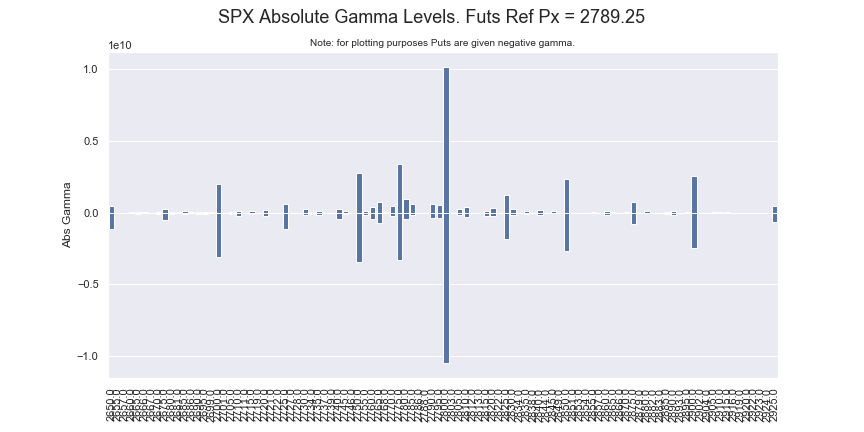

We theorize that strikes with a high amount of options gamma combined with high options volume at that strike(s) can influence the SPX to that level. This something similar to an options “pin” but we think of it more as a “magnet”. You can see in the chart below that the 2800 strike has a large amount of options gamma associated with it:

We wrote about the significance of 2800 in our subscriber note on Tuesday morning:

The market proceeded to shoot to 2850 later that day, leaving our sentiment looking a bit questionable. However the highest volume strike yesterday was 2800 despite the market being almost 2% higher. Today of course the SPX opened under 2800 but is now back to testing that level.

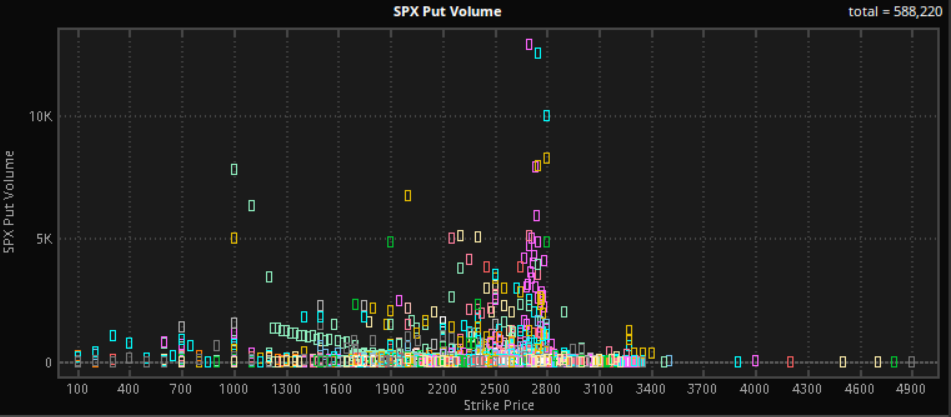

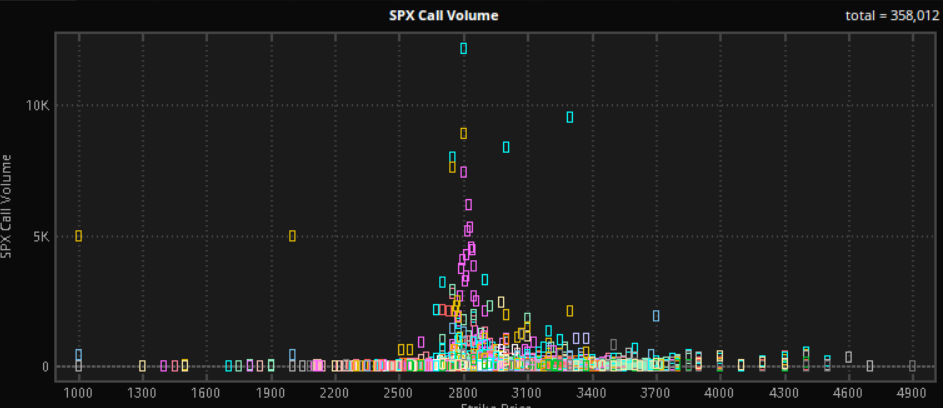

Todays (4/15) Options volume centered around 2800 despite the market testing the 2760 level:

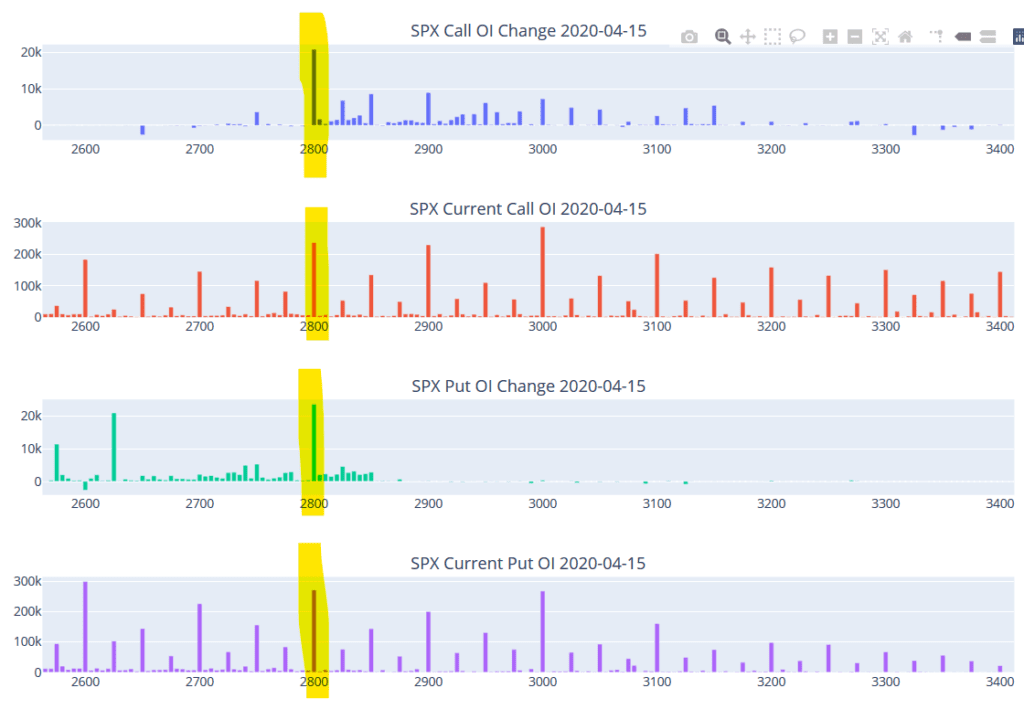

Below is a chart of current open interest, as well as the change in open interest from yesterday to today. You can see that 2800 was the most active despite the market trading above.

With the April Monthly OPEX around the corner things may shift, but for the next few days the market may revolve around 2800 if volume continues to accrue at that strike.