$GME vol has totally faded, just like the interest in @TheRoaringKitty twitter feed (sooo many video clips – that can’t be him posting). Anyway, here we see the peak in 1-month IV at +340% on Tuesday (yellow) when the stock hit >$60. Stock up, vol up. Now the IV’s (and GME’s stock price) have come […]

delta

‘Call AAA’: Santa Claus Is Having Sleigh Troubles

Through an options market lens, the following text will add color to some recent market movements.

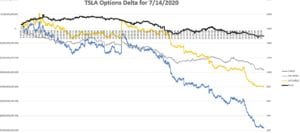

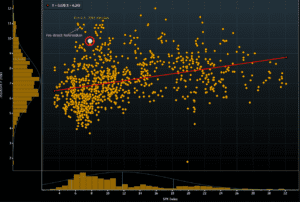

TSLA Options Deltas

We show TSLA having the 1500 as the key options strike going into Friday 7/17. The stock yesterday breached 1750 before pulling back to 1500. Its clear the options flow changed when the stock tagged that 1750 area as you can see in the chart at bottom. Friday will such and interesting date fore the […]

The MGM Call Spectacular

Intrigued by the record amount of call buying we decided to take a look at options in one of the more speculative names: MGM. There wasnt much of a scientific process to select a name, we just jumped to Reddit /wallstreetbets and chose the first name they were excited about. It seems like these folks […]

Speculators, Gamblers, Unite!

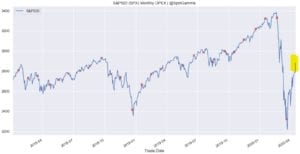

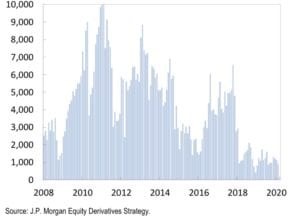

A strange thing has been happening in the options market recently, and I believe that is driving a lot of the intraday volatility we have been seeing. Yesterday (5/27) for instance, the S&P500 Index moved just under 100 total handles on the day. Take a look at the end of day snapshot of put volume […]

Can Options Expiration Turn 2/3?

We wrote about why we think SPX Options Expiration can create volatility before (see here) and wanted to post the chart below which shows just how impactful the large monthly SPX options expiration has been the last 2 months. You can see in the chart below the February expiration was within 2 days of the […]

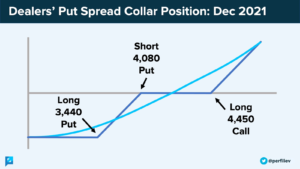

The Case for Reduced Price Volatility

Our current view of markets is that we should see reduced price volatility following the large March expiration that took place this past Friday (3/20). One of the features of this expiration was a large number of in the money puts, which possibly created several billion in deltas for options dealers to hedge. As dealers […]

SPX Skew Nears All Time Highs

As per Bloomberg, Skew (which measures the price of calls vs puts) can often spike when investors are concerned about market risk. Puts will be in higher demand than calls and this moves the skew measurement higher. Currently skew is very high due to a slew of events in the next week: FOMC, BREXIT vote, […]

Nomura’s Gamma December Note

Our model has gamma flipping at 3065, Nomuras is a bit higher. From ZeroHedge The interpretation of Trump’s “better to wait until after the election” for a China trade deal comments is that the Hong Kong human rights bill sponsorship by POTUS has clearly caused agitated the Chinese side (plus this morning’s Reuters report stating […]

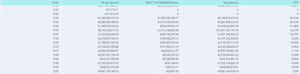

Tracking Deltas on a Large Expiration

Today is an interesting setup that we’d like to document. Currently its Wednesday afternoon with Thanksgiving tomorrow. Therefore tomorrow US markets are closed and a 1/2 day Friday. We picked up on our charts a large amount of at the money (ATM)/slightly in the money ITM calls expiring on Friday at the close. You can […]