Daily Note:

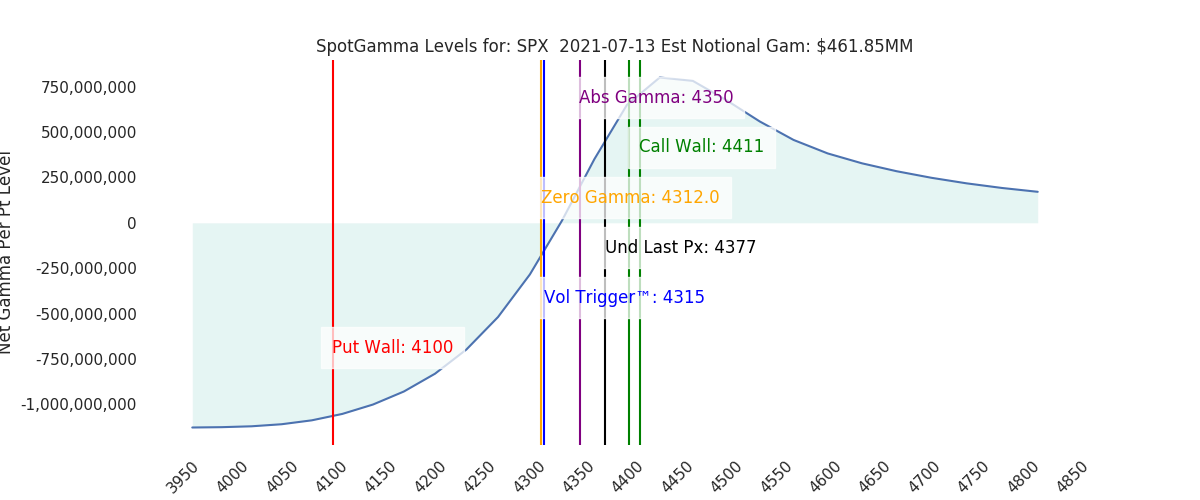

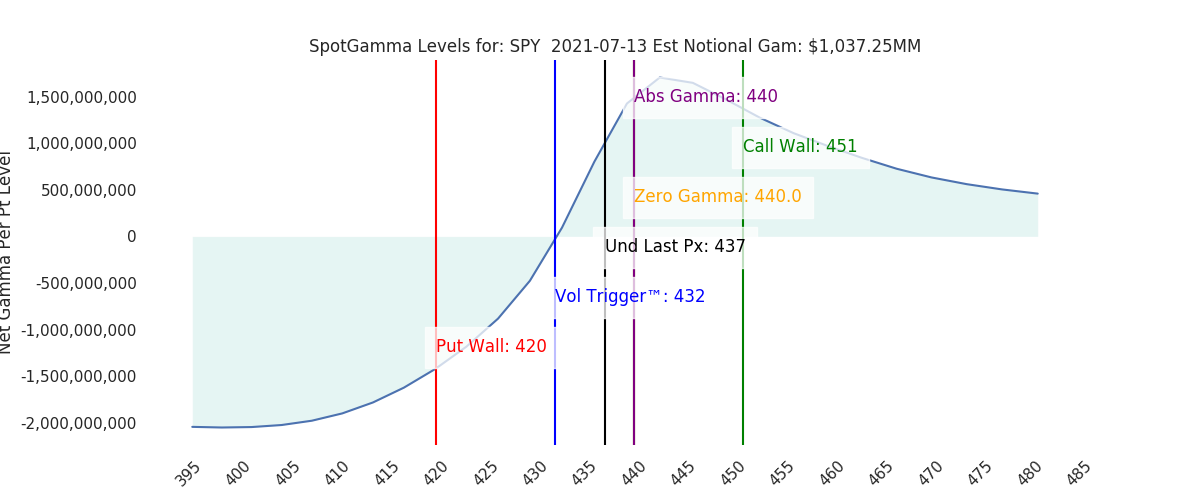

Futures are flat overnight holding 4377. We see little change in gamma levels, with 4350-4400 the main range into Fridays OPEX. With that our model forecasts a very small max move today of 76bps/33pts. 4384 shows as a very large Combo Strike which may be a decent “fair value”/pivot reference for today.

