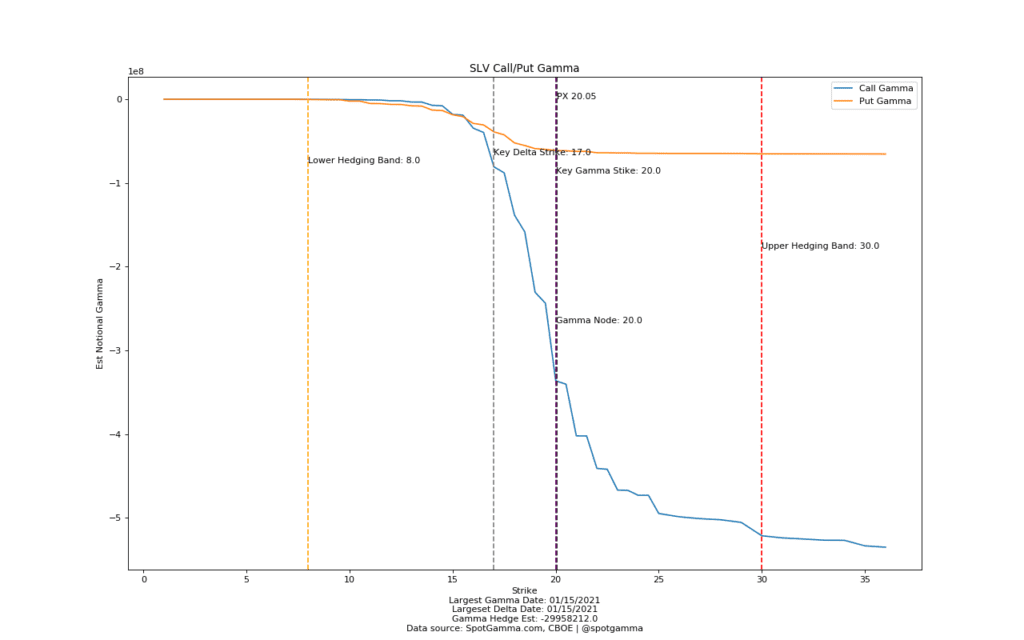

A few days ago we posted the following chart and comment on Twitter about the Silver ETF, SLV:

$SLV running and could be gathering momentum. Seems like there are a fair a amount of calls up into 20’s. If those are net long calls that could help keep it running.

— spotgamma (@spotgamma) July 20, 2020

I do have silver & canned goods buried in an undisclosed location. pic.twitter.com/qw1FtjvK6A

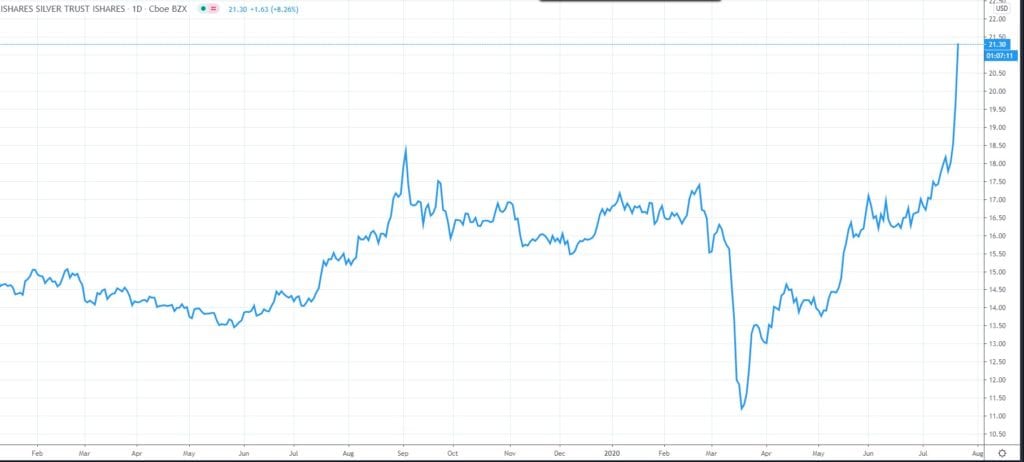

Silver put up a massive ~7% run overnight (7/22/20) putting the SLV etf at ~20.50. You can see in the chart below that options gamma is now concentrated at the 20 strike, which may cause a pause or some consolidation in SLV. We want to see calls added and or rolled higher to keep the move going. The idea being that when investors buy long calls, dealers who are short those calls must buy SLV stock to hedge. This keeps upward pressure on the stock.