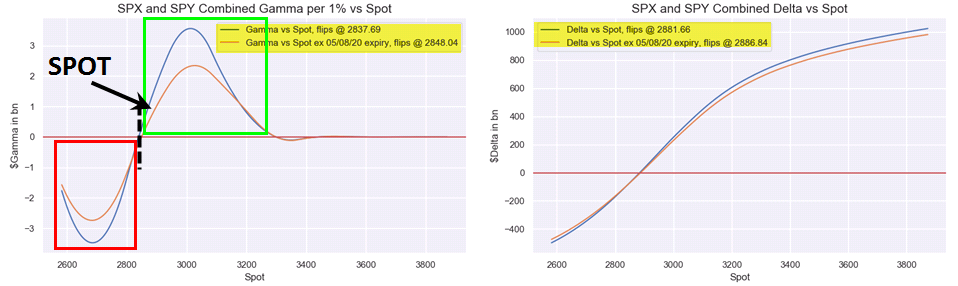

Like we wrote on Twitter and to subscribers a few days ago, the market is stuck in Gamma Neutral and Nomura agrees.

Like our data, Nomura went from ~2940- ~2850. Exact flip points keep flopping. <2800 is trouble | >2900 we can all chase the top | 2800-2900 ¯\_(ツ)_/¯ pic.twitter.com/VvwkBETfms

— spotgamma (@spotgamma) May 4, 2020

Quoted from ZH:

Failing to take advantage of positive dealer gamma, the S&P is now stuck in “no man’s land” and as Nomura’s Charlie McElligott writes in his latest note, the market is “essentially near the Dealer “Neutral Gamma” level (~2845) and between 2 of the 3 largest Gamma strikes on the board (2850 w $1.355B and 2900 with $1.284B), while also now at the “Neutral Delta” level (2882 incl this week’s expiry).

ZH/NOMURA

What this meant then too and occurring simultaneously was a set of further positive inputs into the “vol normalization” process, following the various “short vol” stop-outs in late March—by late April we’d seen the return of Overwriters into “expensive” vols, while too we saw the resumption of an upwardly-sloping front-end of the VIX curve as an “all-clear” signal for the return of systematic “Short Vol” & VIX roll-down strategies

NOMURA