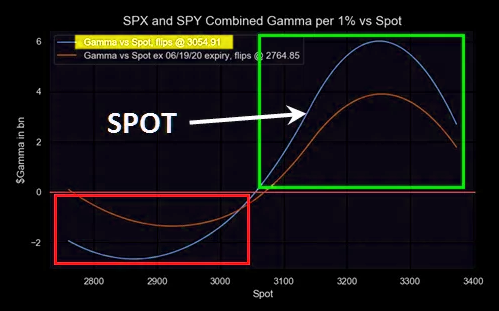

Nomura marks a much lower gamma flip point of June options expiration, which would suggest markets may open in more positive gamma territory after Fridays expiration. Notice the flip goes from ~3050 (coincides with spotgamma levels) down to 2764. Obviously this Nomura forecast cant account for any rolled positions that haven’t happened yet.

The other issue is that we have record long call positions in equities which are set to expire Friday. This adds a lot of negative gamma to the pool that will be removed. This could all create a lot of volatility.