Like we have been highlighting to subscribers this weeks May SPX options expiration (OPEX) (Friday AM) could bring a state change to markets. From ZH we find another note from Nomura, echoing our sentiment:

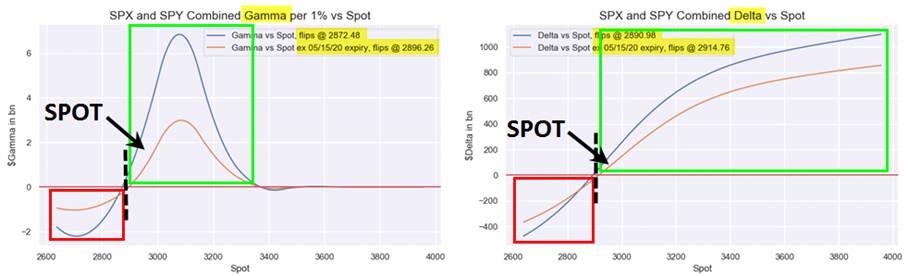

Into this week’s options expiry, Spooz (ref 2927) continue to remain pretty-sticky between 3 of the 4 largest $Gamma strikes on the board, locally with $1.32B at the 2900 line (35% coming-off Friday) and currently buffered between the $1.48B at 2950 (48% comes off) and the $1.28B down at 2850 (33% comes off); the 3000 line is a monster at $2.25B and will also see potential for a “gamma unclenching” after Friday, with upwards of ~29% of the $Gamma potentially dropping post-expiry.

Nomura’s Charlie McElligott

Whats interesting about this setup is that June expiration is actually a good bit larger than May. We see roughly 5 million contracts in June expropriation, with only 2.3 million in May. Therefore we have some fairly concentrated May positions that roll off, which could loosen up the current ~2900 holding area. This could create a period of volatility (up or down markets, large movement) if large sets of these June options then go in the money.

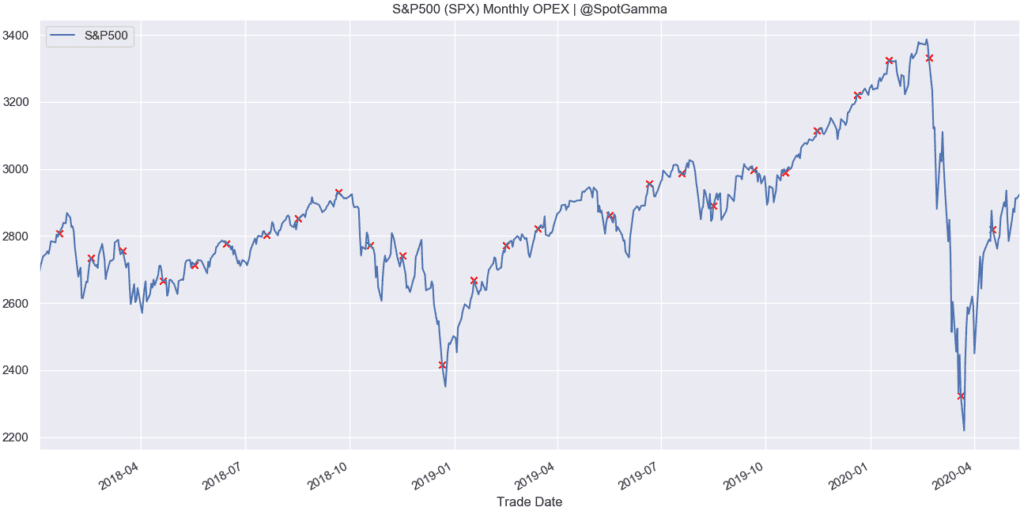

In summary – there is a possible catalyst for the markets on Friday with expiration happening. While Aprils OPEX didnt produce a change in markets, it was relatively small compared to Mays OPEX. In the chart below you can see that the larger Monthly SPX (AM’s) can sometimes market turning points in markets.