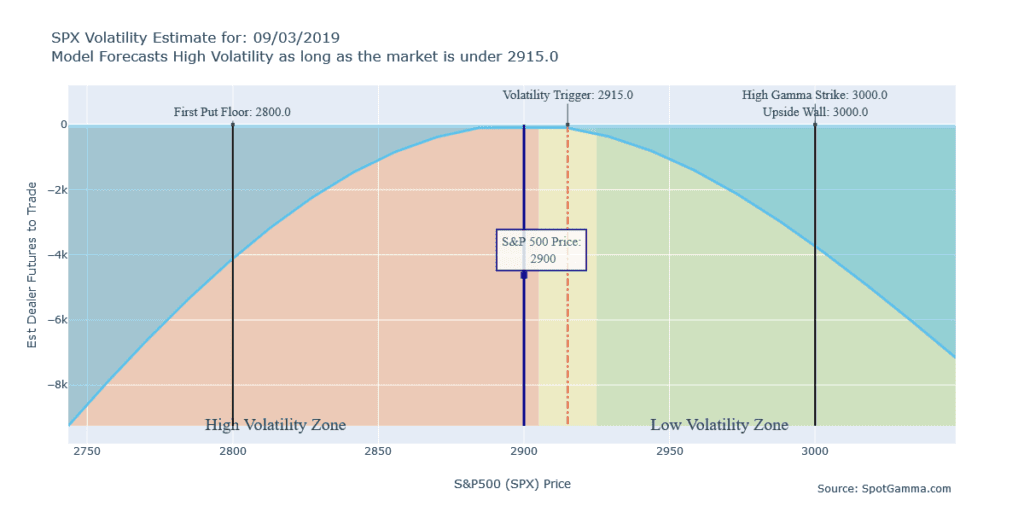

There are several catalysts in September that could cause the same volatility we saw in August. So far this morning there is appears that China Trade has made no headway and futures are around 2900. As you can see in the chart below that has the SPX & SPY markets starting short gamma and therefore we anticipate a volatile start to the day and month. Based on our options tables we see 2850 as a possible support and 2915 as overhead resistance. 3000 overhead has been and continues to look like a very large wall if a rally sparks. That being said, there are a ton of catalysts for both headline risk and technical gamma movement, setting the stage for August style volatility. Because these events are mid-month we can anticipate the VIX remaining elevated for the next 2 weeks. Some important dates:

- ECB Rate decision 9/12

- FED Rate decision 9/17

- September – Large quarter-end options expiration 9/20 (“Triple Witching”)

- Additionally: China trade – lots of tweets/headline risk

It should be noted that major news (ex: China Trade deal or Trump Tweet) can overwhelm these levels. Here is a great video by Charlie McElligott from Nomura discussing the next few weeks from a Gamma and Rate perspective.