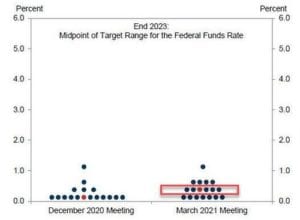

BY TYLER DURDENWEDNESDAY, APR 28, 2021 – 01:25 PM As we detailed overnight, today’s FOMC is widely expected to be “steady as she goes” with Biden conveying that the FOMC is not yet thinking about shifting its dovish stance. The only “risk” associated with today could be a “semantics” acknowledgement of better data (though we note the […]

mcgelligot

Nomura Gamma Update

A “Fairly Rare Phenomenon” Occurs In Equity Options Land BY TYLER DURDENMONDAY, APR 12, 2021 – 10:15 AM US equity futures have traded the high to low range of Friday’s late-day meltup mania since they opened last night as a modest Asian derisking (following disappointing Chinese credit data, particularly with concerns surrounding the sharp decline of […]

Pre FOMC Nomura Gamma Update

From ZH: With less than 24 hours to go until one of the most closely watch Fed announcements in a long time, the VIX finds itself hanging just below 20, the gamma gravity in the S&P is at 4,000 while dealers remains short Nasdaq/QQQ gamma (which however is shrinking by the day). In short, depending […]

“Full-Tilt Insanity Mode” – Nomura Warns This Week’s OpEx Is “Absolutely Going To Matter” For ‘Weaponized Gamma’ Crowd

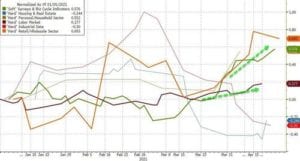

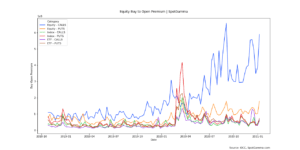

Via ZeroHedge The world appears to be stock in what Nomura’s Charlie McElligott calls “Robinhood / YOLO / ‘weaponized gamma’” nonsense as the equity buy-to-open premium is soaring in individual stocks (and indices)… Source: SpotGamma Specifically, the Nomura MD notes that it is Op-Ex week, and the options positioning is absolutely going to matter, particularly off the back of […]

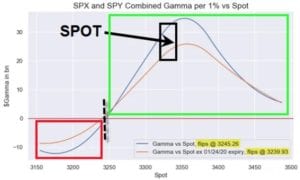

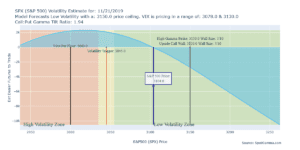

Nomura Gamma Update 1/22/20

Heisenberg posted an updated gamma note from Nomura, and we like to note them here versus SpotGamma data. Nomura posts a combined SPX/SPY figure whereas we break the data out. The note and charts sync with much of what we have been saying: That long gamma is still in control. Last week, Charlie noted that […]

Nomuras Pre-Event Gamma View

From heisenberg: Charlie McElligott, Nomura: “As VVIX & Skew went ‘bid’ BIG TIME yday, this indicates that the market is now once again beginning to price-in ‘tail’ scenarios”, “[That] offers attractive risk-reversal opportunities to play for an upside S&P breakout following a potential ‘hedge puke’”, he added, noting that in the event we do get […]

Nomura’s Gamma December Note

Our model has gamma flipping at 3065, Nomuras is a bit higher. From ZeroHedge The interpretation of Trump’s “better to wait until after the election” for a China trade deal comments is that the Hong Kong human rights bill sponsorship by POTUS has clearly caused agitated the Chinese side (plus this morning’s Reuters report stating […]

SpotGamma vs Nomura

We like to post the banks gamma model output as way to check our own models. The two line up almost exactly. For now, US equities are “pinned” thanks to helpful greeks – at least until something really bad happens. “The fact remains that SPX will stay ‘sticky’ up here between the enormous 3100- ($9.4B […]