The S&P 500 delivered a week that looked dramatic at times, but ended up just drifting slightly — closing up 1.8% after a wild ride.

While volatility spiked early in the week from tariff deadlines and semiconductor earnings disappointments, IV quickly collapsed as 0DTE flows reasserted control. This vol crush became a self-reinforcing tailwind for equities, with short-dated IVs falling from elevated teens back to the low-to-mid range by week’s end.

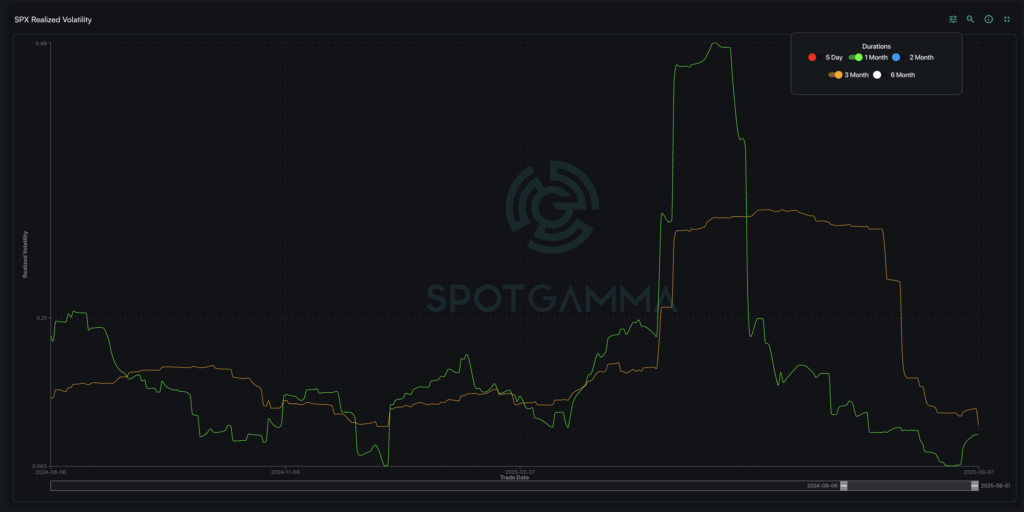

SPX realized volatility reveals a dramatic and persistent compression compared to the prior year, clearly showing the unusual low-vol regime that has dominated market dynamics these past few months.

This relentless vol contraction explains why even last week’s volatility spike barely registered on the longer-term scale, highlighting how conditioned the market has become to suppressed movement.

These “death valley” vol levels are approaching dangerous territory where extremely low realized volatility becomes a risk factor itself, creating perfect conditions for sudden vol expansion while simultaneously enabling the vanna-driven equity tailwinds we’ve been experiencing.

The current setup works beautifully when IV rises gradually alongside stable spot prices, yet this dynamic is still fragile to shocks — any negative catalyst could flip vanna flows from supportive to destructive, as the same dealer hedging that has been buying stock would suddenly turn into forced selling if prices fall while IV spikes.

Trade Spotlight: PLTR Drift Higher

This week has seen the market driven to extremes, with stock dispersion reaching unprecedented levels while index vol sits near record lows. Meanwhile, PLTR continues to reach all-time highs weekly as long calls pile in relentlessly.

