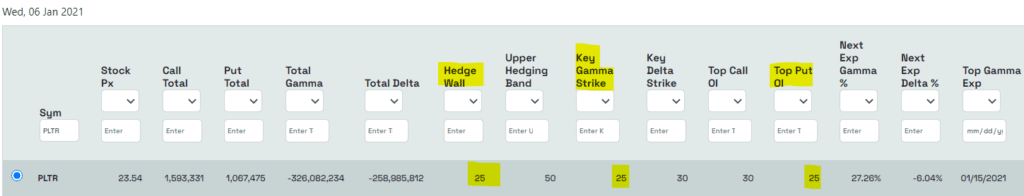

PLTR stock was a reddit/wallstreetbets darling, and its stock price benefitted from large call options action. Lately large put contracts have been coming in, and pushed the stock lower. Our analysis shows that the 25 strike holds lots of gamma, and much of that gamma is in the forms of puts.

Consequently we note this is like a magnet area that likely holds until 1/15/21 options expiration, when much of this open interest expires. After this expiration its likely these 25 strike puts roll away and the stock can lift higher.

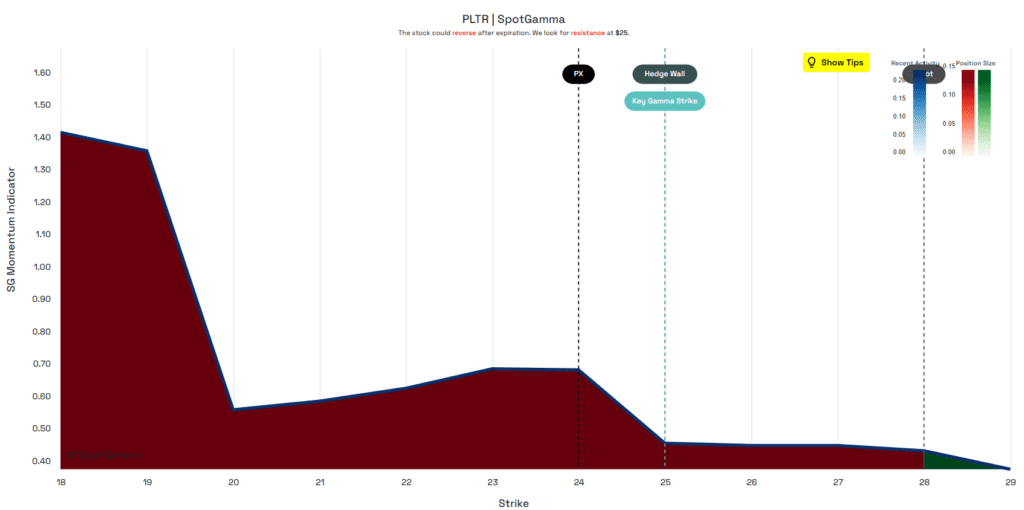

You can see below we highlighted the large put driven gamma figures which denote the 25 strike as a significant area.

Our EquityHub snapshot here indicates that volatility will remain fairly flat (relative to historical volatility) for the stock at current prices. This is indicated by the red area of the chart being roughly parallel to the x axis. The deep red color of the area chart also denotes the heavy put concentration.

1/8/21 UPDATE:

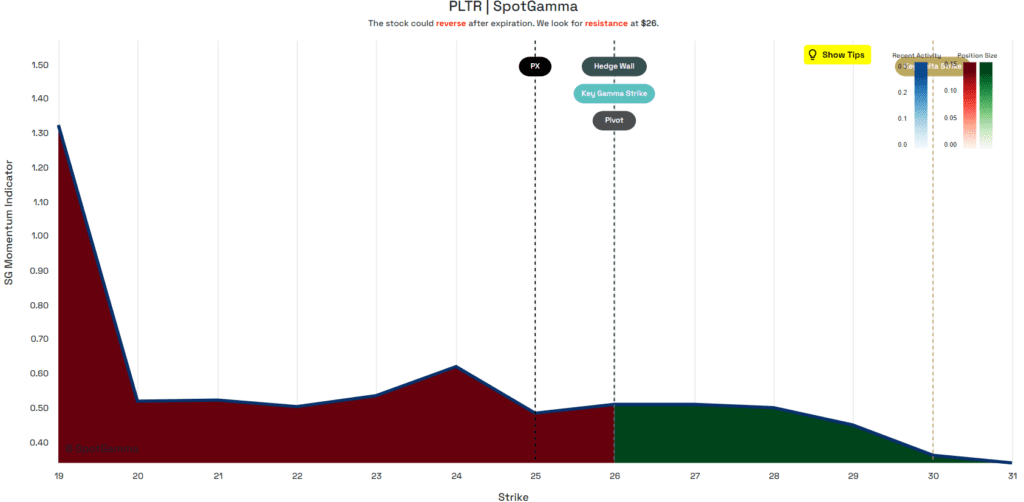

The picture in PLTR changed overnight, with a call buying surge (469k volume in calls) pushing the key gamma strike to $26. This also moved our hedge wall to $26. Note the movement in the stock so far today.

Contrast the EquityHub chart below to the one above, and you can see the bullish shift as the green shaded area is much larger for today than yesterday.

To run your own analysis on this and 3500 other stocks and ETFs, sign up for SpotGamma Pro today.