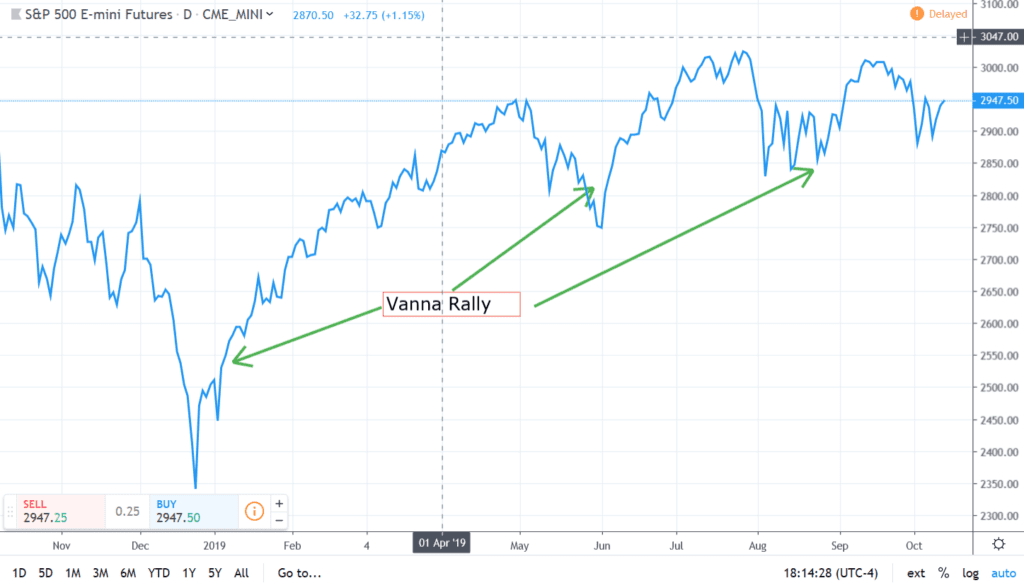

Now a prescient time to talk about options Vanna, and a Vanna rally.

Vanna measures the change in delta for a change in Implied Volatility.

Long calls + short puts = Long Vanna

We view options market makers as typically long vanna. When volatility crushes they therefore must buy stock back to reduce their hedges. In our opinion this is what fuels “V” shape rallies that occur after large negative gamma induced market drawdowns.