A “Fairly Rare Phenomenon” Occurs In Equity Options Land

BY TYLER DURDENMONDAY, APR 12, 2021 – 10:15 AM

US equity futures have traded the high to low range of Friday’s late-day meltup mania since they opened last night as a modest Asian derisking (following disappointing Chinese credit data, particularly with concerns surrounding the sharp decline of bond financing as well as the weekend news that a new study shows that the South African variant may evade protection from the Pfizer vaccine.)

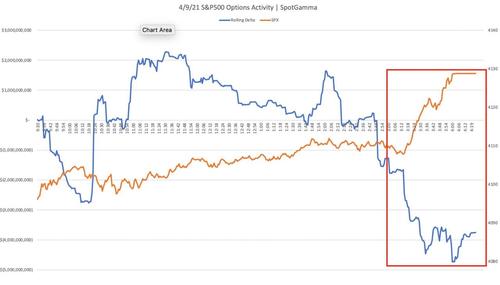

That meltup was odd as SpotGamma notes the strange and conflicting message from surging price and negative delta. What’s shown here is the traded delta (on a rolling basis) in blue, versus the SPX price in orange.

As you can see the traded delta was sharply negative from ~2pm on, and seemed to accelerate right at the time when the SPX went north.

What’s odd about this is that we think all of this delta should have made dealers long(er) delta and needing to add some short hedges.

Clearly not all moves in markets are options driven, but that correlation (red box) is rather striking.

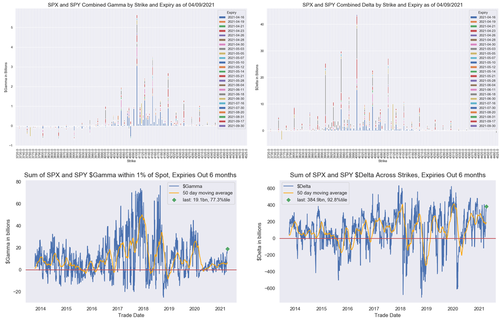

Nomura’s Charlie McElligott notes that Friday’s chaos left the lumpiest gamma strikes all higher, with 4100 at $6.046B, 4125 with $2.42B, 4150 with $3.58B and 4200 with $2.87B, with Dealers deeply in “long gamma” territory and an overall extreme “long delta” which makes sense near all-time highs, currently $385B and 92.8%ile.

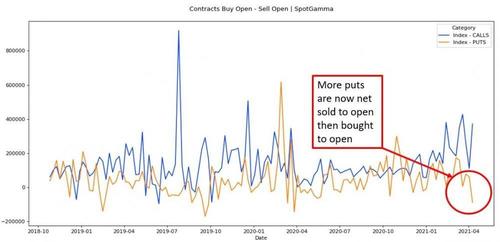

However, as SpotGamma points out, the OCC data we sent out last night shows that there is a very large short put position on in index options.

If we consider this in with the SPX, it implies that the dealers options position is more market neutral than our model suggests (as dealers would hold these long puts that traders are selling). If dealers are buying put options, the number of futures they need to sell as a hedge is reduced.

Therefore as the market goes higher dealers have less futures to sell, and it could explain why the options resistance levels didn’t have as much “grip” Friday.

As you can see in the chart below, this (market being net short index puts) is a fairly rare phenomenon, and the previous times its occurred was after large market selloffs – not all time highs like we have now.

It likely added to the buying pressure seen last week, but also increases risk going forward.