Summary: Issue: SpotGamma believes that current markets reflect a great amount of risk and face the prospect of a violent drawdown. This is due to the following: Hedging: Low levels of options-based hedging. Short-Selling: Low levels of stock shorting. Speculation: High levels of margin used to buy stocks. Remedies: SpotGamma levels continue to be […]

zero gamma

SpotGamma Levels at Work

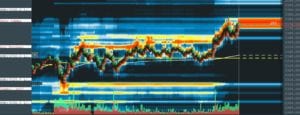

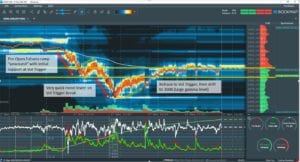

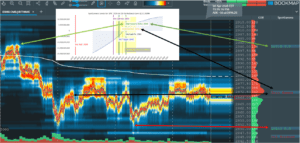

We publish key levels based off of S&P500 options gamma and interest levels before the open. We can push these levels into various trading systems like Bookmap. As you can see in the Bookmap screenshot below the ES futures played off of our trading levels throughout the day. The market opened and immediately tested 3025 […]

The Volatility Trigger for ES Futures Traders

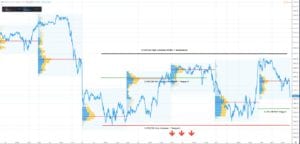

Wednesday 5/27 was a great example of how the Volatility Trigger can be a key level in trading. The concept of the volatility trigger is that when the market moves below the Trigger, options dealers are short gamma. This may mean that they start to sell futures as the market moves lower, and but futures […]

Pre Fed Dealer Gamma Charts

We note to subscribers today that the market is at a key “gamma crossroads” around 2900 where we see sustained positive gamma above that level and the possibility of a strong move into negative gamma if the Fed disappoints today. For the past week we have been consolidating around the zero gamma level and options […]

Options Gamma Levels and Futures Movement

Today was an interesting day to highlight how our SPX Index options gamma levels can come into play for futures trading. Coming into today the market had experienced a sharp rally, and futures were set to open over 2900. Below you see a snapshot of ES futures in Bookmap, and our morning gamma chart (sent […]

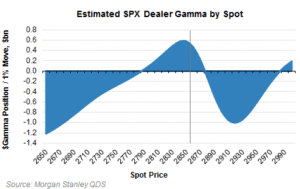

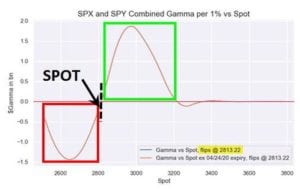

Nomura’s Gamma Estimate April 2020

Zerohedge gives us Nomuras gamma estimate for 4/24/20 with an estimate gamma flip point of around 2800 in the SPX. Note this is a COMBINED SPY/SPX estimate. As Nomura’s Charlie McElligott notes, the S&P 2,800 has emerged as the “Neutral Gamma” zone for the market “and again, is likely to remain that way, as the […]

Zero Gamma = Zero Gravity

We posted a few days ago about the “right” tail risk and the possibility of a market rally. In a note to subscribers we added to this, suggesting the market may be in an airpocket. Specifically: “zero gravity”. Most of you are probably familiar with those flights which take you to the edge of space […]

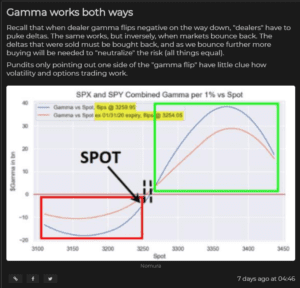

Yes, Gamma Works Both Ways

There has been quite a rally of of recent lows as the market has been digesting Coronavirus headlines. A bit over one week ago the market was testing the “zero gamma” level – which can present a challenging choice for traders. The chart below shows ES futures with our levels noted from the first week […]

Somethings Gotta Give – The SPX Box

A quick note, particularly for documentation. Currently (1/31/20) the market awaits a slew of catalysts including: coronavirus updates, Iowa caucuses and the Chinese market reopening. For the last few days we’ve been contained in this fairly volatile range between ~3300 (our high gamma strike) and ~3240 (zero gamma). Above we can bask in the comfort […]

Virus Outbreak – Week in Review

Ahead of important AAPL (Apple) earnings and the FOMC we wanted to review the market over the past week. We have spent a lot of time drawing an analogy between todays market and that of January ’18 (see here). Interestingly the Jan ’18 market topped the same day as the current market. Currently gamma is […]