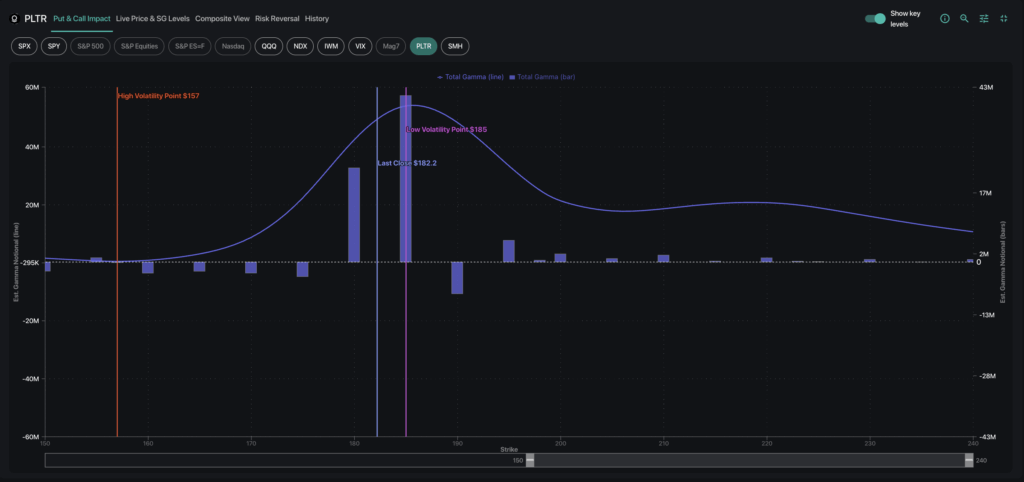

Gamma exposure for PLTR reveals strongly bullish dealer positioning with +57M in market maker gamma at the current $185 price level, creating an attractive “upward drift” setup given strong support.

The heavy concentration of positive dealer gamma between $180-$185 creates a volatility suppression zone that serves as a supportive floor for PLTR. This indicates the potential for range-bound trading with an upward bias. Note that gamma falls off significantly below this range — meaning price falling below this range would accelerate downward pressure from dealer hedging.

Next Week’s Outlook: The Calm Before August OPEX

Looking ahead, we’re entering a week with few potential catalysts: CPI on Tuesday (8/12) serves as the week’s only major data point. If CPI passes without incident, we expect further vol contraction through Friday’s OPEX (8/15). The real fireworks may wait until Jackson Hole (8/23) and NVDA earnings (8/27) at the end of the month.

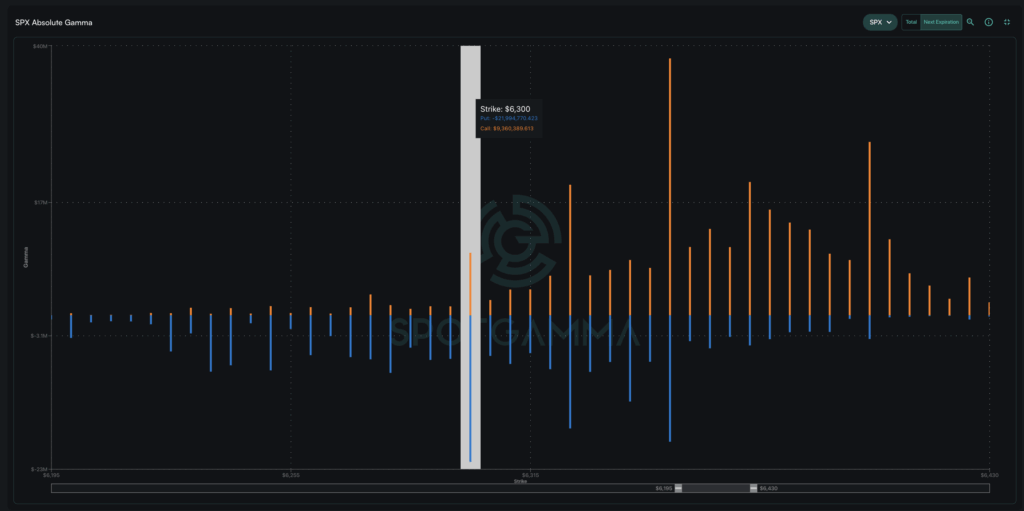

Our gamma model validates our Vol Trigger framework and underscores why our 6,300 pivot level remains so critical – a break below could trigger the vol expansion that would upend the current compressed environment.

Low volatility, positive gamma positioning, and cheap tech call premiums may continue to favor a bullish trajectory — but keep the Vol Trigger level bookmarked, as breaks below 6,300 could quickly shift the narrative.

Ready to see what options flows are signaling ahead of every day? Track these evolving options dynamics daily with SpotGamma’s options analytics as we navigate unprecdented low vols heading into August OPEX.