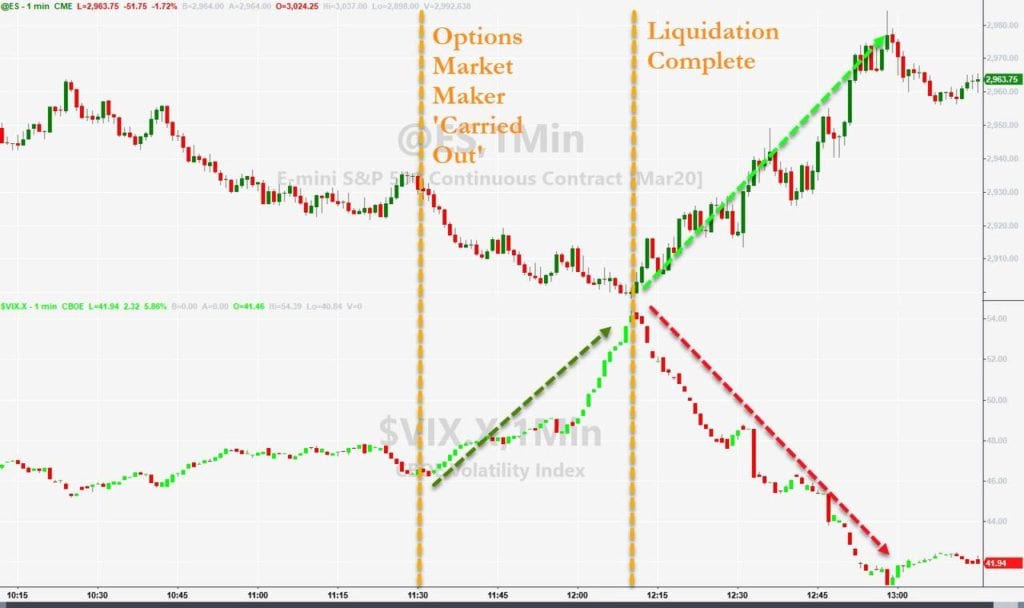

ZeroHedge posted an article Friday that caught a lot of attention. Basically they claim that a firm got a tap on the shoulder from the risk department and were forced to close out positions. This may also have been a Margin Call. If someone got tagged (allegedly) doesn’t really matter to us, what happened in the market does matter. Below is the chart from ZH (note the the second yellow line “Liquidation Complete” was roughly 3pm EST):

Both of those yellow lines show a turning point in the market, but its the second “Liquidation Complete” that is particularly interesting. Why:

- It came off the lows of the day, at important support level of 2900 and with the market under pretty heavy selling pressure

- Because it happened in a deeply negative gamma environment, when the market was forced higher it sparked a reflexive market response. Implied volatility was crushed (see VIX in chart above) and the market jumped up. As that happened it forced options dealers (who were theoretically short gamma) to buy more futures, which pushed SPX prices up higher. This further hits implied vols, and the cycle continued.

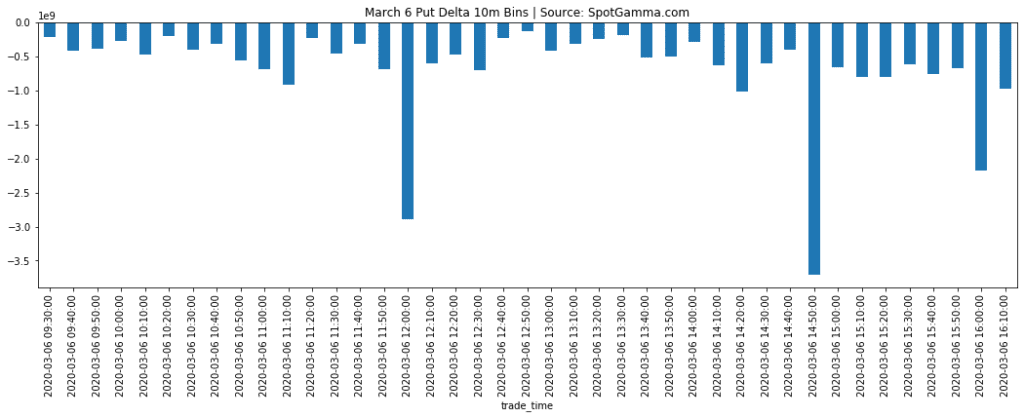

What is quite interesting is if we look at options volume on that day we can actually see some data supporting large options trading in SPX at those same times. See the chart below which aggregates the delta of every SPX Put trade on the day, then bins them in 10 minute intervals. Note that this does not take into account whether the puts were bought or sold, simply an “absolute” delta aggregate.

What appears to have happened is that someone sold a lot of puts at 2900, right around 3pm eastern. I believe they were sold as the market responded with VIX dropping, and the market shooting higher. In theory had all those puts have been purchased, they would have required options dealers to short futures as a hedge, which may have punched the market through that critical 2900 support.

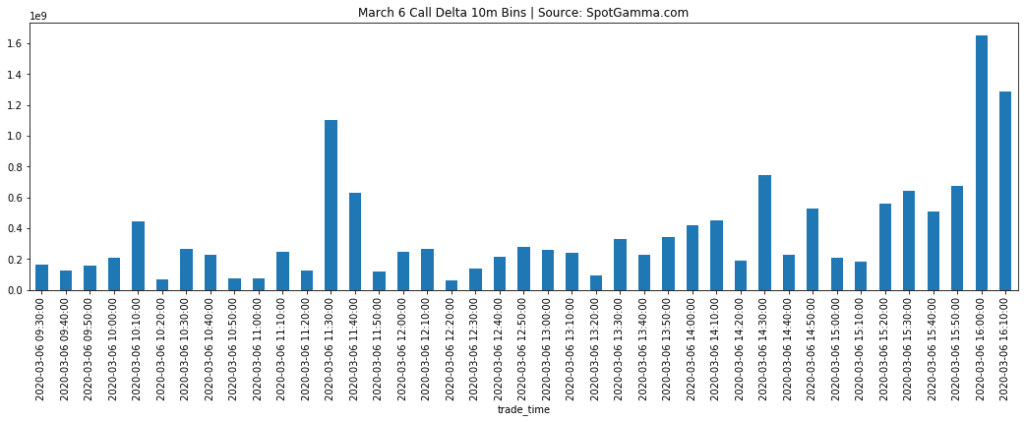

Below is call volume, you note that nothing particularly interesting stood out at 3pm EST.

I would speculate that because it appears puts were sold at the lows on Friday, that this was most likely not a firm blowout. Those long puts should have been performing well at 2900 – although you cannot be sure how they were hedged (or if they were hedging something else). What is clear is that some large put trades took place, and immediately after the market launched higher.