Listed here are some helpful statistics around two of SpotGamma’s key proprietary support and resistance levels:

The SPX Call Wall & Put Wall

These levels are derived purely from options positioning.

This data is based off of 1265 trading days, ending 1/20/2023.

SPX Call Wall

- How many times did the market open within 1 % of the Call Wall: 36%

- On an open within 1% of the Call Wall, how often was the Call Wall breached? 28%

- How many times did the SPX open above the Call Wall: 8%

- If the SPX opened above the Call Wall, how often did it hold above the wall? 17%

- When the Call Wall was breached, how often did it close above: 32%

- If the SPX closes above the Call Wall, what is the average close above the Wall: 0.67%

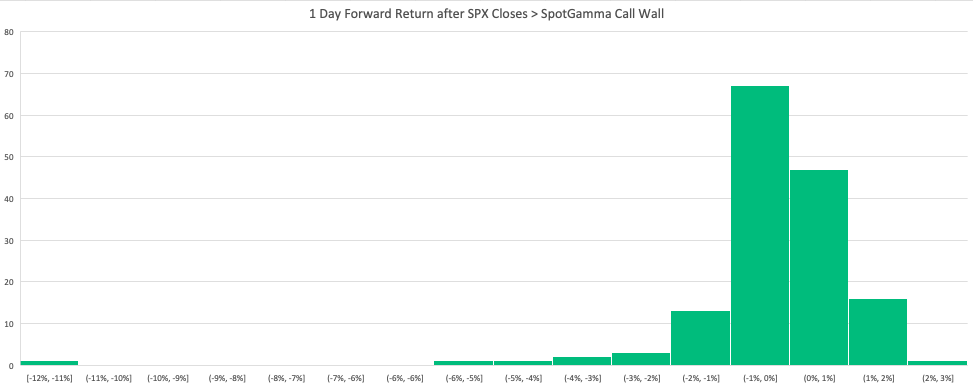

- 1 Day Forward Return after close above Call Wall: -0.24%

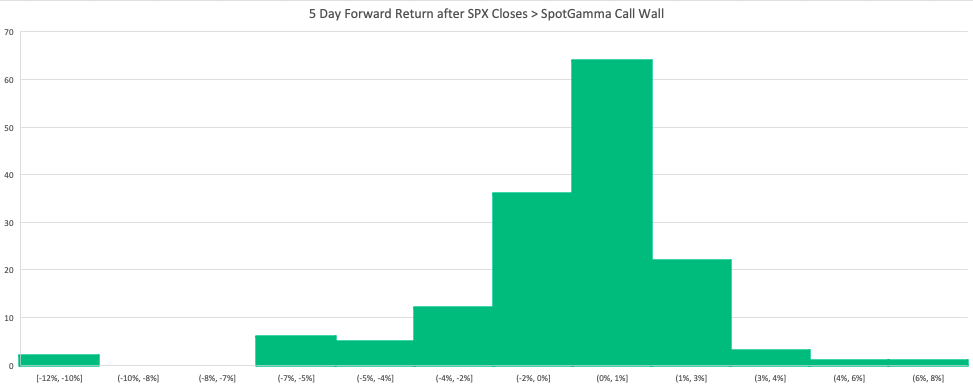

- 5 Day Forward Return after close above Call Wall: -0.38%

As you can see here, the SPX tends to have negative 1 day, and 5 day (second plot) forward price performance the day after closing above the Call Wall resistance level.

SPX Put Wall

- How often did the market open within 1 % of the Put Wall: 12%

- On an open within 1% of the Put Wall, how often was the Put Wall breached? 34%

- How often did the SPX open below the Put Wall: 4%

- If the SPX opened below the Put Wall, how often did it hold below the wall? 21%

- When the Put Wall was breached, how often did it close below: 39%

- If the SPX closes below the Put Wall, what is the average close below the Wall: -1.6%

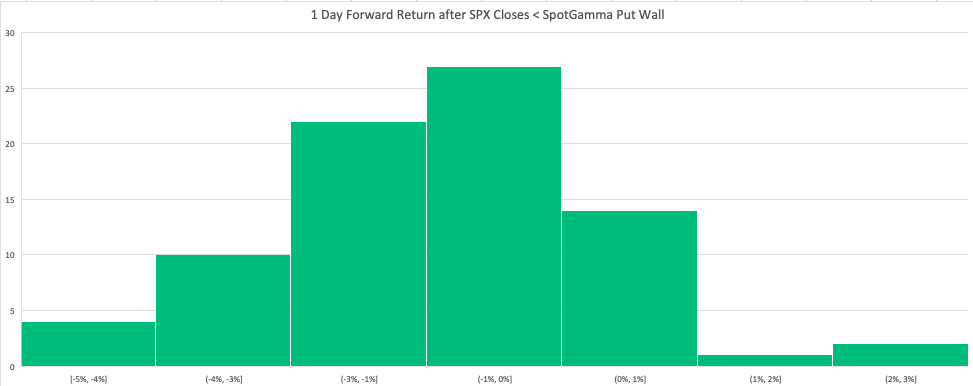

- 1 Day Forward Return after close below Put Wall: -1.45%

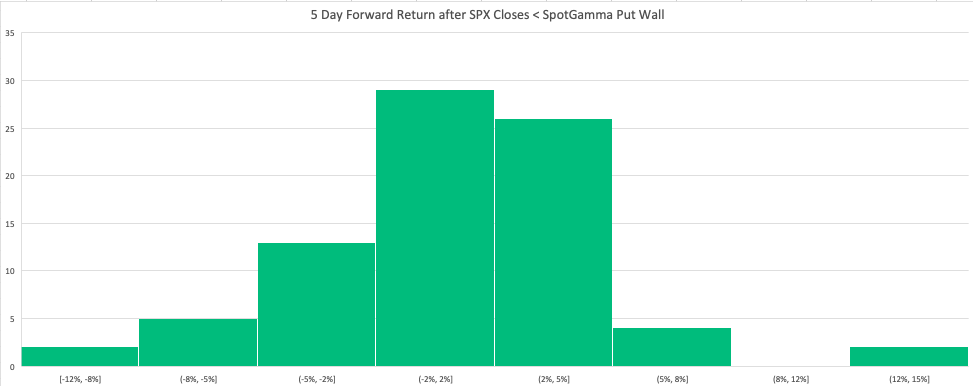

- 5 Day Forward Return after close below Put Wall: 0.26%

The S&P tends to have negative forward 1 day price performance after closing below the Put Wall.

Contrary to 1 day performance, the S&P tends to have positive 5 day forward performance after closing below the Put Wall.