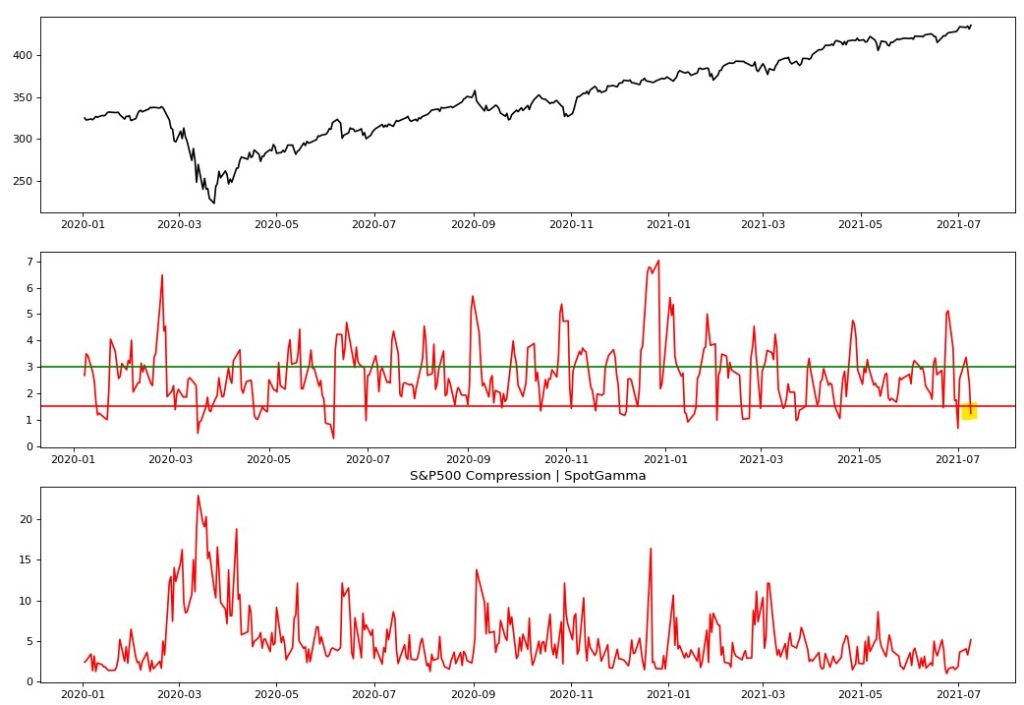

As we grind toward the Friday OPEX we note that our intraday volatility metrics are once again pushing lows. This is seen in the middle chart wherein the “compression” reading is back to a historic lower bound. This is aligning perfectly with a “release” post-OPEX. What is equally interesting here is that realized volatility (bottom chart) is well off of the lows seen at the start of July.

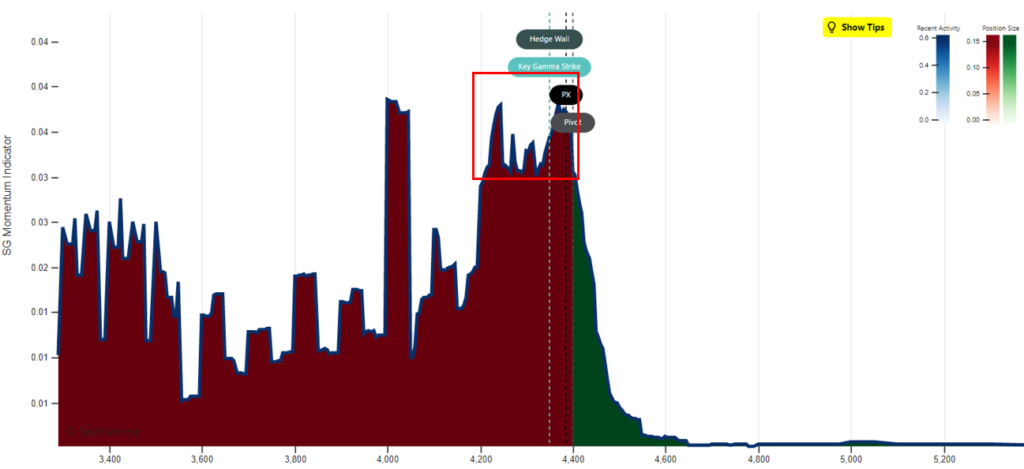

The other unique chart comes from our EquityHub, which shows a very stable gamma to the downside. We’ve come to see that the “rate of change of gamma” has been useful in marking inflection points and as you can see below there is no real change in this SG Momentum (y axis) until markets break 4250. This picture is likely to change into Friday, but it suggests lower downside risks for today.

