From ZeroHedge

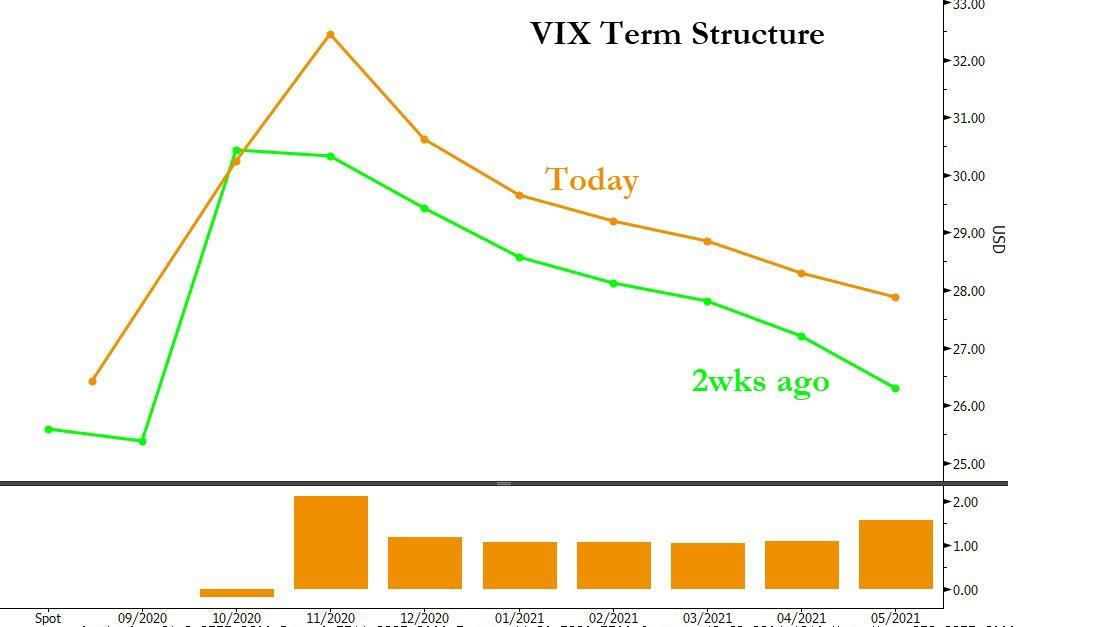

While JPMorgan could not agree last week if the month-end pension and fund flows (which according to one JPM quant at $200bn would be the largest forced selling since March, and according to another would be a “tailwind” for equities) would be positive or negative for stocks, one look at market gamma suggests that contrary to expectations for a violent month-end in either direction, we may get just the opposite.

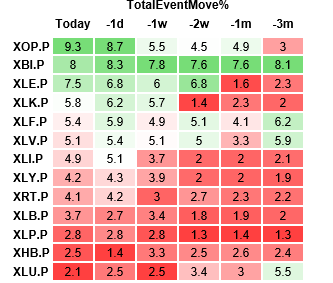

As Nomura’s Charlie McElligott writes this morning, when looking at where the VIX curve stands right now…

… this steepness of implied vol in the front-end for the U.S. election event-risk as shown in the chart below, coupled with the now consensus belief “doomsday” permutations which could see a the final election result dragged out into year end or even 2021, “has created a dynamic which keeps realized vol “stuck” in no man’s land, because Dealers are then likely being incentivized (from both pnl- and risk-mgmt- perspectives) to be “long vol, long gamma.”

Indeed, as McElligott shows, dealers are currently in “long Gamma” territory – but just barely – for both SPX SPY after the rally back up to current spot (“Gamma Neutral” level at 3310, ex 10/02 at 3298) and QQQ (“Gamma Neutral” level at 273.37, ex 10/02 at 276.14)

According to the Nomura strategist, this modest gamma positioning will “keep things in-check” from a realized vol perspective as we approach the election where a worst-case scenario is currently being priced in by the market (unless of course there were a macro catalyst for the curve to flatten- or invert-).

Yet while equity vol is already pricing in a “doomsday” election scenario, the scenario McElligott thinks is mispriced – with surging implied vol premium due to the election concerns, which extends into Dec and Jan – is one where the “extended chaos” scenario does not realize, and instead we get an earlier final determination than said consensus “lingering disarray” view and/or a large, clear-cut Biden electoral win.

To this point, a rather impactful chart from the NYT yday showing that Biden has enough electoral votes to win over three unique modeling scenarios: 1) Electoral votes counting only states where a candidate leads by 3 or more; 2) electoral votes if polling leads translate perfectly to results (with the caveat that they of course will not); and 3) electoral votes if state poll are as wrong as they were in 2016

While many traders will disagree with McElligott’s sanguine take on the election especially since even Trump has said ultimately SCOTUS will decide the next president which means the election won’t be decided until well into 2021, the Nomura strategist contends that such a dynamic where all this “doomsday prepping” suddenly is decaying powerfully against the event-risk hedgers, would force a potential puke of said “crash” back into the Street “which could mechanically (and counterintuitively) catapult markets higher, EVEN IF the market narrative on risk sentiment into Biden’s “negative for growth” higher tax-, higher regulation- framework is believed to be headwind for corporates/equities.”about:blankabout:blank

That said, there is a counter “sell flow” to consider into this “mechanical bid” which sees investors turning “hard sellers” in the case of a clear Biden win, as most will expect a large Capital Gains tax increase coming in Year 1 of Biden regime (although a note from Goldman earlier today tried to mitigate this possibility, more on that later).

