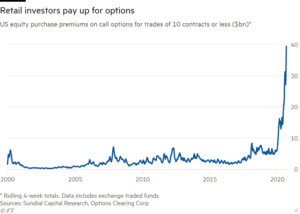

FT article shines light on what we said: Softbanks wasnt so much of a whale. …retail traders have together spent almost $40bn on similar trades just over the past four weeks, according to Sundial Capital Research. Dean Curnutt, the chief executive of Macro Risk Advisors, a derivatives strategy firm, said those millions of retail traders […]

retail

Negative Gamma to the Upside

Pure speculation can drive markets higher. As you get people pouring into equities but also options. As investors buy long calls, that may force dealers (who are short those calls) to purchase the underlying. This is a gamma trap. Record retail account openings – CNBC Consider the video of this guy below. He used to […]

Speculators, Gamblers, Unite!

A strange thing has been happening in the options market recently, and I believe that is driving a lot of the intraday volatility we have been seeing. Yesterday (5/27) for instance, the S&P500 Index moved just under 100 total handles on the day. Take a look at the end of day snapshot of put volume […]

Attack of Risk Reversal

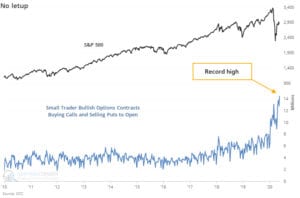

@SentimentTrader posted this chart showing record “small” positions in long calls and short puts. Sentiment says these are “10 contracts or fewer per trade”, insinuating retail traders. This type of trade (long call/short put) is a position also known as a risk reversal. While the traders are not likely actually trading short puts and long […]