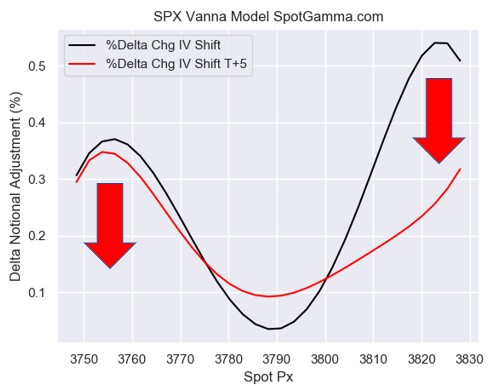

Options Vanna is the delta adjustment required for a change in implied volatility. When we model market makers options hedging activity, we adjust options implied volatility to understand how hedging flows might impact the stock markets. Market makers likely hedge SPX and SPY options with ES futures, so these hedges may have a large influence on the S&P500.

What you see in the sample chart below is that dealers get longer as the market shifts both higher and lower. To adjust dealers would need to sell futures (red arrows) to move their long options delta position back to flat. These metrics change daily, and are part of our subscription analysis.

In the S&P500 options complex we generally feel that declining implied volatility incents market makers to reduce their short futures positions.

The data depicted here syncs in many ways with that of our gamma models. It should be noted that the gamma models already account for changes in position, price, volatility and time.