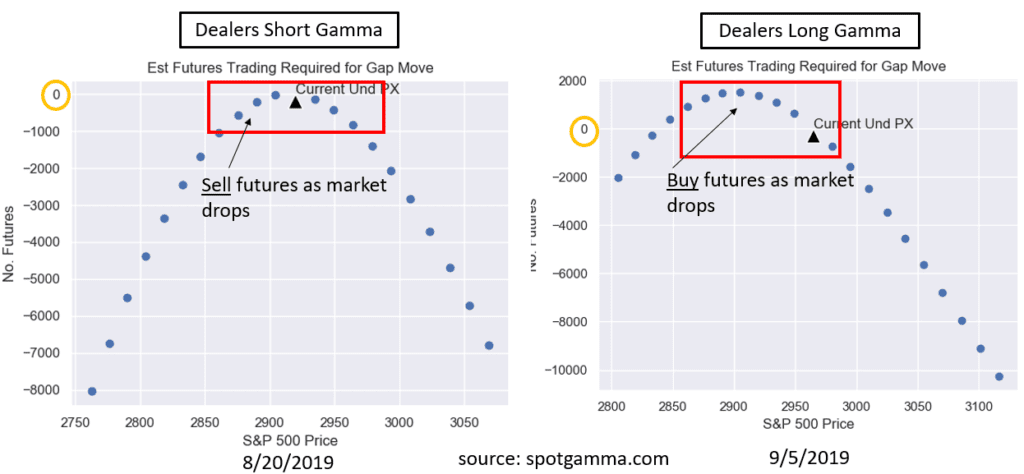

As dealers were short gamma for most of August they have moved to long gamma. Below is a chart comparing their theoretical behavior in each gamma regime. You can see when dealers are short gamma and the market is falling they are trading with the market, fueling the drop. Conversely when long gamma they are buying into the market as it sells off. We think of it like this:

Short Gamma = Volatility Fueling, Long Gamma = Volatility Dampening

We calculate the level at which dealers flip from long gamma to short, its noted as the “volatility trigger” on our charts. Here is more about short gamma and the “gamma trap.”