There’s really only one way to summarize the past few days: “What a week!”

Markets delivered some of the most extreme intraday swings of the year, culminating in Thursday’s violent selloff and Friday’s equally dramatic reversal—one of the sharpest two-day sequences we’ve seen in 2025. As of Thursday, the S&P 500 was on track for the worst November performance since 2008.

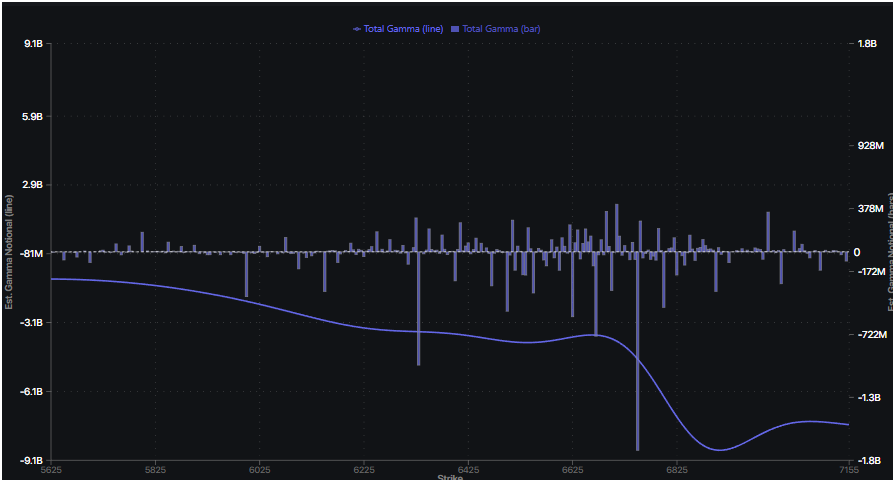

However, this turbulence was not shocking for traders watching options dynamics. From the start of the week, SPX gamma flipped deeply negative across all strikes, setting the stage for outsized movement in either direction as dealers were forced to hedge by trading with price action.

While 0DTE vol sellers provided some support early in the week, the overwhelmingly red heatmap meant that negative gamma remained dominant.

How Negative Gamma Drove Last Week’s Turbulence

The week began with traders cautiously approaching NVDA’s Wednesday earnings report: the company represented $4 trillion in market cap and over 7% of the entire S&P 500 complex by weight. Wednesday’s VIX expiration, Thursday’s NFP jobs data release, and Friday’s monthly OPEX each brought additional fuel to the volatility fire.

Despite NVDA’s earnings beat and a better-than-expected jobs report, the options market showed that traders were not out of the woods yet. We referenced this in our Thursday pre-market AM Note: “S&P gamma remains negative across all near-term strikes…if SPX moves back <6,700, we’d take that as a meaningful risk-off signal.”

Despite a strong open on Thursday, negative gamma combined with wary trader sentiment to ignite the sharp selloff at 10:40am: SPX violenty dropped 200 points in just over an hour.

The negative gamma environment meant that dealer hedging would accelerate this move. Using HIRO, SpotGamma traders saw that Thursday’s selloff was driven by both 0DTE and longer-dated put buying. The massive $13 billion negative delta was the largest daily value observed in months, driving SPX down 3.5% intraday.

Friday’s dramatic reversal showed the flipside of negative gamma: despite wavering at the open, the S&P 500 ralied with another outsized 2% intraday move as traders bought calls forcing dealers to hedge upwards.

Next week brings an interesting challenge for traders, as a market rocked with recently heightened volatility enters a truncated holiday week. Markets close for Thanksgiving on Thursday and will only be open for a half-day session on Friday.

The Post-OPEX Landscape: Thanksgiving Week Uncertainty

Monthly OPEX on Friday cleared significant positioning from the board, which historically leads to a mean reversion in realized vol. However, while Friday’s rally reversed much of the negative sentiment, this type of volatility surge can deliver an impact that extends beyond OPEX.

Negative gamma fueled much of last week’s amplified price action, and the negative gamma regime looks to persist into Monday for SPX. Given the compressed trading schedule, this could set markets up for an unusual Thanksgiving week.

Due to the holiday time decay factor, traders generally don’t enjoy paying for option premiums that will lose value rapidly over a long weekend. However, the shortened week ahead will undoubtedly be haunted by the memory of last week’s volatility.

The most concerning aspect of Thursday’s violent selloff remains that there is no clear catalyst or event that explains what happened. When markets drop without an obvious trigger, it increases uncertainty and can drive tail risk—particularly over quiet weekends when liquidity thins and unexpected news can surface.

The lack of a clear catalyst for the selloff means traders may need to be more cautious than usual. The historical playbook suggests buying the dip and fading the volatility, but the unclear fundamental driver introduces additional uncertainty into that trade.