all major US equity benchmarks throughout the week, with institutions establishing both short-term tactical and long-term structural protection.

The negative delta exposure across the major indices closely tracks with bearish options flow across all major US equity benchmarks as shown in our September 22 FlowPatrol report, including names such as SPY, QQQ, and IWM.

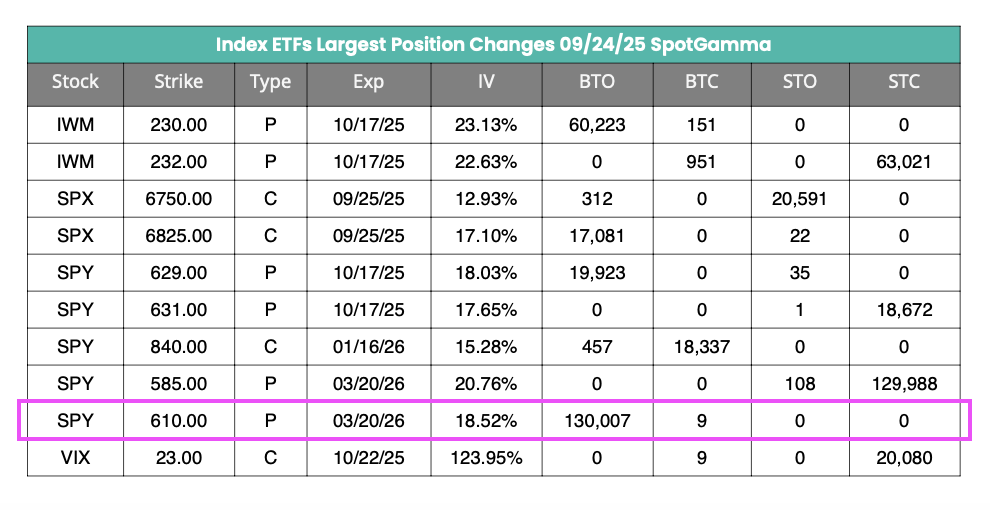

Additionally, the bought-to-open (BTO) index options positioning reveals aggressive new downside hedging across major ETFs, with institutions establishing fresh protective positions rather than closing existing ones.

Of all names last week SPY shows the most significant new downside hedging activity with over 130k contracts bought at the 610 strike and nearly 20k contracts at the 629 strike.

In the tech sector, similarly large put positions were opened in QQQ (121k new puts added at the 555 strike) and IWM, with additional VIX call-buying.

The worst case scenario is that these new positions represent fresh hedges against – or speculative bets on – a Volmegeddon scenario that would only pay off in severe market stress. At the very least, it appears that large buy-side firms are preparing for a transition away from the zombie market we have observed this past summer.

As we head into what could be a pivotal week, we urge readers to keep an eye on both when and how the market structure could shift – and the specter of heightened volatility seems to be a strong possibility as we head into the fall. The post-9/30 environment may require recalibrating risk frameworks and position sizing accordingly.