LIVE today! Join Brent & Imran Lakha on YouTube at 2PM EST!

Model Overview:

4400 resistance, 4350 support into 7/16 OPEX

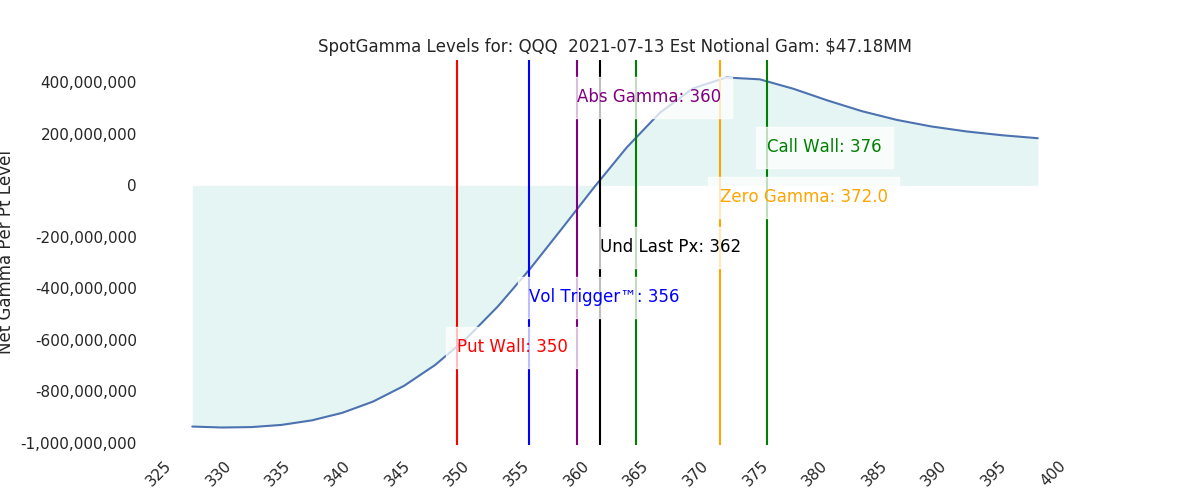

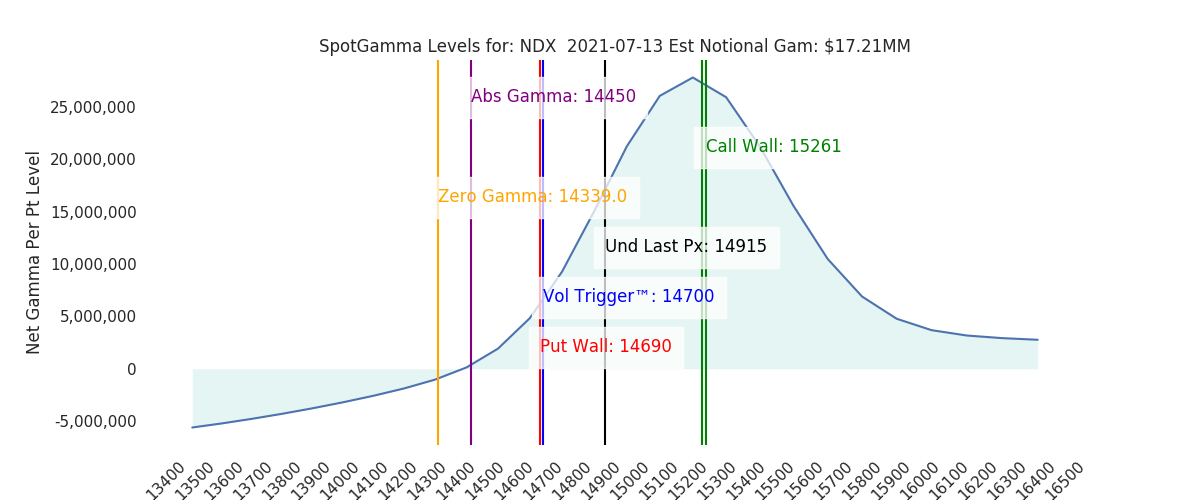

