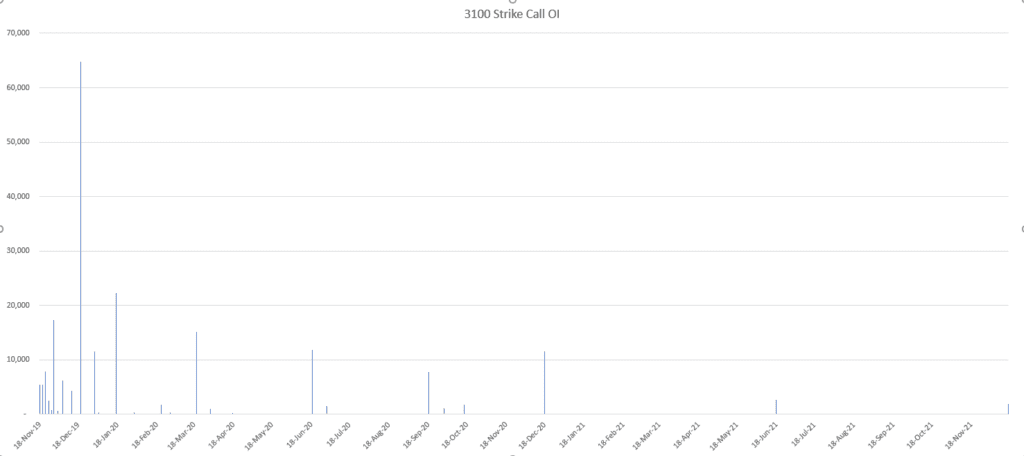

The idea has been that the roll-up of the 3050 calls to 3100 calls has caused a squeeze (see here) and that the 3100 strike currently holds the key to the next move in the SPX. November SPX expiration may help to get things moving – you can see in the chart below there is a fair amount of OI in Nov, but the bulk is sitting in Dec expiration.

If the market rises up enough to get those 3100 strike calls to roll higher than we may see a continuation of the gamma squeeze. Eyes on expiration next week for the first signs of changes in gamma.