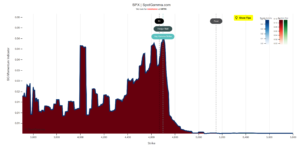

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]

hedge wall

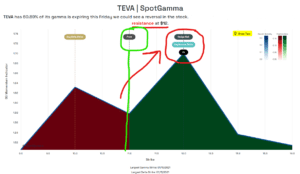

TEVA $12 Pin & Release?

TEVA is up about 10% the last several days, with a lot of gamma concentrated at the $12 strike. Most of this (~60%) expires Friday, 1/15. We therefore have compression under the key level of $12 as out of the money calls decay and keep a lid on TEVA prices into 1/15 expiration. Our EquityHub […]

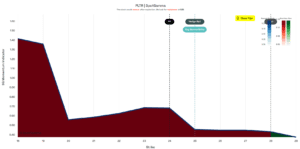

PLTR & Options Hedge Walls

PLTR stock was a reddit/wallstreetbets darling, and its stock price benefitted from large call options action. Lately large put contracts have been coming in, and pushed the stock lower. Our analysis shows that the 25 strike holds lots of gamma, and much of that gamma is in the forms of puts. Consequently we note this […]

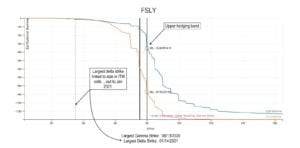

FSLY Stock Analysis

This was a great chart posted by our friend @ccurvetrading of FSLY stock based on our options data. You’ll note there was a lot of gamma put gamma set to expire today (8/13) which would be crushed if the stock started a move higher. This may have caused dealers to rapidly cover short hedges. We […]