Today was an interesting day to highlight how our SPX Index options gamma levels can come into play for futures trading. Coming into today the market had experienced a sharp rally, and futures were set to open over 2900.

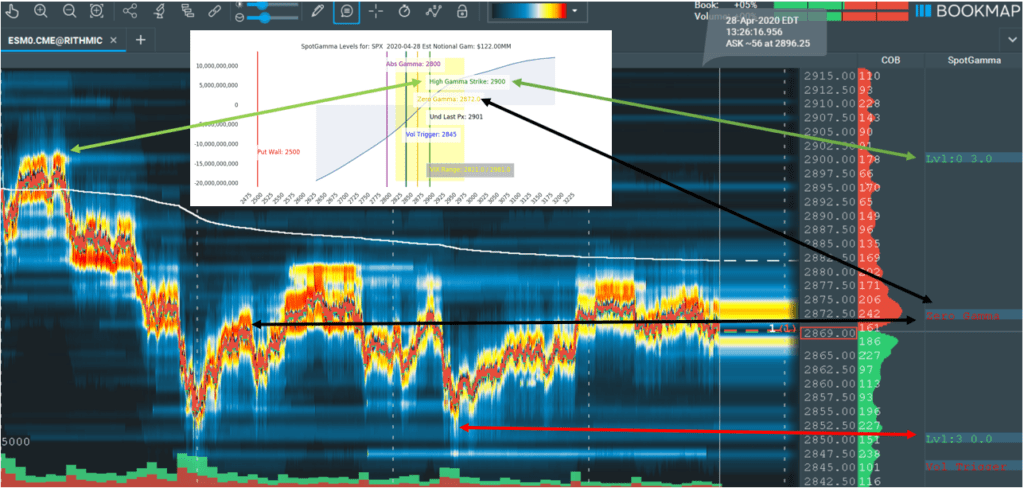

Below you see a snapshot of ES futures in Bookmap, and our morning gamma chart (sent preopen to subscribers). There are 3 key levels that show up in the trading day here and we will step through them:

- “High Gamma Strike” – 2900 level. This is the level we calculate has the most call gamma, and may be resistance in the market. You will note that the high in SPX for the day was 2910 and we were just a few handles above 2900 in ES.

- “Zero Gamma” – 2972 level. This is the level at which gamma flips from positive to negative. It often appears as support or resistance in the market. See another example here.

- Large Gamma Strike – 2850 level. We calculate a large amount of open interest at 2850 making it a possible support area.

The column to the far right is a CloudNote service we offer to subscribers who use the Bookmap trading software.