Nonetheless, according to McElligott, this possibility is not necessarily best expressed in an “SPX Higher” hedge trade, and instead “it might be more about a dispersion trade, as we see some higher beta ETFs explode higher.”

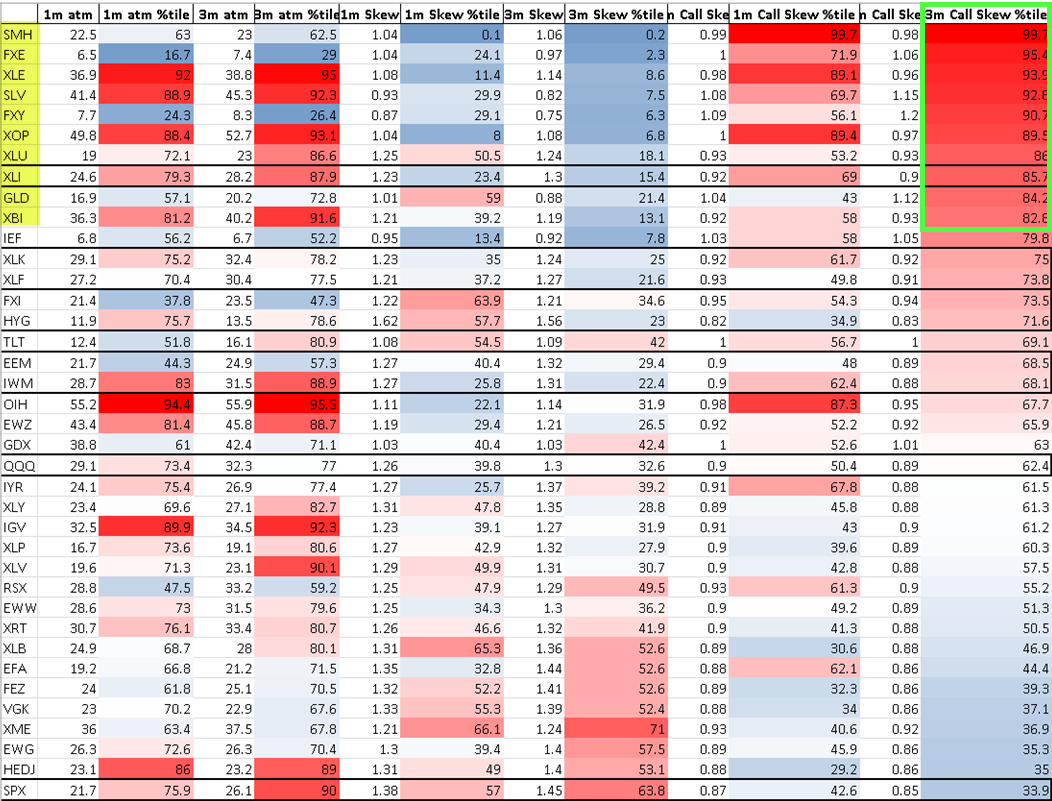

This VIX “uncoiling”, along of course with a positive vaccine surprise between now and then, means that market “crash-UP” risk is more pronounced than “crash-DOWN” – especially with VIX already pricing in election doomsday, across risk proxy ETFs “with 3m Call Skew %iles way up in long-term, multi-decade ranks into the 80s and 90s %iles.”

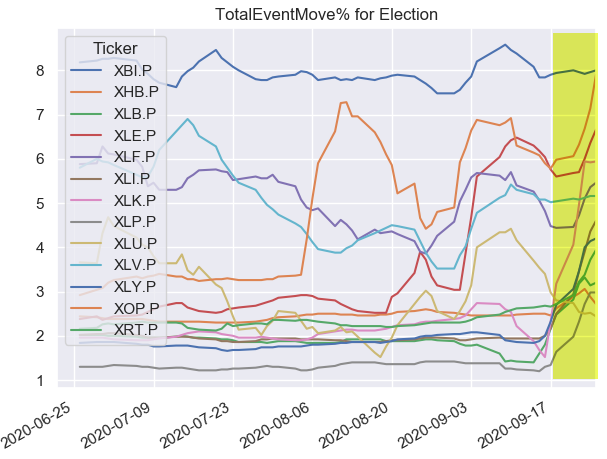

Incidentally, as Nomura shows, the vol-implied election moves are getting “pretty spicy”, as the 16Oct20 20Nov20 18Dec20 ATM vols show: