A strange thing has been happening in the options market recently, and I believe that is driving a lot of the intraday volatility we have been seeing. Yesterday (5/27) for instance, the S&P500 Index moved just under 100 total handles on the day.

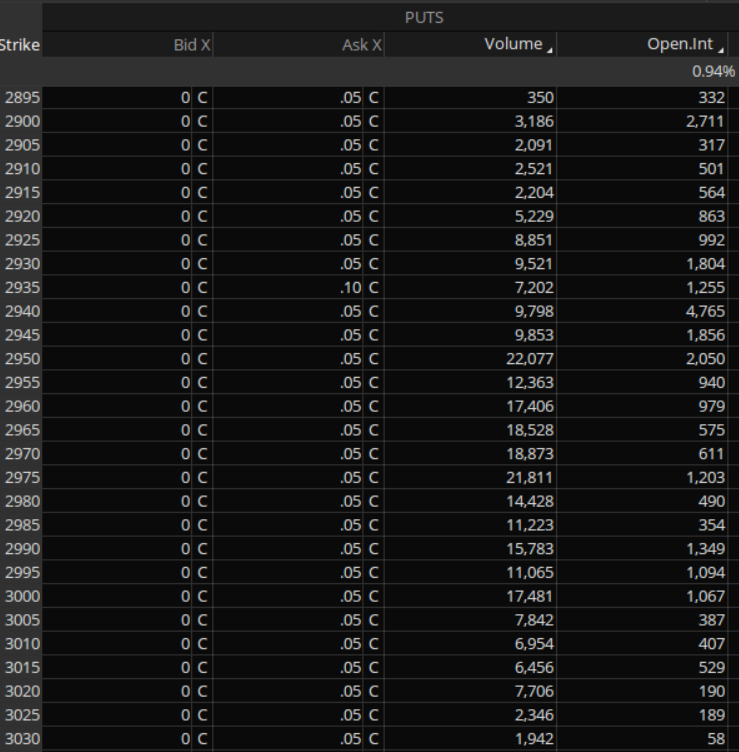

Take a look at the end of day snapshot of put volume vs Open Interest. The fact that open interest is heavily outweighed by volume infers that there was a lot of speculative action in these contracts yesterday. The same situation was in call contracts. The total volume on the day was about 1.1 million contracts, 25% of this volume was in the contract that expired that day.

While “speculative”, this action may still require market makers (MM) be active hedgers when these options trade. If suddenly a bunch of put buyers step in, this means MM’s are short puts, and must hedge by selling futures. Conversely when these puts are closed or lose value, MM’s will buy back futures. This expands volatility.

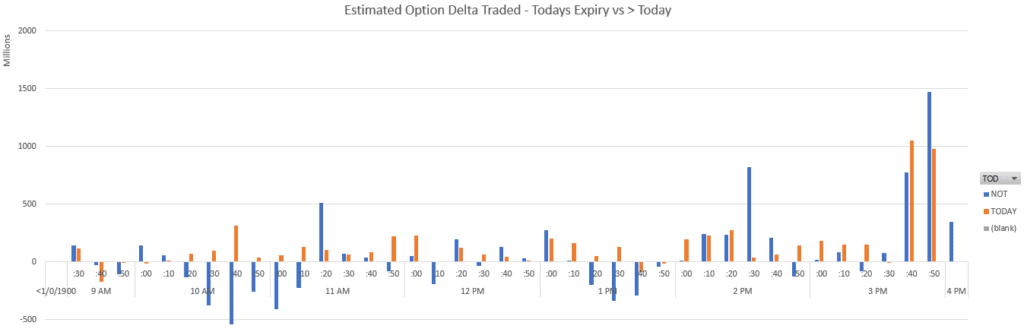

For those of you that follow “market gamma” (aka GEX) this ultra short term volume poses more as a “delta” trade than a gamma. Its delta because large positions are being added and removed, as opposed to MMs adjusting hedges on long term positions. Below is a chart that compares Wednesday expiration contract volume (orange) against all other contracts (blue). We put the volume in 10 min bins and delta adjusted it to give a sense of the possible hedging requirements.

To this “speculation” point – the average trade size for the Wednesday expiration was 6.72. For all other expirations it was 12.86.

As you can see the same day (Wed) contract volume was often larger that “regular” volume. If we are correct in that this “same day” flow must be more actively hedged it may very well be one of the catalysts for some of the rapid price movement we’ve been seeing in SPX/ES futures.

Another point: For those of you using GEX/gamma as a volatility indicator, this volume may be something you need to watch on an intraday basis. GEX/gamma doesnt pick this stuff up because Its opened and closed/expired on the same day.