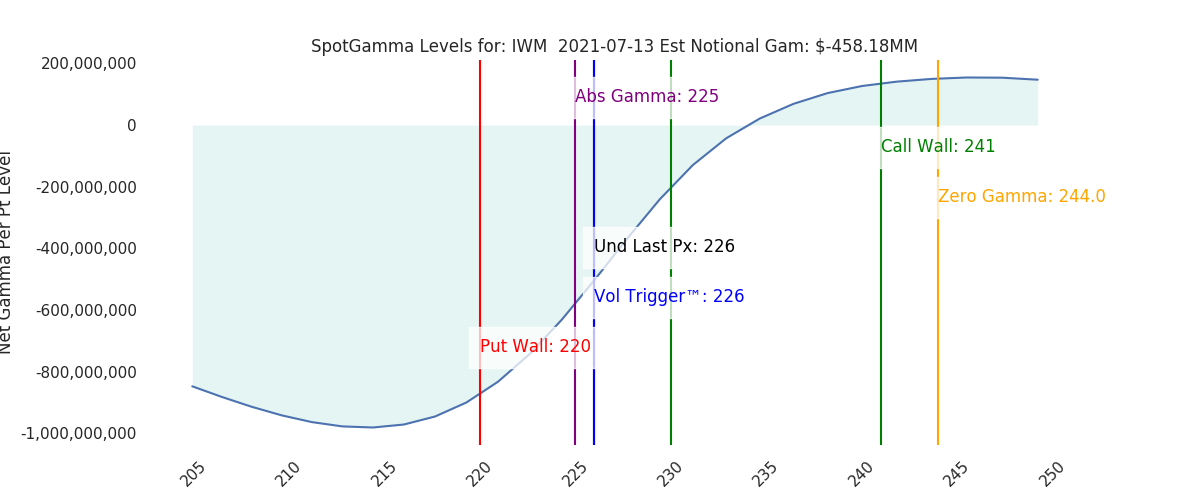

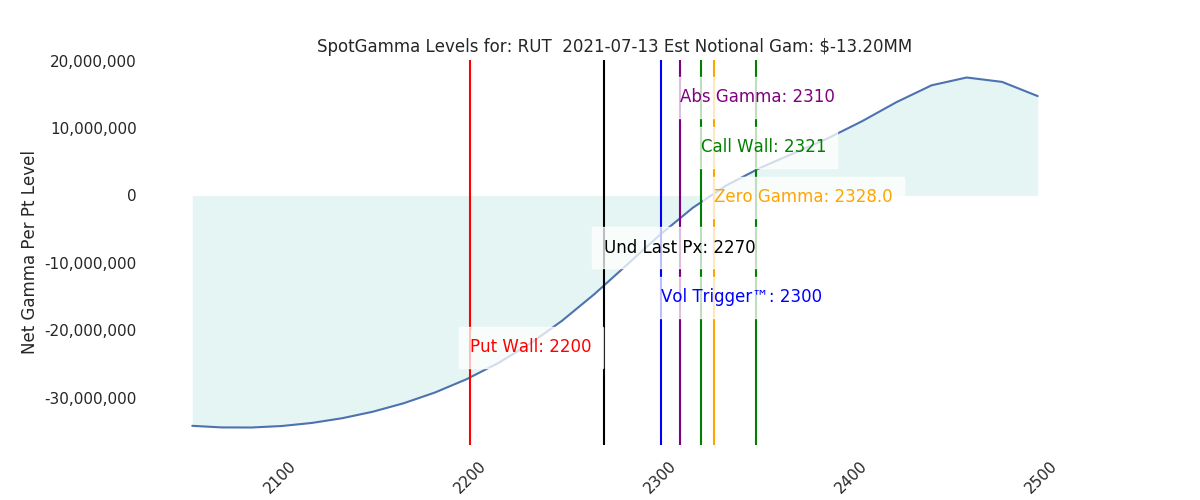

| SpotGamma Proprietary Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Ref Price: | 4377 | 4376 | 437 | 14915 | 362 |

