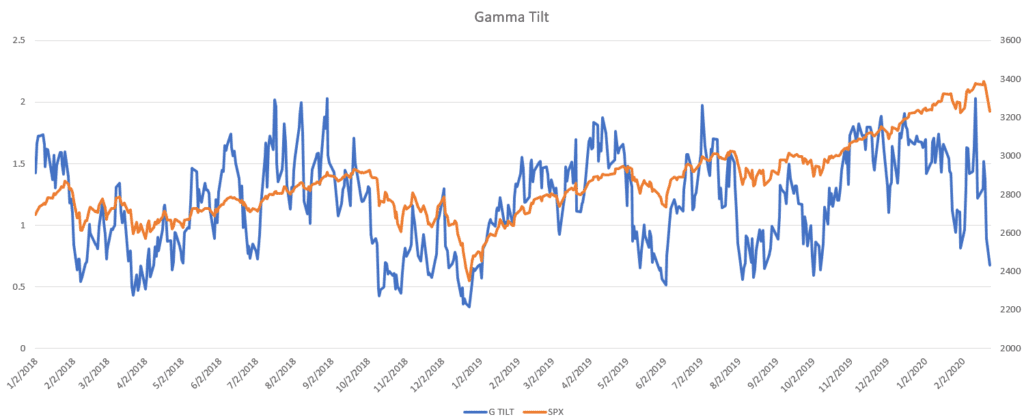

One of the indicators we watch for a potential bottom is Gamma Tilt – or the ratio of call gamma to put gamma. When this level hits lows it may be an indication that the market is oversold. Currently the S&P500 Index is about 8% in ~5 trading days.

Here is the current indicator for the SPX Gamma Tilt on 2/25/20, and as you can see it is approaching lows which can be found at recent market bottoms. It should be noted that the 2 year history of this particular indicator was during a strong bull market and that may skew results.

The forward 5 day return of buying SPX when the indicator <.5 is ~50bps. The 10 day is ~100bps, but its an admittedly small sample set.