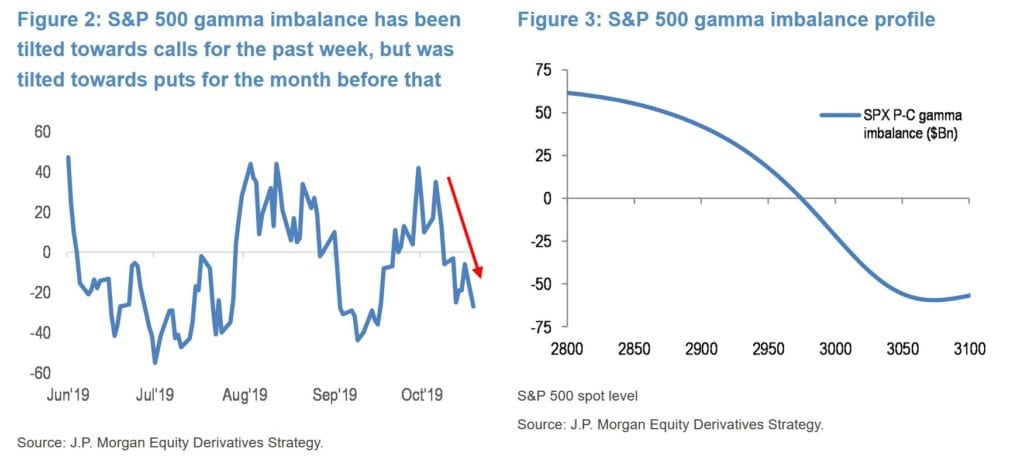

JPM recently put out the following charts on S&P500 Gamma including a ratio of call gamma to put gamma which is quite interesting. It shows the amount of call gamma minus put gamma which could be interpreted in a few different ways. One way would be to look at it as how the market is hedged, meaning if there is a large call gamma to put gamma maybe the market is not well hedged for a drop.

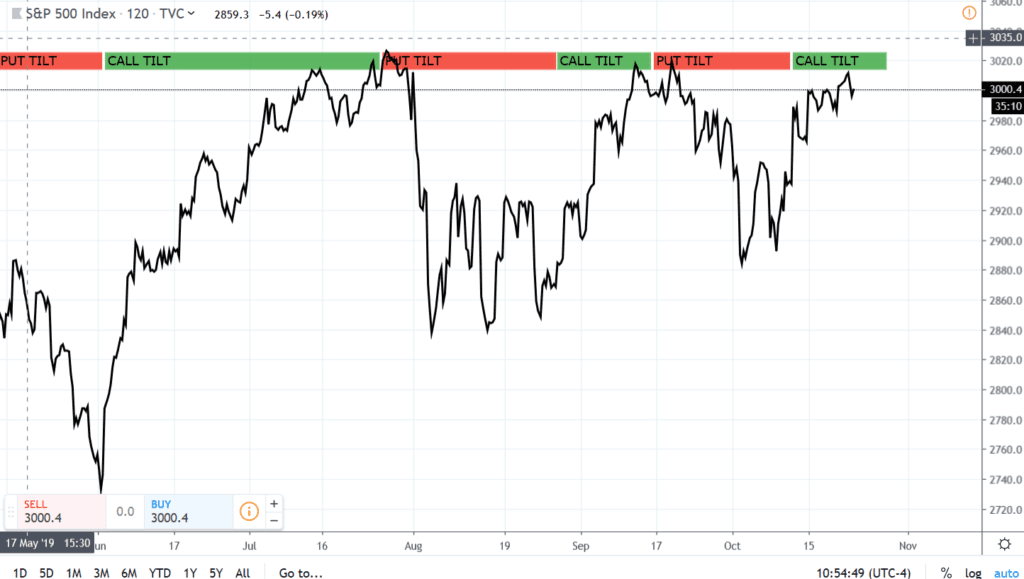

Here is an SPX chart labeled with the “tilt” from the top left gamma chart. Certainly not assuming we get a selloff here, but the market currently has a “call tilt” which appears to be related to short term tops.