| SpotGamma Imp. 1 Day Move: | 0.76%, | 33.0 pts | Range: 4344.0 | 4410.0 | ||

| SpotGamma Imp. 5 Day Move: | 4351 | 1.82% | Range: 4272.0 | 4430.0 | ||

| SpotGamma Gamma Index™: | 1.53 | 1.53 | 0.23 | 0.10 | 0.00 |

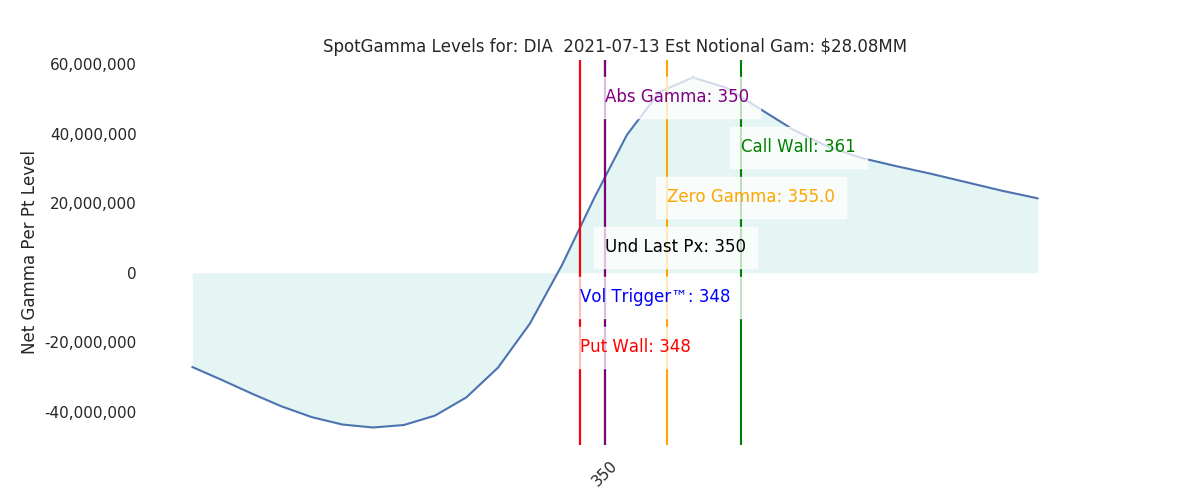

| Volatility Trigger™: | 4315 | 4315 | 432 | 14700 | 356 |

| SpotGamma Absolute Gamma Strike: | 4350 | 4350 | 440 | 14450 | 360 |

| Gamma Notional(MM): | $462 | $455 | $1,037 | $17 | $47 |

| Additional Key Levels | Latest Data | Previous | SPY | NDX | QQQ |

|---|---|---|---|---|---|

| Zero Gamma Level: | 4312 | 4311 | 0 | 0 | 0 |

| Put Wall Support: | 4100 | 4100 | 420 | 14690 | 350 |

| Call Wall Strike: | 4400 | 4400 | 440 | 15250 | 365 |

| CP Gam Tilt: | 1.56 | 1.31 | 1.36 | 2.6 | 1.04 |

| Delta Neutral Px: | 4162 | ||||

| Net Delta(MM): | $1,368,658 | $1,368,423 | $182,598 | $45,447 | $84,681 |

| 25D Risk Reversal | -0.06 | -0.06 | -0.06 | -0.05 | -0.05 |

| Top Absolute Gamma Strikes: |

|---|

| SPX: [4400, 4375, 4350, 4300] |

| SPY: [440, 437, 436, 435] |

| QQQ: [362, 360, 355, 350] |

| NDX:[15300, 15250, 14800, 14450] |

| SPX Combo: [4384.0, 4406.0, 4432.0, 4397.0, 4358.0] |

| NDX Combo: [15219.0, 14952.0, 15264.0, 15160.0, 14789.0] |

| ©TenTen Capital LLC d.b.a. SpotGamma Please leave us a review: Click Here |

| See the FAQ for more information on reading the SpotGamma graph. |

| SpotGamma provides this information for research purposes only. It is not investment advice. SpotGamma is not qualified to provide investment advice, nor does it guarantee the accuracy of the information provided. This email is intended solely for subscribers, please do not distribute the information without the express written consent of SpotGamma.com. |