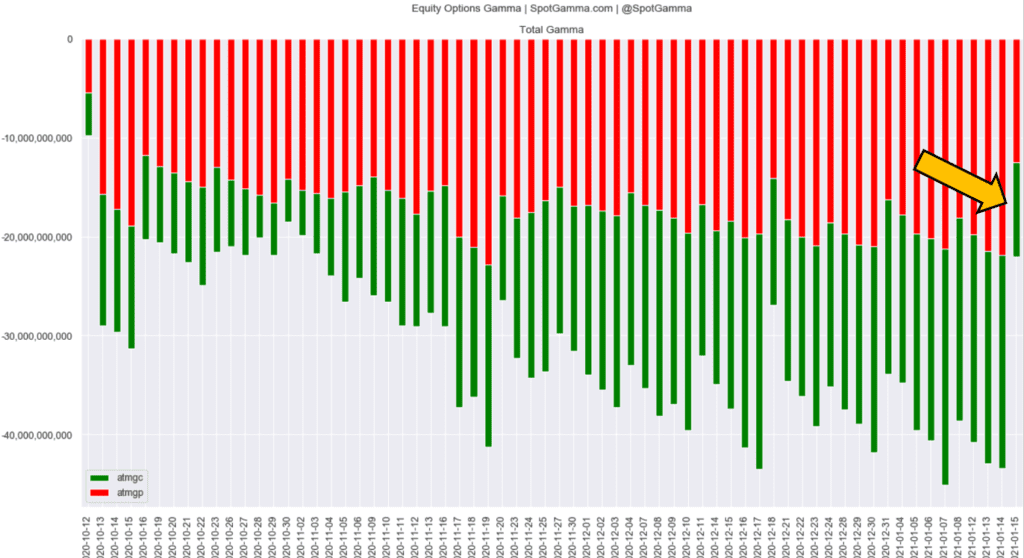

We noted to subscribers on Thursday & Friday that we thought markets were entering a period with the potential for high volatility. This was due to Friday’s very large 1/15 options expiration which resulted in a ~50% reduction in single stock gamma as seen below. This creates volatility because as large options positions expired, are closed and/or rolled dealers have large hedges they need to adjust. There is a trove of data to suggest that the bulk of single stock call activity is long calls, and based on that we believe dealers (who are short calls vs long stock) therefore have long stock positions to sell.

This selling may have resulted in the weakness we saw in many names into and on Friday. We believe much of this selling was due to both:

- Options positions being closed ahead of 4pm expiration

- Out of the money call decay (charm)

You can see below the highlighted periods, which were a 11/20 monthly OPEX, and a large 12/20 quarterly OPEX. There was weakness on both days, with the Monday following Dec OPEX being particularly volatile (~1.5% initial drawdown & recovery).

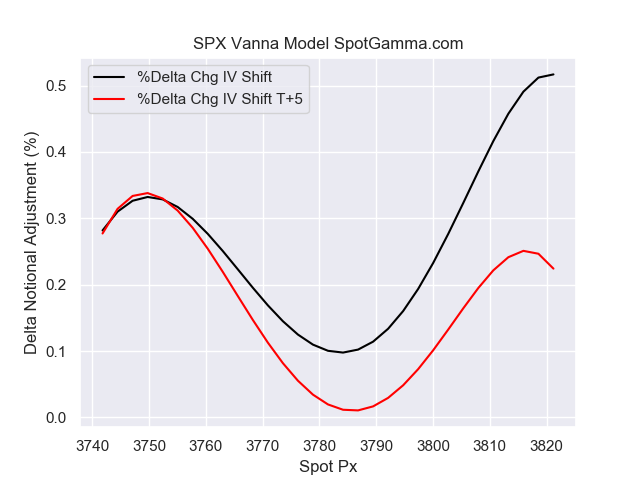

A representation of SPX dealer hedging for 1/15 OPEX is shown below. The black line was the mark on Thursday evening, with the red line being the forecasted position on Tuesday. This red line being substantially lower than the black suggests that dealers had to reduce delta exposure as a result of expiration. Note there is a larger shift at overhead prices suggesting this was a “call heavy” expiration.

Accordingly there is now less hedging required on a rally (dealers would sell into an SPX rally as they are likely long gamma), but the downside exposure remains nearly the same. Dealers may also sell short if the market declines from Fridays closing levels due to negative gamma, as put positions engage. Note this model incorporates an implied volatility [IV] shift as spot changes.

Recall too that the bulk of this SPX position expired at 9:30AM EST on Friday, which may have been the cause of some of the weakness in markets, particularly as the dealer call position changed rather sharply. However SPY, QQQ and single stock option positions did expire at the 4pm close.

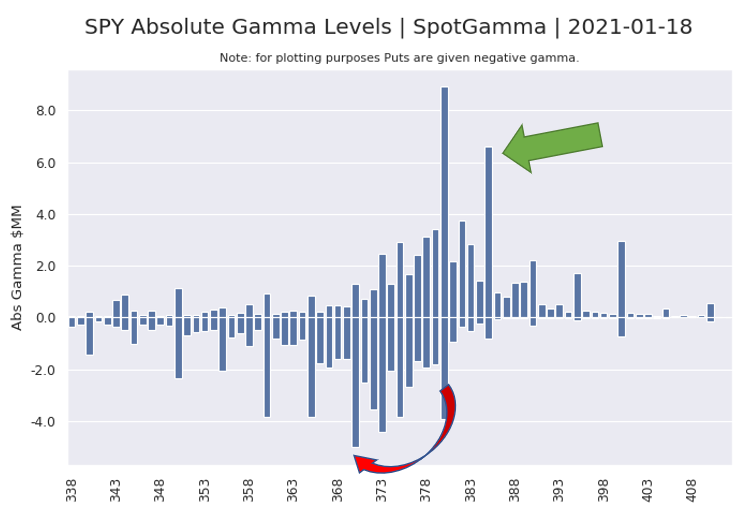

The net of all this is that the dealer gamma position is much lighter, with 3800 being the major options strike and a major pinning point. VIX expiration is Wednesday AM (1/20) and followed by the Biden inauguration.

We give edge to Tuesday starting with some downside due to residual OPEX hedge unwinds and IV holding higher due to the inauguration event. This presents as a more substantial risk if selling breaks 3725SPX/373SPY. This is due to the negative gamma position that exist at strikes <3800/380. If post OPEX flows enter the market on Tuesday as strong selling, this could push a reflexive feedback loop as IV spikes and put values increase.

After Tuesday if markets are able to hold the 3750 area we could see a volatility “release” assuming a smooth Presidential transition. This may stoke a “vanna rally” as event premium in IV dries up. As IV declines put values drop, which allows dealers (who are short puts) to buy back short hedges. This could fuel a quick rally up to the 3850SPX/385SPY level (green arrow).

If you’re interesting in learning more about options gamma, vanna, and charm, check our our educational series.