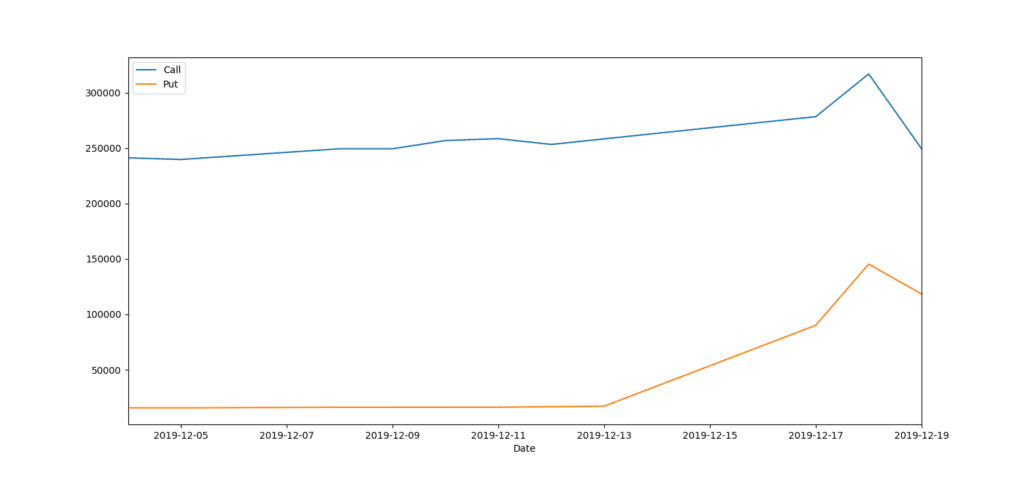

December is always a large options expiration as we have large open interest and a SPY dividend payment. Because of all of this the expiration has the potential to mark turning points in the market as large positions are closed, roll or expire. 3200 has been a key level the last week with major options volume trading there and the market hugging that high. Last night we picked up a shift in data that may well indicate a larger move is coming. First is a large reduction in call open interest as seen below:

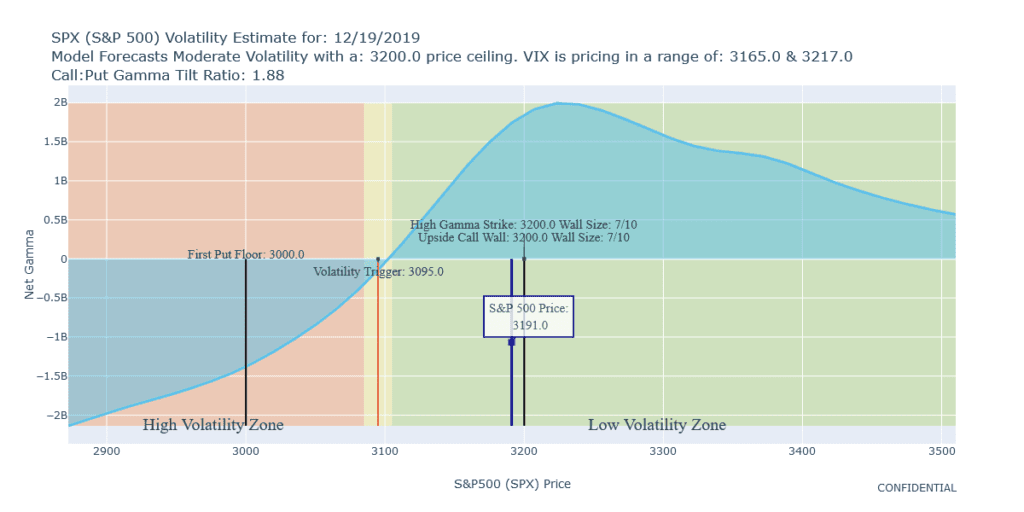

Second was a drop in total gamma from >$2bn to ~$1.6bn.

While we won’t suggest a direction we do think that this implies some large movement into January.